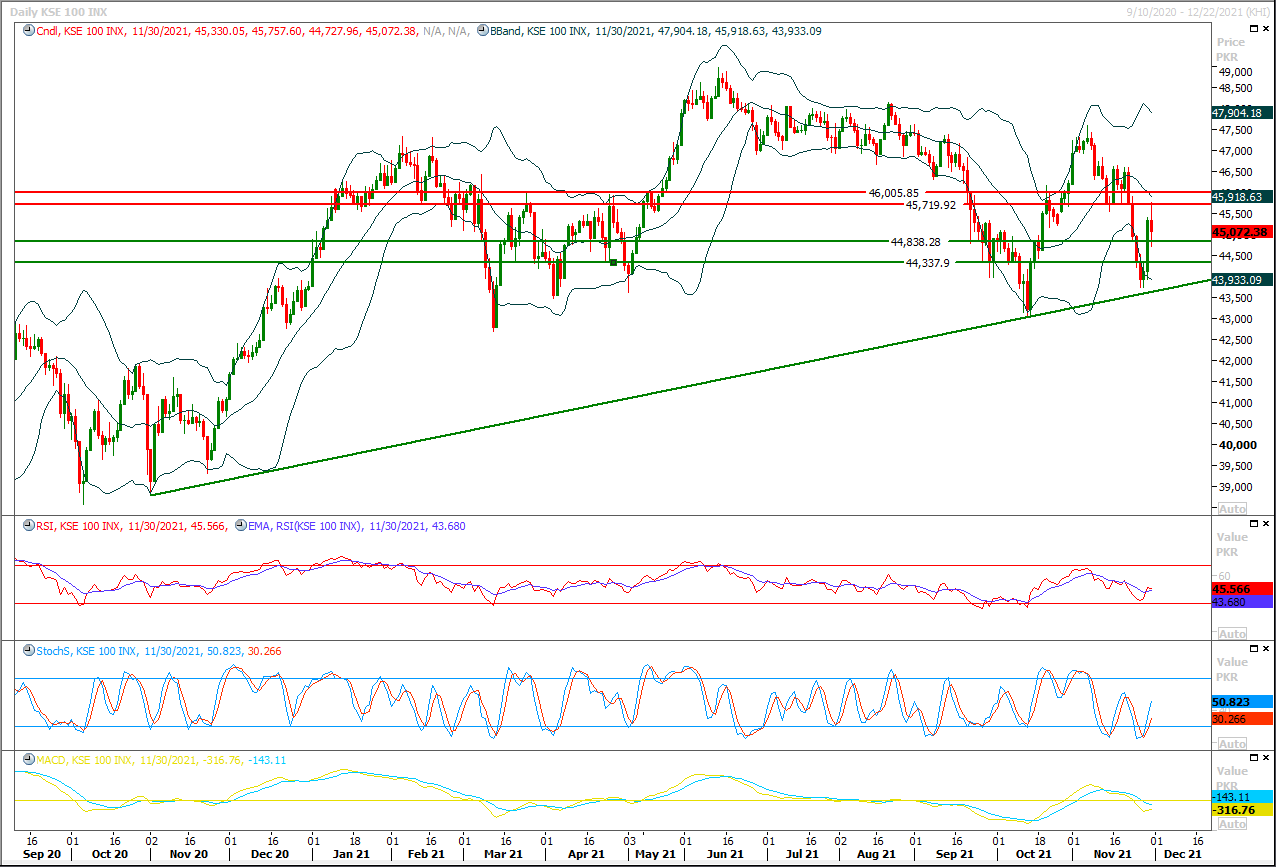

The Benchmark KSE100 index had faced rejection from correction level of its last bearish rally which falls on a horizontal resistant region during last trading session and index closed with a negative note at day end. As of now it's expected that index would try to expand this correction towards bearish direction therefore it's recommended to stay cautious because if index would succeed in sliding below 44,800pts on hourly closing basis then it would try to target 44,330pts. Meanwhile closing below 44,200pts would add further pressure on index and it may start sliding towards 43,700pts and 43,500pts in coming days. While on flip side in case of bullish pull back index would face initial resistance between 45,200pts-45,350pts therefore selling on strength could be beneficial with strict stop loss of 45,700pts.

Asian stocks rose from a one-year low on Wednesday as U.S. share futures and oil recovered from the previous day's selloff, but uncertainty over the impact of the Omicron coronavirus variant kept investors on edge.U.S. Treasury yields rose, supporting the dollar after U.S. Fed chair Jerome Powell overnight came close to indicating the Fed will speed up the pace of its asset purchases at its meeting later this month.At present the market focus has been on Omicron and the potential that that can disrupt the world, but the real focus should be on the Fed and the rate policy.

Read More...Foreign Minister Shah Mehmood Qureshi said yesterday that the government was committed to boosting agriculture.The FM has stressed need for the use of modern technology to enhance agricultural productivity. Addressing the launching ceremony of Agri mobile App here, he said awareness among farmers would yield better results in this regard.FM Qureshi said agricultural sector maintains key importance as bulk of our population’s existence depends on it. He said enhanced productivity would create exportable surplus and that is only possible through use of modern technology in cultivation and water management.

Read More...

FBR surpasses 5-month tax target by Rs298b

The Federal Board of Revenue (FBR) has surpassed the five months (July to November) tax collection target by Rs298 billion.The FBR has released the provisional revenue collection figures for the months July-November of current financial year 2021-22. According to the provisional information, FBR has collected net revenue of Rs. 2,314 billion during July-November period of current financial year 2021-22, which has exceeded the target of Rs. 2,016 billion by Rs. 298 billion. This represents a growth of about 36.5% over the collection of Rs. 1,695 billion during the same period last year.

Read More...

November inflation hits 11.5pc, highest in 20 months

An upward swing in consumer prices continued in November as inflation edged up to 11.5 per cent from 9.2pc, the highest increase noted in the past 20 months influenced by a record hike in fuel prices last month, the Pakistan Bureau of Statistics (PBS) data showed on Tuesday.The massive rupee depreciation fuelled import-led inflation. Inflation measured by the Consumer Price Index (CPI) increased to its highest level in 20 months — the period when global oil prices kept rising steadily undermining earlier gains.At the same time, prices of fresh vegetables, fruits and meat have also posted a persistent increase in major urban and rural centres.

Read More...

No change in oil prices as tax rates raised

Despite decline in international prices, the government on Tuesday decided to keep the prices of all major petroleum products unchanged for the next 15 days by increasing tax rates — both petroleum levy and general sales tax.The decision to increase the rates of petroleum levy and GST was taken in line with commitments given to the International Monetary Fund, otherwise the prices should have gone down by Rs8-9 per litre in line with decline in international prices.A part of this reduction was consumed by exchange rate loss while the government absorbed about Rs6 per litre reduction through combined increase in petroleum levy and GST rates.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.