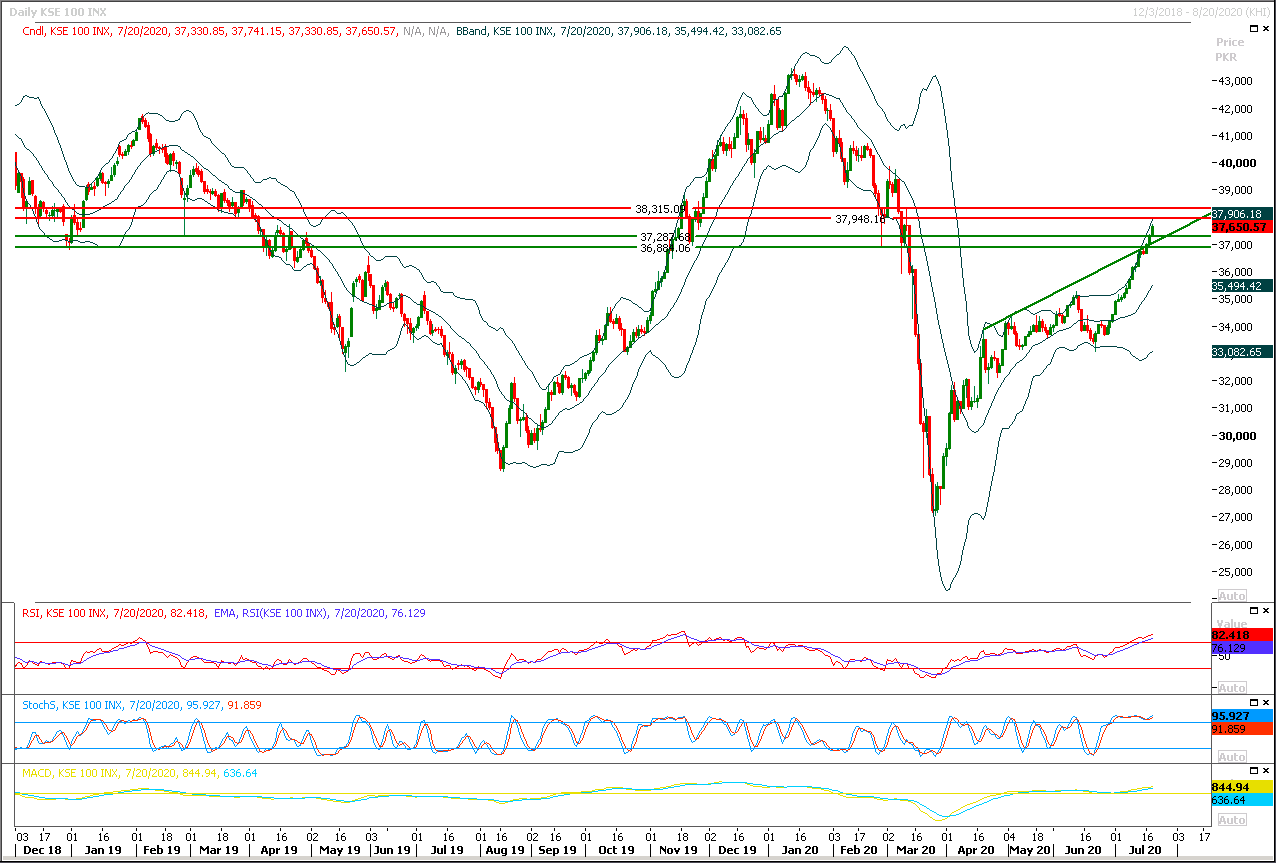

Technical Overview

The Benchmark KSE100 index have witnessed a health trading volume figures during last trading session which was needed after breakout of its rising wedge in bullish direction and now it's considered that resistant trend line of that wedge would react as strong supportive region in case of bearish pressure in coming days. It's recommended to stay on buying side and post trailing stop loss on existing long positions because index may witness some pressure from 38,000pts or 38,300pts in coming days. Momentum would remain bullish as long as its trading above 37,200pts and it's expected that it would try to target 37,950pts or 38,000pts during current trading session while breakout above these regions would call for 38,300pts and 38,500pts. It's recommended to start profit taking from long positions around 38,000pts because a correction is long due and it would be healthy for market to continue its momentum. While on flip side in case of bearish pressure index would try to find some ground at 37,500pts initially and later on 37,200pts and 36,880pts regions would try to pump some fresh volumes in market.

