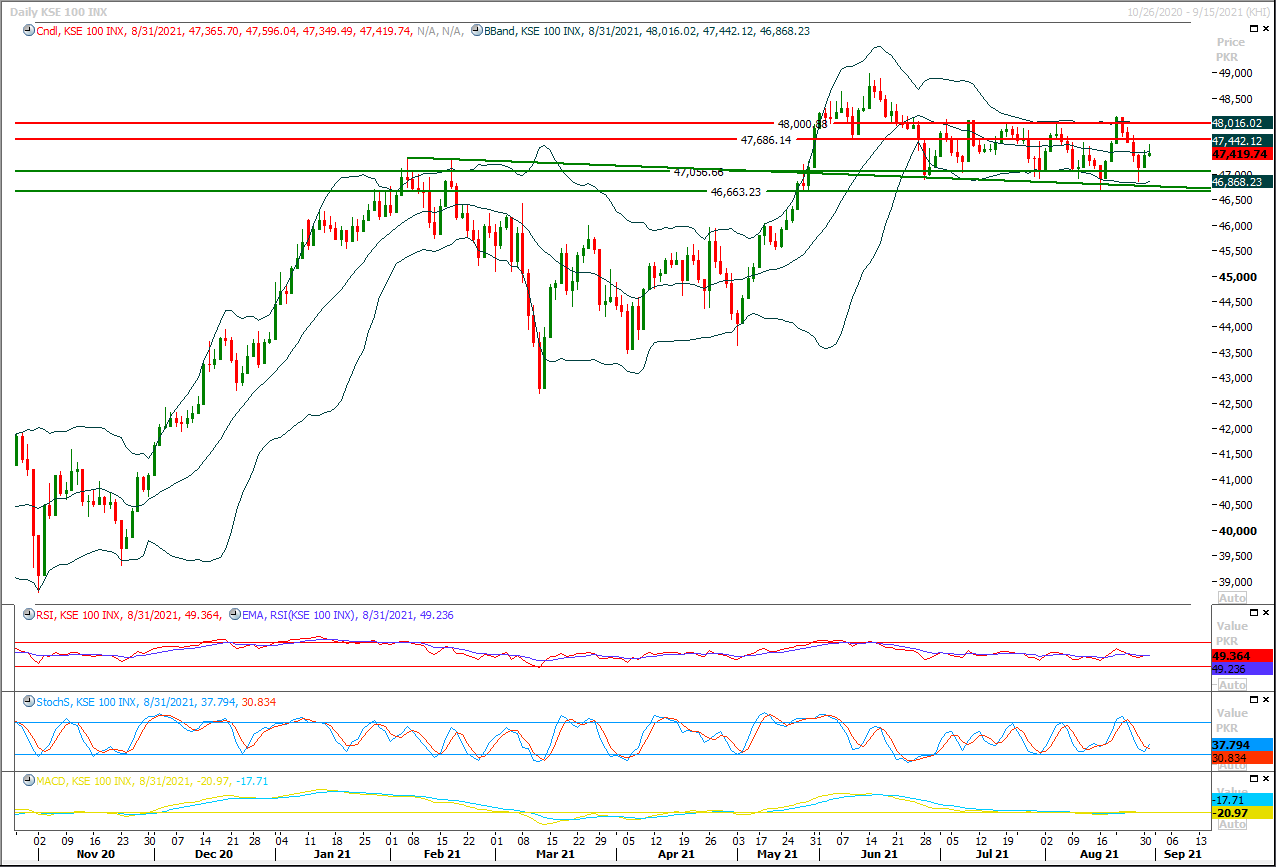

The Benchmark KSE100 index had faced rejection from its bearish correction level along with a strong horizontal resistant region during last trading session and closed below 50% correction of its last bearish rally . As of now a daily hammer have been formatted and it's expected that index may remain volatile during current trading session. There are chances of an evening star on daily chart if index would succeed in sliding below 47,250pts but it's recommended to stay cautious and adopt swing trading until index gave a clear breakout of either side. Meanwhile hourly momentum indicators are in bearish mode but daily indicators have created bullish crossovers which indicates that index may try to take a spike in coming days. Currently index would face initial resistance at 47,680pts which would be followed by 47,760pts and 47,900pts. While on flip side index would try to establish ground above 47,065pts where a horizontal supportive region would try to pump some fresh volumes but breakout below this region would call for 46,900pts. Overall index would remain range bound until it would not either succeed in closing above 48,300pts or below 46,900pts, breakout of either side would call for a rally of 1,000-1,500pts in respective direction.

