Technical Overview

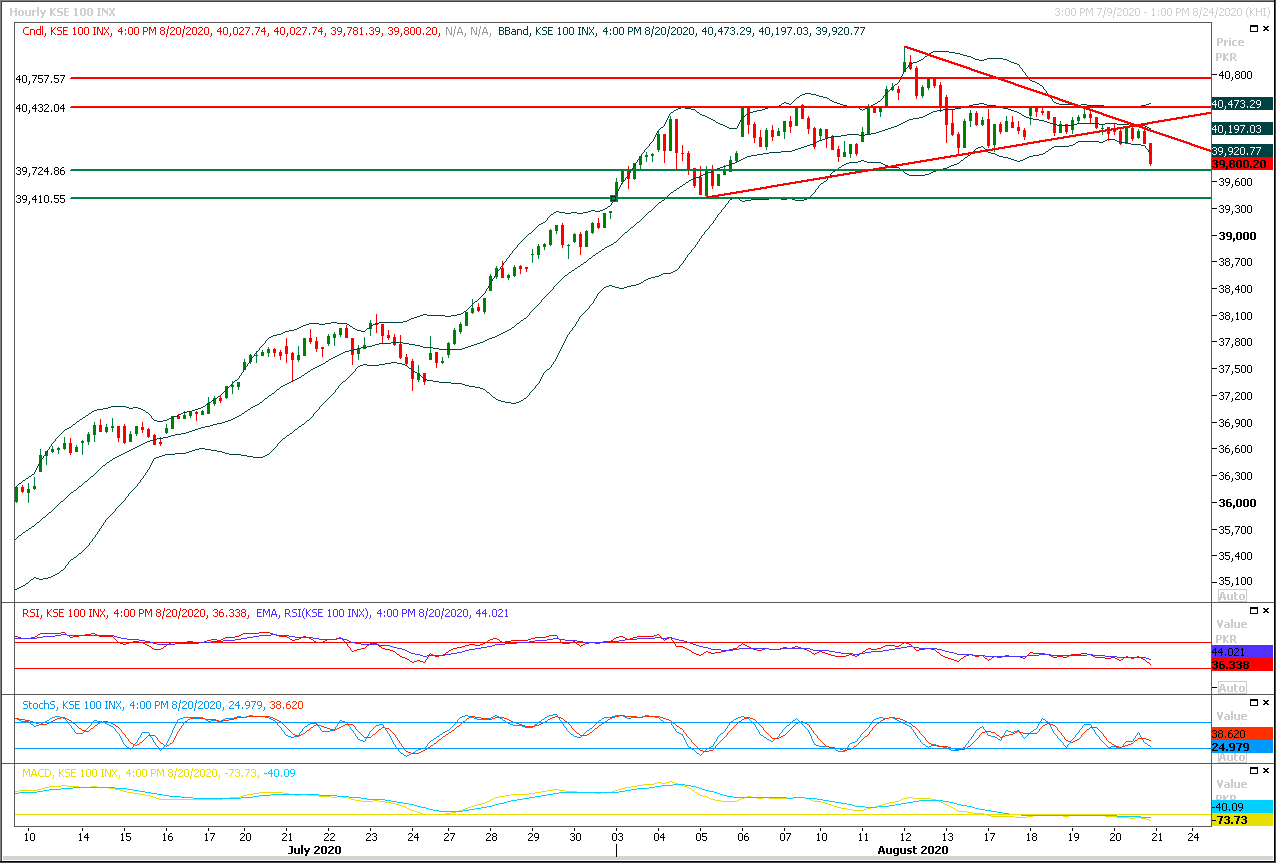

The Benchmark KSE100 index have been dragged downward by its hourly momentum indicators after breakout of its triangle in bearish direction and retesting of supportive trend line of that triangle on hourly chart. As of now index is being capped by a strong resistant trend line which would try to push index further downward but two strong supportive regions are standing at 39,700pts and 39,400pts therefore it's recommended to stay cautious with short positions until index succeeds in closing below 39,320pts on daily chart. Actually daily momentum indicators also have changed their direction towards bearish side and once stochastic would slide below 20 then two or three trading sessions of serious bearishness would be witnessed. It's recommended to practice caution because on hourly chart index have strong supportive regions ahead at 39,700pts and 39,400pts meanwhile on flip side index would face resistances at 40,034pts region and it would remain bearish until it would not succeed in closing above 40,500pts.

