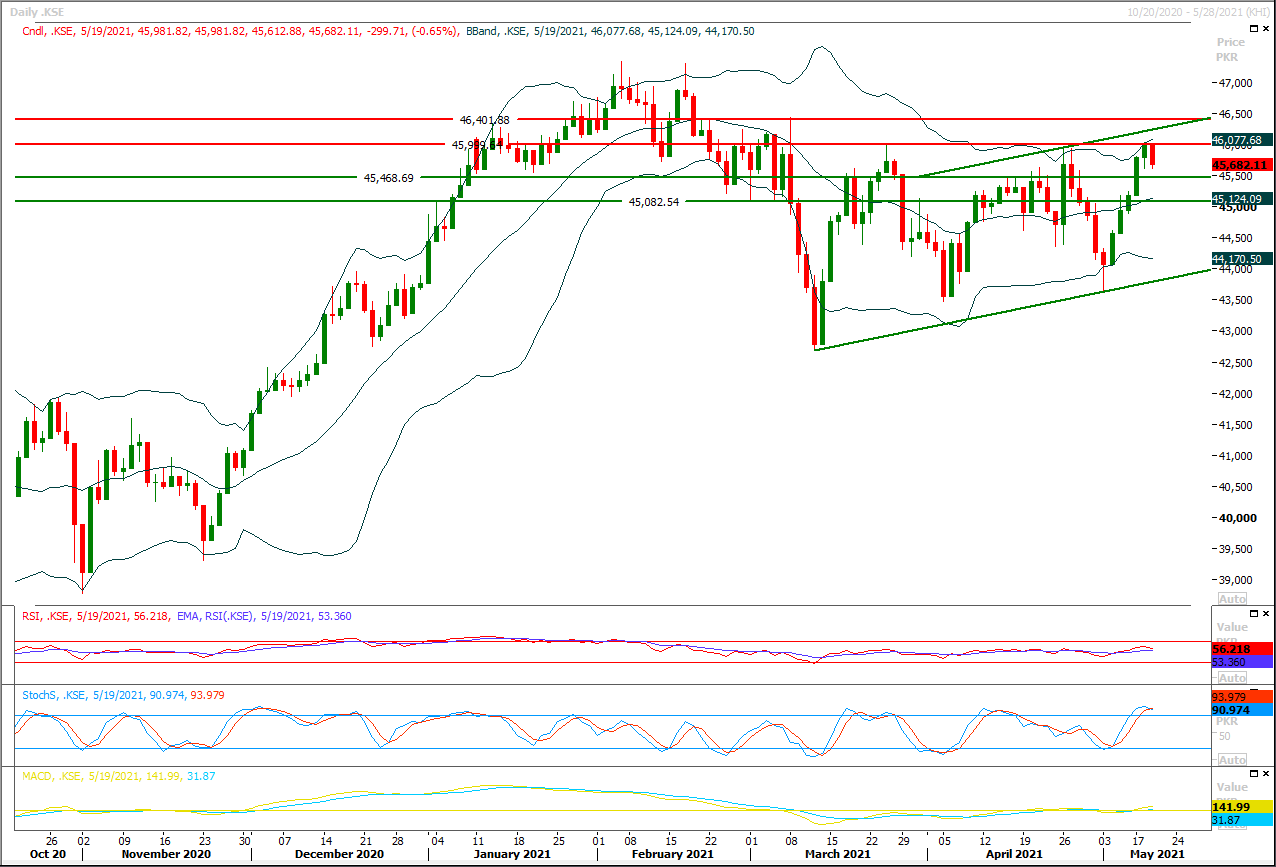

Technical Overview

The Benchmark KSE100 index had created a bearish engulfing pattern on daily chart after facing rejection from a triple top on hourly and daily charts during last trading session, as of now it's expected that initially index would face some pressure which may push index towards 45,500pts-45,450pts where it would try to establish ground above a strong horizontal supportive region and some fresh volumes on long side would pop up which would try to push index again back on bullish track but it's recommended to stay cautious because if index would not succeed in sustaining above this region then it would try to target its next supportive regions at 45,200pts and 45,080pts. Daily momentum indicators have changed their direction towards bearish side but it needs confirmation which would occur if index would succeed in closing below 45,500pts today. While on flip side in case of bullish pull back index would face initial resistance at 46,000pts which would be followed by 46,200pts. Overall a volatile session would be witnessed during current trading session therefore it's recommended to stay cautious and swing trading is recommended with strict stop losses on both sides. Currently index is trading in a very crucial range as its caged in a triangle on weekly chart and weekly closing above 45,700pts would gave a bullish breakout of this triangle therefore it's recommended to adopt wait and see strategy to initiate new long positions for short term trading.

Regional Markets

Australian doctors warn vaccine hesitancy makes citizens "sitting ducks"

Australia's peak medical body on Thursday warned the country's residents were "sitting ducks" for COVID-19, as business leaders call for the international border to be reopened faster despite a sluggish national vaccination drive.

Read More...

Business News

Irsa warns water shortages may aggravate

Australia's peak medical body on Thursday warned the country's residents were "sitting ducks" for COVID-19, as business leaders call for the international border to be reopened faster despite a sluggish national vaccination drive.As temperatures drop in catchment areas, national water shortages have risen close to 30 per cent, against earlier calculations of 10pc, and the Indus River System Authority (Irsa) says that next 48 hours are crucial. According to Irsa, it was currently distributing water at 18pc shortages because of national storages, which have around one million acre feet and are supporting current distribution. However, next two days are very critical — if temperatures keep the current pattern, “we would be in trouble.” Punjab, however, wrote a stinging letter to Irsa on Wednesday, berating it for “risking Mangla dam filling” for its current distribution preferences. “Punjab demands in the strongest possible words that Irsa adjusts kharif allocations judiciously to meet with the demands of provinces in accordance with the available inflows at rim stations without disturbing the planned filling of Mangla reservoir.

