Technical Overview

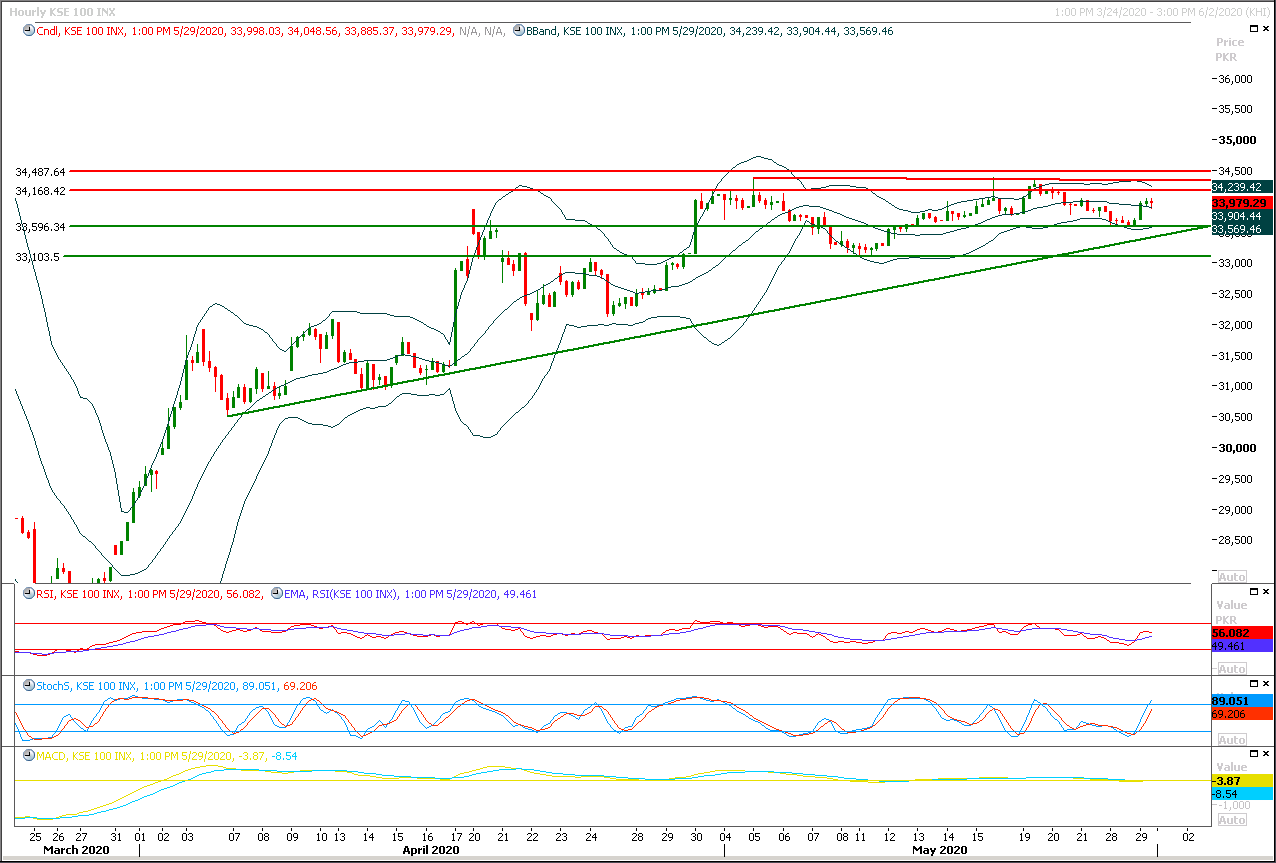

The Benchmark KSE100 index is being capped by a descending trend line on daily and intraday chart and it's expected that index would open with a positive gap above this trend line but it needs to be very cautious because breakout above said line would not call for a bullish rally because index would still face strong resistances at 34,200pts and 34,500pts from two strong horizontal resistances, index would remain range bound until it would not succeed in closing above 35,200pts. Mean while momentum indicators on hourly chart would try to change their momentum towards bearish side if index would not succeed in closing above 34,200pts. Therefore it's recommended to stay cautious and post trailing stop loss on existing long positions because if index would start falling after facing rejection from its resistant regions then its initial support would be 33,500pts, and breakout below that region would call for 32,500pts.

