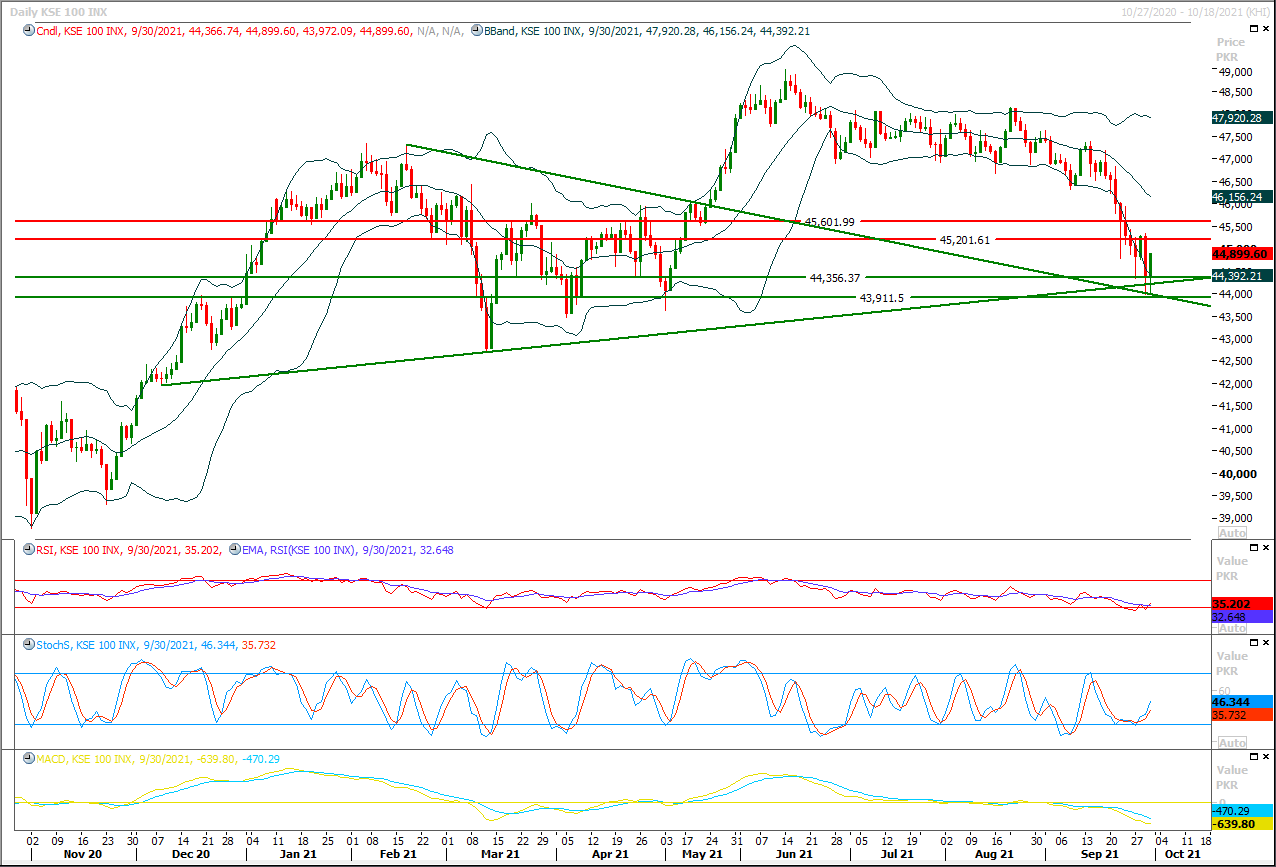

The Benchmark KSE100 index had bounced back after posting a double bottom on daily chart and created a piercing line formation to some extent, meanwhile supportive trend line of its descending wedge have pushed back into bullish direction on hourly chart but it's still trading inside same wedge therefore it can be said that index is taking correction of its last bearish rally and it would be considered bearish until it would not succeed in closing above its key resistance level of 45,200pts. For current trading session initially index would start the day with a positive note but later on it may face rejection from its resistant regions because strong resistant regions are standing ahead at 45,000pts and 45,200pts where resistant trend line of its descending wedge and a horizontal resistant region would try to cap current bullish sentiment. It's recommended to post trailing stop loss on existing long positions and if it would not succeed in closing above its initial resistant regions then it's recommended to start selling on strength. On flip side it's expected that index would start sliding downward before 45,200pts-45,350pts region and it would initially try to target 44,500pts and breakout below this region would call for 44,330pts. On longer run index have created an evening shooting star on monthly chart which is a negative sign and it may push index towards 41,900pts initially once it would succeed in closing below 43,500pts on daily chart.

