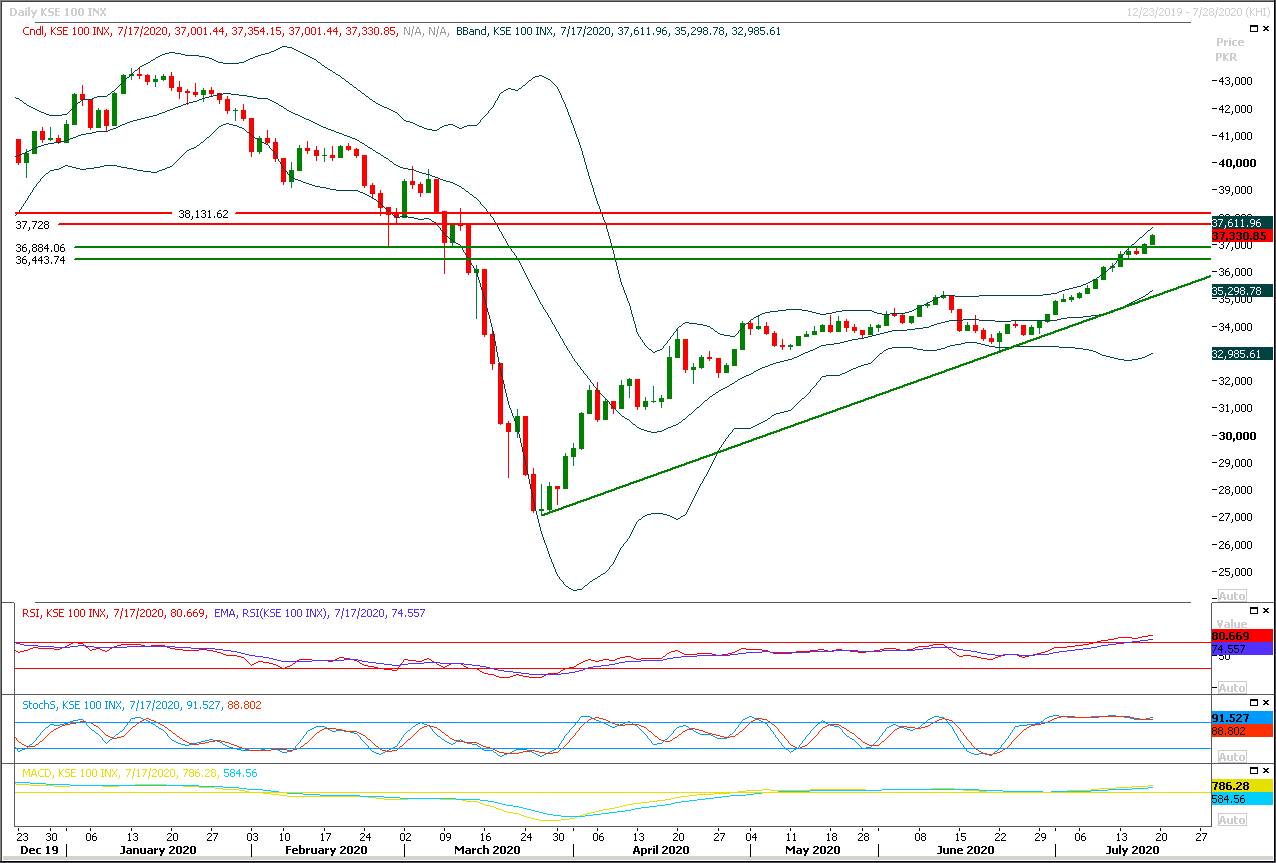

Technical Overview

The Benchmark KSE100 index have succeeded in giving a breakout of its ascending wedge in upward direction which indicates that index could continue its bullish sentiment but it would need massive volume to continue its bullish journey. Initially index would try to target 37,500pts and 37,730pts to maintain its upward trend while breakout above 37,800pts would invite some fresh volumes and index would start gaining strength against current uncertainty. It's recommended to remain on buying side until index generate a reversal sign either on intraday or daily chart and avoid short selling till that. It's expected that index would face resistances at 37,500pts and 37,730pts and if bulls would not succeed in providing required volumes then it would start losing strength.

