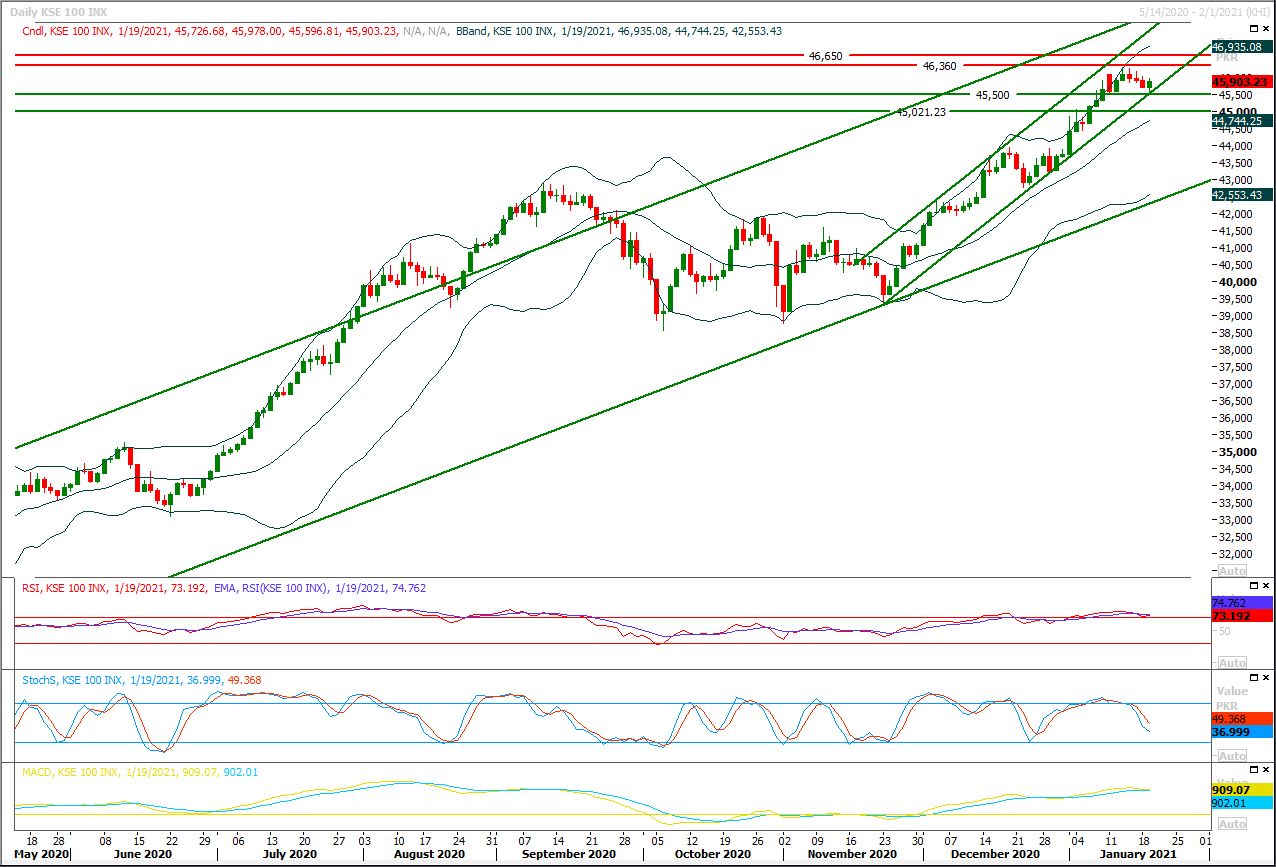

Technical Overview

The Benchmark KSE100 index had bounced back after getting support from a crossover of a horizontal supportive region with a rising trend line on daily chart during last trading session but could not succeed in recovering above its major resistant region of 46,000pts. But Daily momentum indicators are still in bearish mode, meanwhile daily MACD have started losing strength which is a negative indicator, while hourly Stochastic and MAORSI have changed their direction towards bullish side but MACD is still moving in negative zone which may lead index further downward if it would not succeed in penetration above its resistant regions. As now index would face initial resistance between 46,100pts-46,200pts region while breakout above this region would push index towards 46,350pts, overall index would remain in uncertain zone unless until it would not succeed closing above 46,500pts therefore it's recommended to stay cautious and post trailing stop loss on existing long positions. While on flip side in case of rejection from its resistant regions index would slide downward and would try to establish ground above 45,600pts while breakout below that region would call for 46,470pts and 46,300pts. It's expected that a volatile session would be witnessed during current trading session therefore swing trading could be beneficial.

