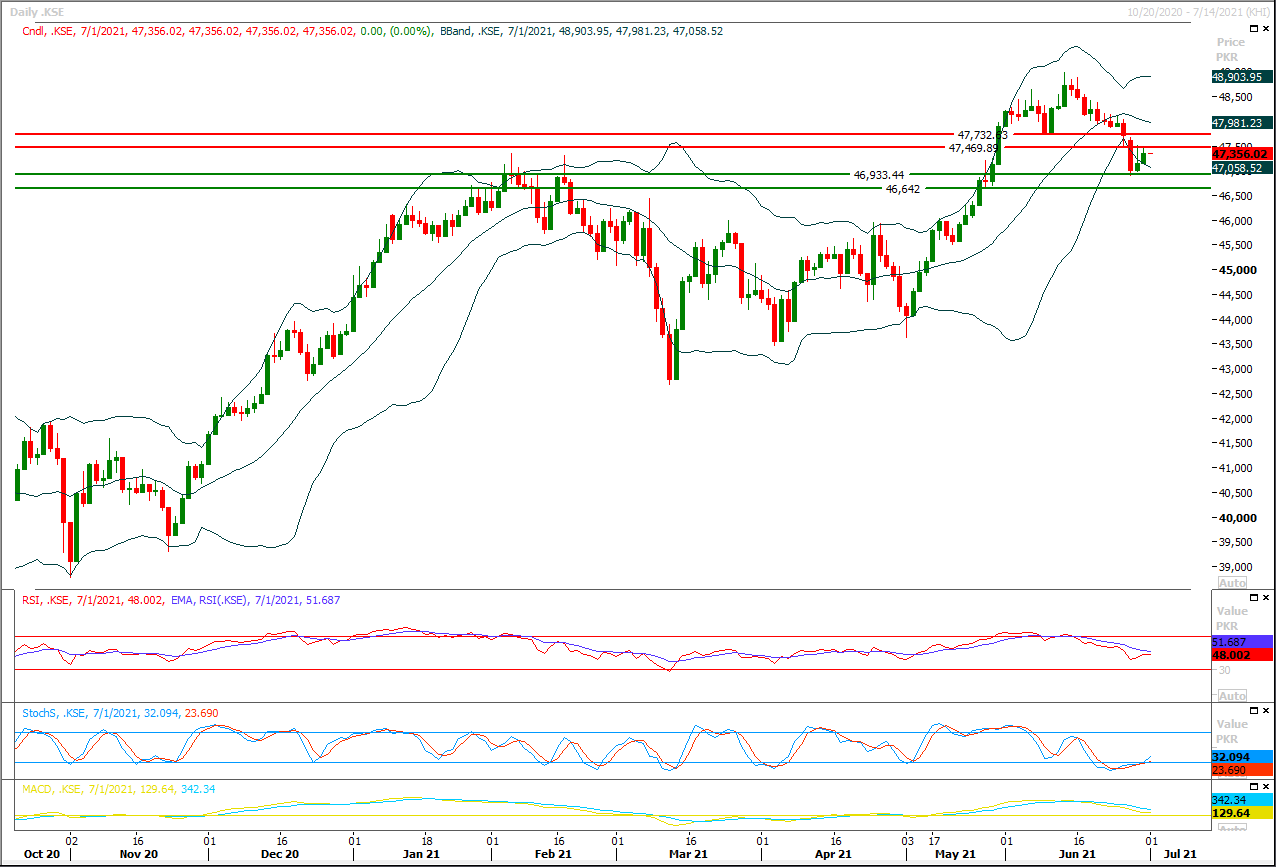

The Benchmark KSE100 index had tried to recover from a strong horizontal supportive region during last trading session but it faced rejection from 50% correction of its last bearish rally and index turned downward again after retesting supportive trend line of its hourly wedge and neck line of its header and shoulder formation. As of now hourly momentum indicators are in bearish mode which indicates that index may face some serious pressure during current trading session but its recommended to stay cautious and wait for breakout below 46,900pts before initiating new short selling positions because this region is actively working as a pivotal value and breakout below this region would call for 46,500pts and 46,000pts. For current trading session 46,900pts would try to push index upward again to retest its resistant regions therefore a volatile session could be witnessed between 46,900pts and 47,500pts. On bullish side 47,500pts would try to react as initial resistance which would be followed by 47,650pts and 47,900pts. In case index would succeed in maintaining above 46,900pts and take a spike towards 47,500pts till day end then there are chances of a morning shooting star on daily chart but it's recommended to wait for confirmation of morning star on hourly chart before initiating new long positions.

Regional Markets

Japan business mood at 2.5-year high as COVID hit eases -Tankan

Japanese big manufacturers' business confidence improved in the second quarter to hit a two-and-half-year high, a central bank survey showed, a sign solid global demand was helping the economy emerge from the coronavirus pandemic-induced doldrums.Service-sector sentiment also turned positive for the first time in five quarters, the Bank of Japan's "Tankan" survey showed, indicating that the economic recovery was broadening even as Japan struggles to contain a fresh wave of coronavirus infections.Companies expect to increase capital expenditure in the year that began in April as profit recovers from last year's slump, offering hope among policymakers who project growth to accelerate in the latter half of this year.

Read More...

Business News

PNSC invites proposals from investors, operators to start ferry services