On flip side, index would try to find some ground at 37,000pts and 36,860pts in case of bearish pressure and rejection from its resistant regions, it would remain range bound until its caged between 36,500-37,800pts while breakout of either side would push index for further 500-800 points in respective direction.

Regional Markets

Asian shares defensive; eyes on EU summit, U.S. stimulus talks

Asian shares began warily on Monday as investors eyed efforts to stitch together more fiscal stimulus in the eurozone and United States to help economies ride out the effects of a record jump in COVID-19 cases globally.MSCI’s broadest index of Asia-Pacific shares outside Japan was flat at 541.49, with Australian shares down 0.3% and South Korea’s KOSPI just a shade higher. Japan’s Nikkei was up 0.1%. E-minis for the S&P 500 rose 0.1% in early Asian trading. Last week, European, U.S. and other equity markets notched their third weekly gain in a row, although the pace of the rally has slowed. The Dow fell 0.23% on Friday, the S&P 500 gained 0.29% and the Nasdaq Composite added 0.28%.Read More...

Business News

Taking total debt to Rs2150b, PTI govt adds Rs962b to power circular debt in less than 2 years

The government of Pakistan Tehreek-e-Insaf has added Rs962 billion to the power circular debt during less than two years of its tenure taking the total debt to Rs2150 billion, official documents reveals. On average Rs481 billion per year was added to the circular debt in 2018-19 and 2019-20, official documents available with The Nation reveals. As per the data in June 2018, the country’s total circular debt was Rs1126 billion which has gone up to Rs2150 billion till June 30th, 2020. In June 2013, when the PML (N) came into power, the total circular debt was Rs308 billion, which included Rs68 billion payable to IPPs and Gencos and Rs240 billion PHPL debt. In their first year in office, the PML (N) government had accumulated Rs213 billion in circular debt and on June 2014 the total debt reached to Rs 531 billion.

Read More...

Govt aims to import high grade fuel in current FY

The government has planned to start import of high grade petrol and diesel during the current fiscal year aimed at tackling the environmental issues and meeting requirements of high-tech vehicles in the country. “To reduce the environmental impact through improved quality of fuel, high grade imports of petroleum products i.e. Petrol and High Speed Diesel is planned to be initiated during 2020-21,” a senior official privy to petroleum sector developments told APP while referring to the Annual Plan 2020-21. For the purpose, he said, a Euro-IV and V standard fuel testing laboratory had already been set up at the Hydrocarbon Development Institute of Pakistan (HDIP) Islamabad, while more labs would be upgraded in due course of time.

Read More...

Work on CPEC Hydropower projects in full swing

The recently signed agreements in Pakistan for hydropower projects under the China-Pakistan Economic Corridor (CPEC) marked the beginning of a mature new phase for the programme, which is under the China-proposed Belt and Road Initiative (BRI), according to Chinese experts. The concessional agreement for the 700.7-MW Azad Pattan Hydropower Project was signed last week, a breakthrough for the implementation of the project, according to China Gezhouba Group, the Chinese investor in the project.

Read More...

Flour shortage, hoarders and phony crackdowns

NEWSPAPER headlines on the issue of rising flour prices have changed from dealing with hoarders with an iron fist to the duty-free import of wheat. It raises the question whether the wheat and flour crisis is finally over. As Prime Minister Imran Khan chaired a meeting on July 14 in Islamabad to order a crackdown on the hoarders of wheat and bring down flour prices, daring flour millers of Karachi increased the price by Rs4 per kilogram to Rs54. The increase in flour prices and high-level meetings in the corridors of power took place simultaneously in the past as well. Consumers had braved a jump of Rs18.50 per kg in flour number 2.5 between April and July 14 despite stern warnings from the prime minister to the provincial authorities to prevent a flour price hike and wheat hoarding.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.