Read More...

Govt raises Rs575bn through T-bills auction

The government on Wednesday raisedRs575.3 billion through the auction of treasury bills (T-bills). The rate was slightly changed from the previous auction held on May 5. Banks with surplus liquidity showed their eagerness to park over one trillion rupees in government papers. However, the government accepted about 50 per cent amount offered by the investors. Since the cut-off yields on all papers were almost unchanged, bankers believe it to be a sign of a stable interest rate. Financial circles have been waiting to see a positive change in the interest rate but the State Bank looks unmoved. Increasing inflation has put pressure on the SBP to change the interest rate in the upward direction. However, growth has been given first chance to improve. The latest data of LSM showed 8.99pc growth during the first nine months of the current fiscal year (9MFY21). However, higher interest rates could hurt growth. The SBP is sticking to 3pc economic growth rate for FY21 while the International Monetary Fund and World Bank see half of the estimate given by the central bank.

Read More...

Profit rates on savings schemes revised

The government has made adjustments to returns on almost all national savings instruments with immediate effect. According to notification issued by the Ministry of Finance, the return on Shuhada’s Family Welfare Accounts and Pensioners’ Benefit Accounts have been reduced from 11.52pc to Rs11.04pc with effect from May 19, 2021. Likewise, the profit payable on Bahbood Savings Certificates has also been reduced from 11.52pc to 11.28pc while return on special savings certificates has been increased from 8.8pc to 9pc. Also, the return on Defence Savings Certificates has been reduced to 7.68pc instead of about 9.52pc.

Read More...

Govt again extends timeline for public sector entities’ privatisation

The government has once again extended the timeline for the privatisation of public sector entities including SME Bank, First Women Bank Limited, Jinnah Convention Centre, House Building Finance Corporation Limited, and Services International Hotel owing to the pandemic and resultant market conditions. Earlier, the government had planned to privatise three public sector entities (PSEs) including SME Bank Limited during ongoing fiscal year. The Privatisation Commission had decided to complete the privatisation process of three PSEs including Divestment of up to 20 per cent Shares of Pakistan Reinsurance Co Ltd, SME Bank Limited and Services International Hotel, Lahore by June 30 this year, according to the official documents.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.