National flag carrier Pakistan National Shipping Corporation (PNSC) has invited proposals from the investors and operators to start Ferry services in order to promote maritime tourism, coastal development and passenger-cum-cargo ferry service in the country. Well placed industry sources told The Nation that proposals from the investors and operators have been invited to run ferry services on either domestic or international routes or both. Sources said that PNSC efforts are part of the government of Prime Minister Imran Khan to tap the potential of country’s Blue Economy by promoting business opportunities in the areas of maritime sector. On its part, PNSC has made significant progress in bulk and liquid cargo segments and had earned significant profit during the financial year 2020-21.

Read More...

Power generation at Tarbela dam continuously decreasing

Power generation at Tarbela dam further reduced to 1299 megawatts while the water level of the reservoir also decreased to 1431.10 feet. According to the Tarbela dam officials, the water inflow on Wednesday was recorded at 116000 cusecs feet while the outflow was 1313300 and the water level of the reservoir remained at 1431.10 feet. 10 power generation plants out of 17 have produced only 1299 megawatts of electricity today, while the plants were working with low capacity and seven of them were shut down. It was also disclosed that today, 800 cusecs of water was released for PHLC to supply water, some areas of KPK for irrigation.

Read More...

BOI, CCIIP join hands to develop Pak-China B2B investment portal

Board of Investment (BOI) has developed a dedicated Pakistan China Business to Business (B2B) investment portal in collaboration with the China Council for International Investment Promotion (CCIIP), for both Pakistan and Chinese companies, which will enable matchmaking of prospective businesses from both countries interested in investing in Pakistan to enter into joint ventures.Secretary Board of Investment Fareena Mazhar on Wednesday said that considering the unique opportunity for Pakistan to relocate Chinese manufacturing base, BOI has developed a dedicated Pakistan China Business to Business (B2B) investment portal.

Read More...

Petroleum division wants NAB reined in

Reporting the petroleum sector’s circular debt at about Rs1.2 trillion, the petroleum division on Wednesday said the National Accountability Bureau’s (NAB) “brutal act” was causing a heavy cost to the economy and needed to be reined in to let the country achieve its potential.Petroleum Secretary Dr Arshad Mahmood, while testifying before the Senate Standing Committee on Petroleum, said NAB had dispossessed the government officials of the initiative to take decisions.“The countries cannot be run like this” but required initiative and enthusiasm, he said, adding that “we are now pitching the proposal that commercial matters be examined by some commercial forum but not NAB on the first cough”.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.