Regional Markets

Asian stocks extend global slide as inflation fears bite

Asian equities followed Wall Street sharply lower and bonds rallied on Friday as risk sentiment soured amid growing worries that inflation may persist even after global growth has peaked. Japan's Nikkei tumbled 1.86%, while the broader Topix slid 1.95%. Australian stocks slumped 2.05% and South Korea's Kospi lost 1.51%. An MSCI index of Asia-Pacific stocks dropped 1.07%.Chinese markets are closed for a week from Friday for the Golden Week holiday. "You can argue whether it's really stagflation or not, but the whole growth-inflation backdrop seems to have just tilted to a less favorable one," said Rob Carnell, Asia-Pacific head of research at ING in Singapore. "Whether or not this is actually going to get imbedded and create problems for years to come, we don't need to know right now - it's sufficiently scary that what we're seeing in markets is justified."

Read More...

Business News

SBP imposes 100pc cash margin on 114 import items

The State Bank of Pakistan (SBP) has imposed 100 per cent cash margin on another 114 items to curb their imports which have grossly destabilised the exchange rate and widened both trade and current account deficits. The sharp rise in the current account deficit (CAD) and steep fall of the rupee against the US dollar forced the economic managers to bring down the import bill which rose to over $6 billion in August. The SBP said the measure will discourage imports of these items and thus support the balance-of-payments. “It has been decided to impose 100 per cent Cash Margin Requirements (CMR) on import of another 114 items, taking the total number to 525,” said a circular issued by the SBP on Thursday.

Read More...

Economic Coordination Committee okays wheat, urea import tenders

The Economic Coordination Committee (ECC) of the Cabinet on Thursday asked the Power Division to seek a review from power regulator for a streak of quarterly tariff adjustments for K-Electric involving Rs101 billion burden on budget and approved tenders for import of 550,000 tonnes of wheat and 100,000 tonnes of urea. The meeting presided over by Finance and Revenue Minister Shaukat Tarin also extended for a month the Prime Minister’s Relief Package-2020 for provision of five essential items on subsidised rates that expired on Sept 30. “The ECC granted extension for one-month with a direction to present a detailed summary before ECC, keeping in view, international price hike in essential food commodities,” a statement said.

Read More...

Pakistan Stock Exchange loses the Midas touch in July-Sept

With its benchmark index losing 12 per cent value in dollar terms, the Pakistan Stock Exchange (PSX) remained the third worst-performing equities market internationally in the July-Sept quarter. According to a research note issued by Topline Securities on Thursday, the quarterly decline follows five consecutive quarters of gains. The KSE-100 index had surged on average 12pc every quarter since April 2020.“Almost all the losses during the (July-Sept) quarter were witnessed in the last two weeks… the KSE-100 index dropped 2,371 points (5pc) in last 13 trading sessions,” said Atif Zafar, director of research at Topline Securities.

Read More...

FBR collects Rs1.395tr in first quarter

The Federal Board of Revenue collected Rs1.395 trillion in the first quarter of the current financial year exceeding the target of Rs1.211tr by Rs186 billion, showed provisional data released by the FBR on Thursday. Comparing with the revenue collection of Rs1.01 trillion in 2020, the revenue collection posted 38pc growth in the first quarter this year. The revenue collection in September 2021 rose by 31.2 per cent from last year’s Rs408bn. These figures would further improve before the close of the day and after book adjustments have been taken into account. The revenue collection is mainly driven by 52pc contribution from tax collection at import stage while only 48pc is from domestic taxes. Manufacturing is one of the leading contributors to revenue collection.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.