Regional Markets

Asian shares extend gains as investors count on stimulus, vaccines

Asian shares advanced on Tuesday as prospects of a deal by European Union leaders to jointly fund recovery of their economies and hopes for a coronavirus vaccine lifted risk appetite. Japan’s Nikkei rose 0.6% while MSCI’s broadest index of Asia-Pacific shares outside Japan gained 1.5% to edge near its four-month peak hit earlier this month. On Wall Street, tech shares jumped after several days in the doldrums, pushing the Nasdaq Composite up 2.51% to a record closing high on Monday. The S&P500 also hit a five-month peak. Euro Stoxx 50 futures gained 0.25% in Asian trade to stand near their highest since early March.Read More...

Business News

NA committee cancels crucial meeting on FATF, circular debt

A scheduled meeting of the National Assembly Standing Committee on Finance, Revenue and Economic Affairs on Monday to discuss Financial Action Task Force (FATF), circular debt and official legislative business was eventually cancelled by its chairman Faiz Ullah Kamoka due to poor response from its members and the Ministry of Finance. Out of the 21 members, only Faheem Khan of PTI and Ali Pervaiz of PMLN showed up. Two joint secretaries of the finance ministry were also present. The NA committee chairman and members waited for more than half an hour for another two members to complete the quorum and begin the proceedings. Adviser to the Prime Minister on Finance & Revenue Dr Abdul Hafeez Shaikh, Secretary Finance and Minister for Industries Hammad Azhar did not show up at the meeting.

Read More...

Dollar surges against rupee

The dollar rose to the highest level of FY21 against the local currency on Monday, reflecting its increasing demand. Currency dealers in the interbank market said the dollar was traded as high as Rs168.70 and closed at Rs168.30 after a gain of about 97 paisas during the day. However, in the second session — which was for the next day (tomorrow value) — it rose to Rs168.75, mounting further pressure on the local currency. The dollar had hit peak on 27 March when it was traded at Rs169.90 in the interbank. The exchange rate remained under pressure particularly after the coronavirus outbreak. The country witnessed an outflow of over $3.5 billion from the domestic bonds while the inflow of foreign direct investment also fell month-on-month in April and May.

Read More...

Mari discovers gas at Hilal-1

Mari Petroleum Company Ltd announced gas discovery at exploratory well Hilal-1 in Mari D&P Lease Area, Daharki, District Ghotki in Sindh. In a notice to the PSX, the company stated that it was the fifth consecutive new discovery in Mari D&P Lease Area based on 1,079 sq km carpet 3D seismic survey of the area in 2015, which was followed by an extensive drilling programme. Hilal-1 was spud-in on April 21 and drilled down to the depth of 1,202 metres into Sui Main Limestone (SML). Upon testing, the well flowed gas from Sui Upper Limestone formation at a flow rate of 11mmcfd with flowing well head pressure of 887 PSI at choke size of 48”/64”.

Read More...

International Finance Corporation to invest $25m in Packages Limited

-International Finance Corporation (IFC), a member of the World Bank Group, has signed a deal for a five-year loan investment of $25 million in Packages Limited, one of Pakistan’s leading packaging and tissue paper producers, to modernise its operations, and cut its water and energy use.IFC has been advising Packages on ways to cut its water and energy use, in a country ranked as among the world’s most energy intensive and facing water shortages. By adopting resource efficiency measures, Packages will be able to annually decrease greenhouse gas (GHG) emissions by about 11,000 tonnes of carbon dioxide equivalent, and save about 43,000 megawatt-hours (MWh) and about 214,000 cubic meters (m3) of water per annum. Overall the company will save annually about $1.4 million in its operations.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.