Regional Markets

Asian shares down on slow-growth fear; dollar stays near three-week low

Asian shares gave up some of their recent gains in cautious trading on Wednesday while the dollar inched back from three-week lows, as worries about slowing global growth in several markets returned to weigh on traders' minds.MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.40%, edging off a three-week high reached the day before.In the past two weeks, the regional benchmark has regained much of the ground lost a few weeks earlier when markets globally dropped, spooked by the possibility that the U.S. Federal Reserve was moving closer to tapering its asset purchases.

Read More...

Business News

PSO books costliest LNG cargo for September

Making a new record, state-run Pakistan State Oil (PSO) on Tuesday awarded a liquefied natural gas (LNG) cargo to commodity trader Vitol at 24.5456pc of Brent (about $17.86 per mmBtu) – the most expensive so far – for delivery on Sept 26-27.“PSO has decided to award the below mentioned cargo for supply of LNG,” PSO announced on its website. Vitol was the single bidder for the Sept 26-27 cargo. Earlier, PSO had rejected slightly higher bid of 27.54pc of Brent by the same single bidder for delivery on Sept 24.The previous record of the highest LNG price was that of $15.93 per unit (22.13pc of Brent) from Qatar Petroleum for Aug 29-30 delivery.On Aug 24, another state-run firm Pakistan LNG Ltd (PLL) had also received very expensive bids for seven LNG cargoes for October and November ranging $17.1449 and $22.6 per mmBtu. PLL has not yet awarded contract for any of the cargoes, bids for which are still valid until next week, and has gone into emergency re-bidding for five cargoes.

Read More...

Oil production sees 10pc drop over a week

The country’s average per day oil and gas production dropped 10 per cent and 2pc, respectively, in the week ending Aug 18-24 to 69,878 barrels and 3,337 million cubic feet from 77,730bopd and 3,406mmcfd over the preceding week Aug 11-17.An analyst at Arif Habib Ltd (AHL) attributed the decline in oil production to annual turnaround (ATA) of Nashpa oil field from where the weekly production fell by 44pc to 7,629bopd from 13,622bopd followed by production drops in other fields also. There was also an ATA in a small oil field called Mela.

Read More...

Cement export down 47.80pc in July

The cement exports witnessed a decrease of 47.80 percent during the first month of current fiscal year 2021-22, against the exports of the corresponding period of last year. The country exported cement worth $11.967 million during July 2021 against the exports of $22.925 million during July 2020, showing a decline of 47.80 percent, according to the Pakistan Bureau of Statistics (PBS) report. In terms of quantity, the exports of cement also dipped by 50.04 percent by going down from 741,391 metric tons to 299,605 metric tons, according to the data. Meanwhile, on month-on-month basis, the exports of cement also decreased by 16.46 percent during July as compared to the exports of $14.325 million in June 2021, the PBS data revealed.

Read More...

Stock market gains another 54 points

The KSE 100-index of the Pakistan Stock Exchange (PSX) continued with bullish trend on Tuesday, gaining 54.04 points, with a positive change of 0.11 per cent, closing at 47,419.74 points against 47,365.70 points on the last working day.A total of 378,832,096 shares were traded during the day compared to the trade of 382,645,112 shares the previous day whereas the price of shares stood at Rs14.023 billion against Rs12.331 billion the previous day. As many as 524 companies’ transacted shares in the stock market, 248 of them recorded gain and 244 sustained losses whereas the share price of 32 companies remained unchanged.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.