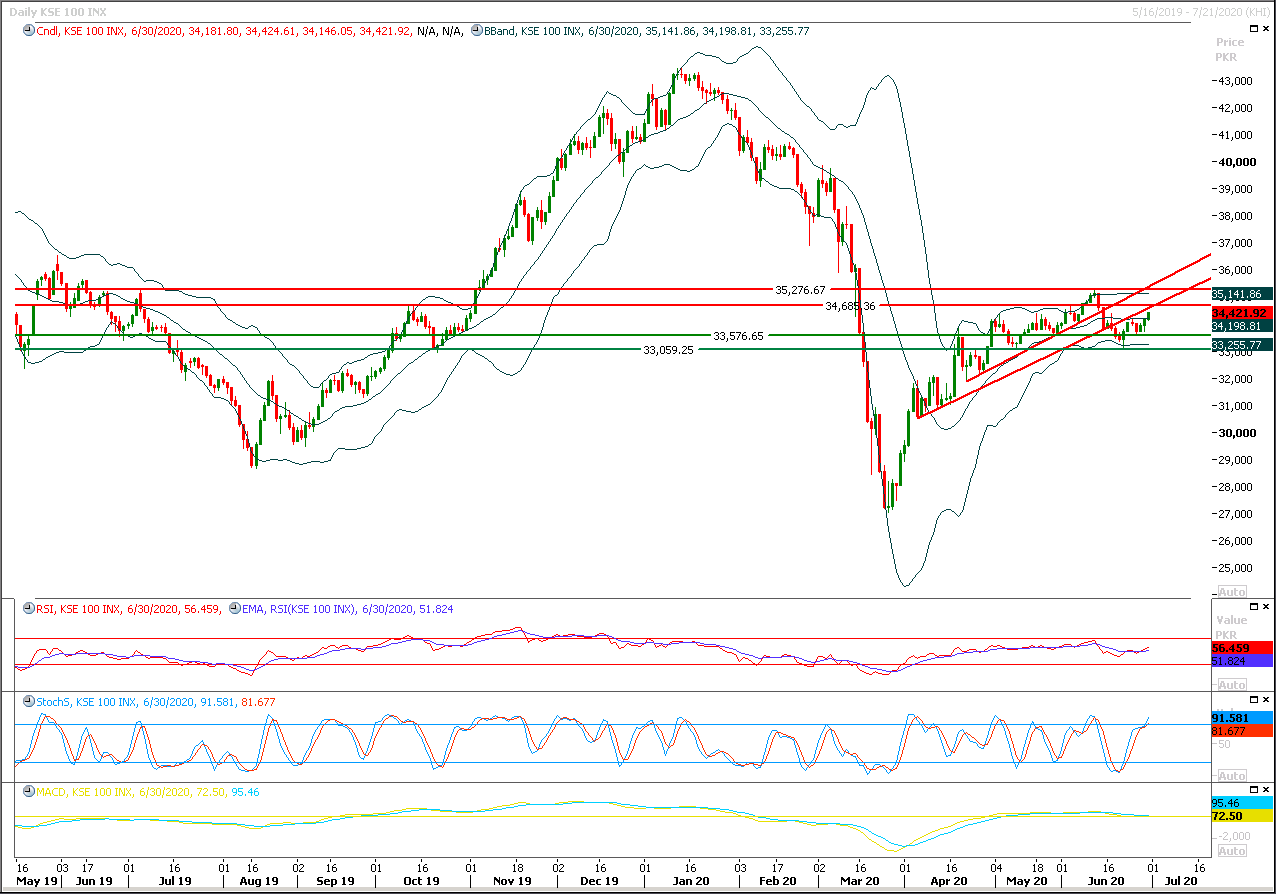

Technical Overview

The Benchmark KSE100 index have continued its bullish momentum during last trading session and have pass another milestone by closing above 34,300pts. As of now momentum seems bullish and it's expected that index would try to target 34,600-34,700pts region. Initially it would face a resistance at 34,680pts where its being capped by a strong resistant trend line along with a horizontal resistant region. It's recommended to stay cautious until index succeed in closing above 34,760pts because below that region some kind of serious volatility could be witnessed and index would need some fresh volume to close above this region because 61.8% correction of previous bearish rally also completes between 34,600-34,700pts region. While breakout of this region in bullish direction would call for 35,200pts in coming days.

