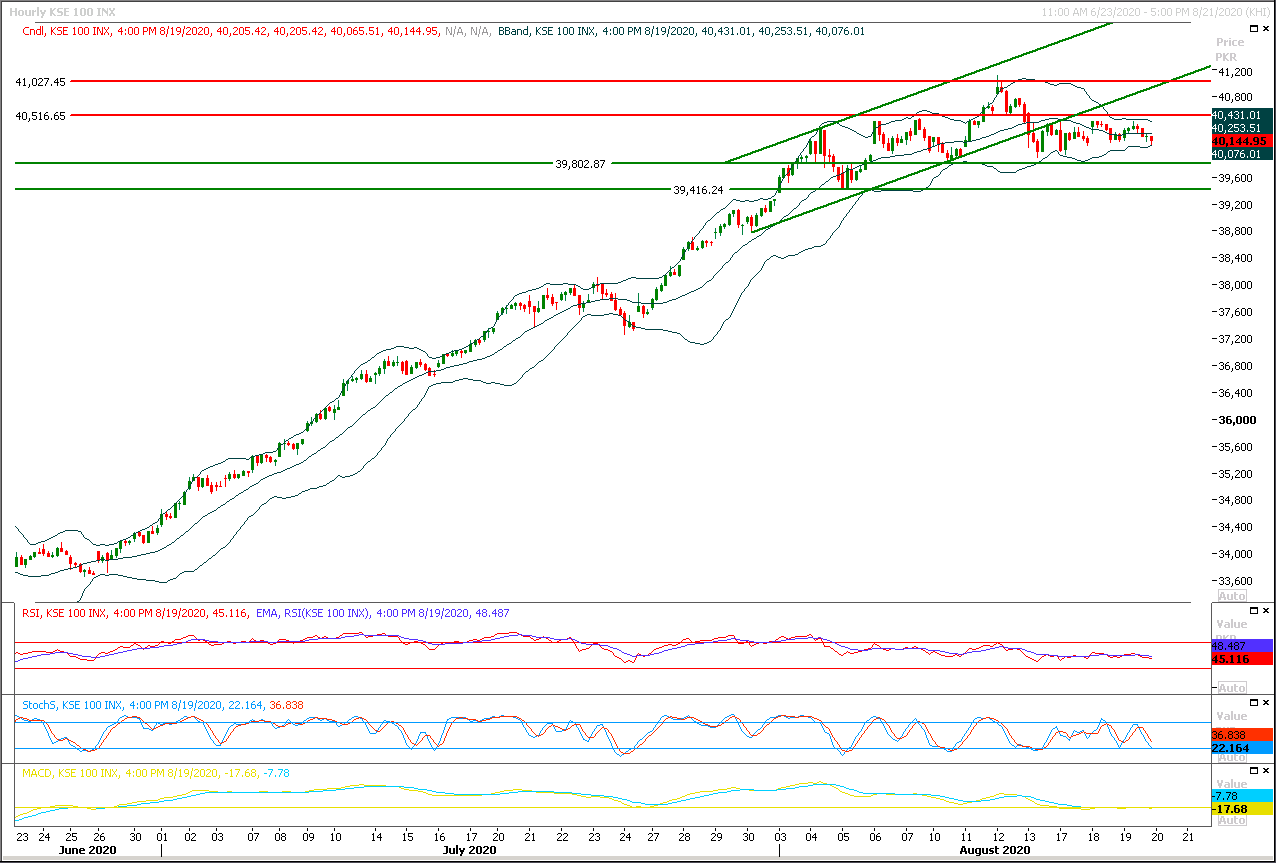

Technical Overview

The Benchmark KSE100 index is being capped by supportive trend line of its bearish channel on hourly chart along with a horizontal resistant region and still have not succceeded in penetration above these regions during last trading session. As of now intraday momentum indicators have changed their direction towards bearish side therefore some kind of serious pressure would be witnessed which would try to push index towards 39,800pts. Mean while on flip side in case of bullish spike index would face major resistances at 40,330pts and 40,530pts on intraday basis. It's expected that index would remain under pressure until it would not succeed in closing above 40,760pts on daily chart. Therefore selling on strength with strict stop loss could be beneficial in current scenario. Once index would succeed in sliding below 39,800pts then its next target would be 39,500pts and 39,200pts.