Regional Markets

Record-breaking stocks take a breather, data weighs on dollar

Asia’s stock markets bounced on Friday following Wall Street’s lead, but were set for their softest week in about a month as investors grapple with tepid economic data and lofty valuations after a huge rally that has wiped out coronavirus losses.MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.6% on Friday, though it is it poised to snap a four-week winning streak with a small weekly loss. Japan’s Nikkei edged up 0.3% but was headed for a 1.5% weekly drop, while a bond market selloff has also moderated in recent days as caution and summer-time lassitude weighs on the mood after the S&P 500 touched another record intraday peak. Another surge in tech stocks took the Nasdaq to a new all-time closing high. [.N] “It’s always going to be a little harder, once that’s happened, to figure out where things are going,” said ING’s head of Asia research, Rob Carnell of the U.S. stock market.

Read More...

Business News

Taxes, duties exempted on import of 0.3m metric tonnes of white sugar

The Federal Board of Revenue (FBR) on Thursday has notified to exempt the import of 0.3 million metric tonnes of white sugar from the taxes and duties. The FBR has issued two different notifications in this regard, which stated that government has exempted the 0.3 million metric tonnes imported sugar from the taxes and duties. The government had allowed importing of 300,000 metric tonnes white sugar to maintain strategic reserves, stabilise prices of sugar and prevent any possible shortfall at the end of this crop year 2019-20.

Read More...

FBR’s field formations engaged in ops against tax evasion, fraud

The field formations of Federal Board of Revenue are engaged in operations against tax evasion and tax fraud to comply with the strict directions of FBR Headquarters. While implementing the directions of FBR, the Directorate of Intelligence and Investigation has unearthed a massive tax evasion case of Rs. 4.36 billion in Lahore. In pursuance of information received, discrete intelligence gathering was carried out in relation to a registered person operating a manufacturing concern of edible products in Lahore as a result of which it was observed that registered person was involved in massive evasion of due sales tax/ commission of tax fraud by way of suppression of its actual quantum of production and supplies.

Read More...

Wapda requests Nepra to increase power tariff by Rs1.65/unit

In its petition for tariff revision, Water and Power Development Authority has requested NEPRA for the increase of Rs 1.65 per unit in power tariff from the WAPDA hydel power stations to meet its revenue requirement of Rs177.518 billion for the fiscal year 2020-21. As per the petition for the revision of Tariff for 2020-21 for Bulk Supply of Power from the WAPDA hydel power stations, submitted to National Electric Power Regulator Authority (NEPRA), WAPDA has requested an increase of Rs1.65 per unit in tariff from the current Rs5.67 to Rs 7.32 per unit, official sources told The Nation here Thursday.In its petition, WAPDA has claimed total revenue requirement of Rs177.528 billion for the current fiscal which is Rs106.169 billion higher than the revenue requirement determined by NEPRA for the fiscal year 2017-18.

Read More...

Govt retired Rs855 billion to SBP in last thirteen months

The ministry of finance on Thursday said that government had retired Rs855 billion to the State Bank of Pakistan (SBP) in last thirteen months by borrowing from the banks. Officials of the ministry of finance have informed the media that the government has retired Rs 570 billion till June 2020 to the State Bank of Pakistan (SBP) and Rs 285 billion in the month of July 2020 by borrowing from the banks. They further informed that incumbent government is reducing the cost of domestic debt through re-profiling and its tenure has been increased while previous government borrowed at higher cost. Officials informed that Debt management wing of the ministry of finance is working actively. Giving details of the recent borrowing,

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.