While on flip side in case of rejection from its resistant regions index would start sliding downward and initially it would try to find some ground at 34,180pts while closing below this region would call for 33,860 and 33,500pts.

Regional Markets

Asian shares inch higher as data drives rebound hopes

Asian stocks struggled for headway on Wednesday as the second half of the year got underway, with improving economic data offset by worries that surging coronavirus cases in the United States could derail the world’s recovery before it properly begins. Following firm U.S. housing data and signs of a rebound in Europe’s economy, the latest boost to sentiment came from Chinese factory activity gathering steam in June, with the Caixin/Markit manufacturing PMI rising to 51.2 compared with expectations for 50.5. But virus cases surged, too, with the U.S. recording 47,000 infections on Tuesday, its biggest single-day spike since the pandemic began. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.4%, led by gains in Korea and China. Japan’s Nikkei slipped 0.2%, though, U.S. stock futures fell 0.3% and gold sat close to an eight-year peak, pointing to elevated caution.

Read More...

Business News

Chinese company allowed exploration in Saindak area

The Balochistan government has allowed Chinese firm Metrological Construction Company of China (MCC) — registered locally with the name of Saindak Metals Limited (SML) — the exploration and development of East Ore Body in Saindak lease area and the company has been issued an NoC for the purpose. Official sources said on Monday that the provincial government also extended the contract of MCC/SML for another 15 years under which the company would continue exploration work on East Ore Body site after the expiry of its present contract on Oct 31, 2022. The MCC, working at the Saindak-Gold-cum-Copper Project since 2002, applied the Balochistan Mines and Mineral Department to allow the company to start exploration work on the East Ore Body of Saindak lease area as its exploration work at the present Saindak site had almost finished.

Read More...

WB approves $500m loan for Pakistan’s budget support

The World Bank (WB) on Tuesday announced that it has approved another $500 million loan to Pakistan for the country’s budget support following its increased expenditures on Covid-19 crisis response. In a statement, the bank said its board of directors approved the financing for the Resilient Institutions for Sustainable Economy (RISE) programme to help Pakistan strengthen fiscal management, promote transparency and private sector growth and undertake foundational reforms in the energy sector to transition to low-carbon energy. These reforms are critical to build fiscal resilience and stimulate recovery from impacts of the Covid-19 pandemic, it said. “Pakistan is suffering a significant fiscal shock from the economic fallout from the pandemic and the increased spending on crisis response, including emergency healthcare, social protection, and business support,” said Illango Patchamuthu, the World Bank Country Director for Pakistan.

Read More...

Revenue collection up 3.9pc in 2019-20

The revenue collection saw a paltry growth of 3.9 per cent year-on-year in 2019-20 mainly due to the lockdown and a sharp deceleration in economic activity since the coronavirus outbreak. From March 18, the government imposed lockdown across the country which was relaxed in the second half of May. The steepest fall in collection was seen in the months of April, dipping by 16pc and May 30.8pc from last year. However in June, the quantum of decline eased to 12pc as the government further relaxed the lockdown and revenue collection reached Rs415bn during the month, compared to Rs472bn in the same period last year.

Read More...

Axe falls on secretary power amid dispute over net hydel profit payments

After months of speculation, the government removed Secretary Power Irfan Ali on Tuesday following his disagreements with key authorities over a number of contentious issues, including net hydel profit (NHP) to provinces, unending circular debt, the procedure for induction of future power projects and ongoing problems with K-Electric. A grade-22 officer of the Pakistan Administrative Service, Mr Ali was made an officer on special duty (OSD) and directed to report to the Establishment Division. He was immediately replaced by another PAS officer of same grade Omar Rasool who was presently working as secretary Board of Investment. Mr Rasool had a debriefing session with Mr Ali on Tuesday before issuance of formal notifications.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.