Regional Markets

Asia stocks prove resilient to US riots as S&P futures bounce

Asian shares pushed to three-month highs on Monday as progress on opening up economies helped offset jitters over riots in U.S. cities and unease over Washington’s power struggle with Beijing. E-Mini futures for the S&P 500 recovered early losses to be up 0.1%, having been down 1% in early trade, while safe-haven gold pared an early rise to be up 0.4% at $1,733 an ounce. Bonds also lost early gains and oil prices slipped. After a cautious start Asian markets were led higher by China on signs parts of the domestic economy were picking up. Hong Kong .HSI managed to rally 2.8%, while Chinese blue chips .CSI300 put on 1.4%. MSCI's broadest index of Asia-Pacific shares outside Japan rise 1.6% to its highest since early March. Japan's Nikkei .N225 added 1% to also reach a three-month peak.

Read More...

Business News

Prices of petroleum products reduced

The government on Sunday reduced prices of all petroleum products except High Speed Diesel (HSD) to partially pass on the impact of massive international price reduction to the masses. The revised prices will remain effective till June 30. In doing so, the government increased the rate of petroleum levy on petrol by more than 26pc to mop up additional windfall revenues of about Rs6.5bn. The levy on petrol was increased from Rs23.76 per litre to the maximum permissible limit of Rs30 per litre. Under the announcement, the ex-depot price of petrol was fixed at Rs74.52 per litre from Rs81.58 per litre at present, showing a reduction of Rs7.06 or 8.65pc. Based on the existing tax rates and the PSO’s import cost, the petrol price should have come down by Rs13.30 per litre but the government decided to revise petroleum levy by Rs6.24 per litre.

Read More...

OGDCL injects nine new wells in production gathering system

The Oil and Gas Development Company Limited (OGDCL) has injected nine new wells, producing 137,230 Barrels crude oil and 5,562 Million Cubic Feet (MMCF) gas, in its production gathering system during three quarters of the current fiscal year. “As many as nine operated wells have been injected in the production gathering system viz., Qadirpur-14&61, Pasakhi Deep-4&5, Nashpa-9, Chanda-5, Qadirpur Deep X-1, TAY North-1and Uch-17A which cumulatively yielded gross crude oil and gas production of 137,230 barrels and 5,562 MMCF respectively, whereas installation of Electrical Submersible Pump at Pasahki-5 produced a positive impact of 500 barrels per day,” the company said in its third quarterly report for the financial year 2019-20.

Read More...

Trade body calls for controlling locust crisis on priority

Federation of Pakistan Chambers of Commerce and Industry (FPCCI’s) Businessmen Panel on Sunday warned that if locust crisis were not controlled in time, the results would be devastating. The Panel, Secretary General (Federal) Ahmad Jawad said in a statement that locusts had spread across the country, causing damage to crops and orchards and posing a threat to food security. “Massive swarms of the desert locust, began damaging crops in Pakistan last month; but the situation worsened this week. Currently more than 60 districts of the country were affected. “Maize, Mung, Mangoes, Cotton and Sugar cane crop are the most affected one from this disease”.

Read More...

Govt focusing to attract FDI, transfer of technology in SEZs

The Advisor to Prime Minister on Commerce and Investment, Abdul Razak Dawood has said the government was prioritizing development of Special Economic Zones (SEZs) for attracting Foreign Direct Investment (FDI) and transfer of technology into the country. “The SEZs are primarily focused on industrialization that result in export promotion, import substitution, transfer of technologies and employment generation, which are the primary targets of our government as well,” Abdul Razak Dawood told APP here. The advisor said the establishment of SEZs was critical to resolving Balance of Payment Issues as ”we tend to give priority to enterprises which are involved in export generation or import substitution” he said. Talking about the criteria, the advisor said that only those economic zones are given status of SEZ which are successful in export generation and import substitution while at zone enterprise level, the admission into an SEZ is based on the economic viability of the business proposal.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.