Regional Markets

Asian stocks, oil buckle on uncertain U.S. recovery

Asian equities and U.S. futures fell on Thursday, hurt by the U.S. Federal Reserve’s cautious view of the economy, tensions with China and new clusters of coronavirus infections.MSCI’s broadest index of Asia-Pacific shares outside Japan slid 1.24%. U.S. stock futures, the S&P 500 e-minis, were down 0.61%. Australian stocks dropped 1.04% due to concern that ties with China will worsen further after a report that Australian regulators will reject acquisitions by a Chinese company. Shares in China fell 0.8%, and Japanese stocks slid 0.77%. South Korean stocks tumbled 2.11% amid a spike in coronavirus cases in Seoul. Market sentiment had been bullish up until Fed policymakers’ comments highlighted uncertainties over the U.S. recovery, with the S&P 500 and the Nasdaq hitting all-time highs driven largely by Apple Inc..

Read More...

Business News

Cost of evacuation of power from Dasu Hydropower Project escalates to Rs132.25b

Central Development Working Party (CDWP) Wednesday approved one project worth Rs3.63 billion and recommended two projects worth 122.128 billion with World Bank share of $450 million to ECNEC for consideration. Central Development Working Party (CDWP) meeting presided over by Planning Commission Deputy Chairman Mohammad Jehanzeb Khan deferred the approval of two projects namely Evacuation of Power from 2160 MW Dasu Hydropower Project (Stage-1) and Pakistan Goes Global and directed the sponsor to rationalise the cost. The cost of evacuation of power from 2160 MW Dasu Hydropower Project (Stage-1) escalated by almost Rs41 billion from Rs 90.832 billion to Rs 132.250 billion whereas the cost of Pakistan Goes Global project is Rs20.515 billion.

Read More...

Inquiry Commission on petrol crisis to submit report to PM within a month

The Inquiry Commission on petrol crisis in the country under the additional Director General Federal Investigation Agency will submit its report to the Prime Minister of Pakistan within one month. The petrol shortage in the month of June was partial and the government has constituted an inquiry commission which will help unearth the actual facts regarding the crises, said Petroleum Division Secretary Asad Haya-u-din while briefing the Standing Committee on Energy (Petroleum Division) which met here under the Chairmanship of MNA Dr. Imran Khattak. Members of the committee, Khurrum Dastagir and Junaid Akber said that when the petrol prices had gone down it was disappeared and when it was increased by Rs25 per litre it was available everywhere. Petroleum secretary said that the fuel shortage was partial and several Oil Marketing Companies (OMCs) were fined.

Read More...

SBP forex reserves to jump to $16 billion

The liquid gross foreign exchange reserves held by the State Bank of Pakistan are expected to rise to over $16 billion by end of current fiscal year-2020-21, according to forecast by the Fitch Ratings. The New York Based international credit rating agency in its recent report said that the central banks’ reserves rose to about $12.5 billion by end-July from $7.7 billion a year prior. A sharp reversal in March of record non-resident inflows to local-currency government notes (reaching a stock of $3.2 billion in February) generated exchange rate volatility and a modest decline in foreign-exchange reserves. It said foreign holdings have stabilised since then, and reserves have been restored through multilateral and bilateral disbursements. Furthermore, the report maintained that Pakistan’s current account deficit narrowed to 1.1 per cent of GDP in FY20 (2019-20), from a peak of 6.1 per cent in FY18, due mainly to import compression and lower oil prices. .

Read More...

Cutlery exports increase by 16.80pc

The cutlery exports from the country witnessed an increase of 16.80 per cent during first month of current financial year (2020-21) as compared to the corresponding period of last fiscal year. The country exported cutlery worth US $10.158 million during July 2020 against the exports of US $8.697 million during July 2019, showing growth of 16.80 per cent, according to the Pakistan Bureau of Statistics (PBS). On month-on-month basis, the exports of cutlery also witnessed grew of 71.65 per cent during July 2020, when compared to the exports of US $ 5.918 million during June 2020, according to the data. It is pertinent to mention here that the trade deficit during the first month of the current fiscal year was dipped by 7.72 per cent as compared to the corresponding period of last year.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.