Regional Markets

Asian markets set for modest upswing after gains on Wall Street

Investors in Asian markets were poised for gains on Wednesday after Wall Street indexes rose on the back of U.S. Treasury Secretary nominee Janet Yellen’s push for a sizable fiscal relief package in response to the COVID-19 pandemic. Australia’s ASX 200 rose more than 0.5% in early trade Wednesday. MSCI’s gauge of stocks across the globe gained 0.03%. Japan’s Nikkei 225 futures added 0.07%, but Hong Kong’s Hang Seng index futures lost 0.29%. At Yellen’s confirmation hearing on Tuesday, she said the benefits of a big stimulus package are greater than the expenses of a higher debt burden. President-elect Joe Biden, who will be sworn into office on Wednesday, last week laid out a $1.9 trillion stimulus package proposal to boost the economy and speed up the distribution of vaccines. On Wall Street, the Dow Jones Industrial Average rose 0.38%, while the S&P 500 gained 0.81%. The tech-heavy Nasdaq Composite added 1.53%.

Read More...

Business News

Indicators show economy witnessing significant growth

At a time when the world economic growth rate has been hit hard by the COVID-19 (coronavirus) shocks, the economy of Pakistan has been showing significant progress as indicated by various indicators, depicting prudent policies of the government in running the country in these crisis times. According to official figures, the Large Scale Manufacturing Industries (LSMI) witnessed a growth of 7.41 per cent during the first five months (July-November) of the current fiscal year compared to the corresponding period of last year. While on a year-on-year basis, the LSMI grew by 14.46 per cent in November 2020 as compared to November 2019. The monthly inflation based on the Consumer Price Index (CPI), decelerated to 8 per cent on year-on-year (YoY) basis in December 2020, from 8.3 per cent during November. On month-on-month (MoM) basis, it decreased by 0.7 per cent in December as compared to an increase of 0.8 per cent in November 2020 and a decrease of 0.3 per cent in December 2019.

Read More...

Govt decides to import another 0.5m tonnes sugar to overcome shortage

The govt has decided to import another 0.5 million tonnes of sugar to overcome the shortage that resulted in massive increase in commodity price. The government is also mulling to exempt commercial import of sugar from duties and taxes by invoking food security provisions. Officials in ministry of Industries and Production have informed that Economic Coordination Committee (ECC) of the Cabinet is likely to take up the summaries of importing more sugar and removing taxes and duties on imported sugar during current week. The ECC was supposed to take up the summaries in last week, but the meeting was postponed.

Read More...

PAC asks AGP for Broadsheet probe report

The Public Accounts Committee (PAC) on Tuesday asked Auditor General of Pakistan (AGP) Javed Jahangir to probe the Broadsheet affair and submit a report within 10 days. PAC chairman Rana Tanveer Hussain said that the amount paid to the foreign company may be recovered from the National Accountability Bureau (NAB) if the report held the bureau responsible. Recently, the Pakistan government paid $28 million to Broadsheet company after the latter secured the verdict from the UK’s High Court. The Broadsheet company claimed multi-million dollars from Pakistan for identifying offshore assets of Pakistani citizens to NAB under an Assets Recovery Agreement (ARA).

Read More...

Let down by UAE firm, Pakistan seeks two LNG cargoes

The government has sought urgent tenders for liquefied natural gas (LNG) deliveries in third and fourth week of February to fill the gap arising out of a default by Emirates National Oil Company (ENOC) on its supply commitment. A senior official at the Ministry of Energy (Petroleum Division) confirmed that two cargoes had been sought from the international market using emergency provisions of the procurement rules. He said Pakistan LNG Limited (PLL) — the state-run entity responsible for import of LNG — had approached prospective suppliers for LNG delivery on Feb 15-16 and Feb 23-24. In such circumstances, normal tendering schedules become impractical and, therefore, bidders have been asked to submit their bids within three days i.e. latest by Jan 22. On Sunday, PLL confirmed that the UAE firm ENOC had defaulted on its bid.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.