Technical Overview

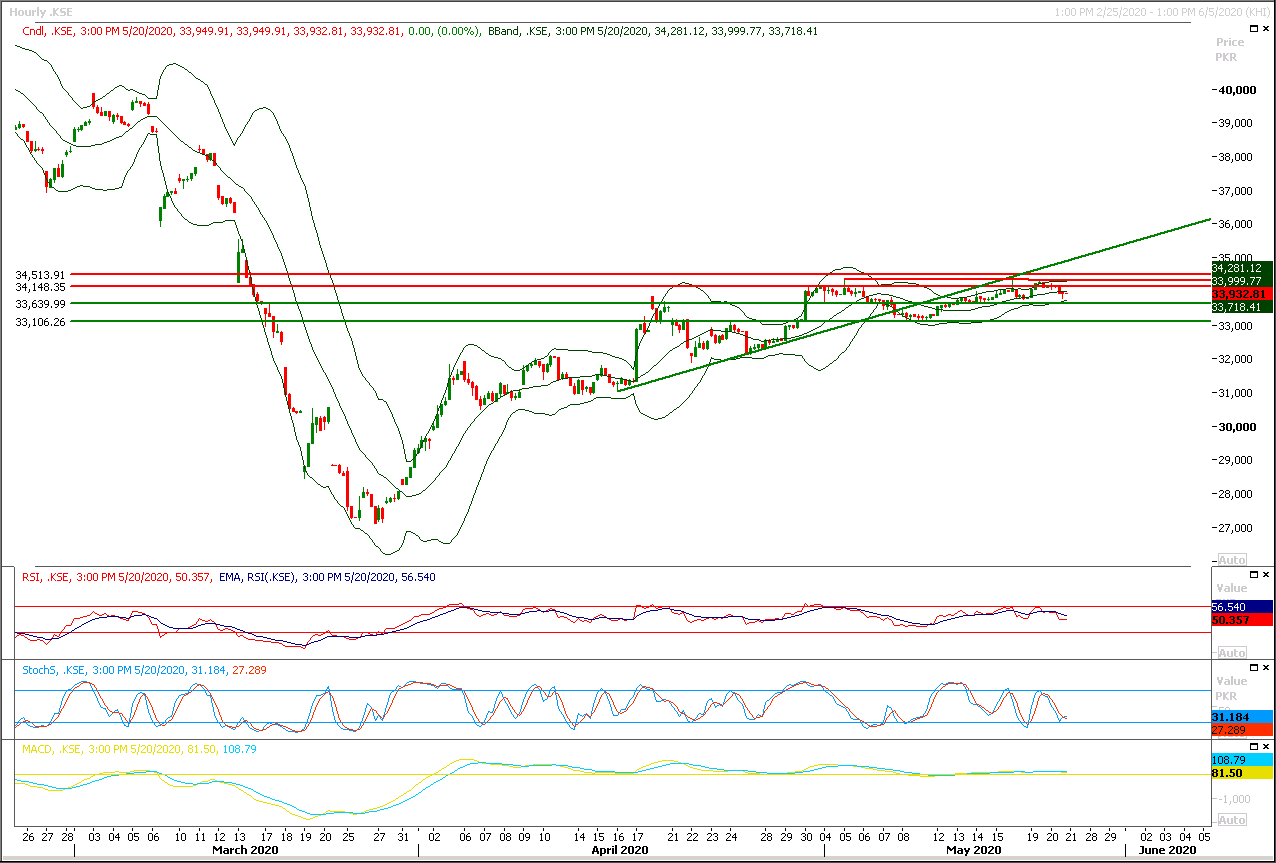

The Benchmark KSE100 index still have not been succeeded in closing above its resistant regions since last two weeks and its moving below supportive trend line of its rising wedge and it faced rejection from same trend line for third time during last trading session and have moved downward after getting resistance from a strong horizontal resistant region, today it's expected that it would face resistance from a descending trend line at 34,400pts as well meanwhile a strong horizontal resistant region at 34,530pts would also try to push index downward in case of any bullish spike. It's recommended to stay cautious and post trailing stop loss on existing long positions. while closing above 34,530pts would call for 35,200pts. It seems that index is losing its strength and if it would not succeed in giving a clear breakout of its resistant regions this week then in next week some serious pressure could be witnessed.

While on flip side index would try to find ground at 33,860pts and 33,500pts in case of any bearish pressure and a tripple top formation would take place if index would not succeed in closing above 34,500 during current trading session.

Regional Markets

Asia shares temper rally, await China policy meeting

Asian shares stepped back slightly and U.S. stock futures fell on Thursday as lingering caution about the long-term impact of the coronavirus outbreak offset some of this week’s enthusiasm over re-opening of economies. Investors were also looking ahead to a key policy gathering in China that may yield more economic stimulus, while recent data around the world underscored that a sustainable recovery is several months away. MSCI’s broadest index of Asia-Pacific shares outside Japan was up just 0.04%, having rallied around 3% so far this week. S&P 500 e-mini stock futures fell 0.66%.

Read More...

Business News

Pakistan will not go for commercial loans’ refinancing, Shaikh tells ECC

The Economic Coordination Committee (ECC) of the Cabinet has approved in principal to allow Economic Affairs Division (EAD) to sign an MoU for availing the G-20 relief initiative subject to the approval of the Cabinet. Pakistan is required to enter into this MoU with all official bilateral creditors including Paris Club creditors to implement the debt relief initiative of G-20. Chairman ECC Hafeez Shaikh unequivocally informed the forum that Pakistan has no intension of seeking any kind of relief for repayment of its commercial loans/ borrowings. He also informed that Pakistan has the means and will to honor its commercial commitments.

Read More...

ECC okays diversion of Rs10bn from Covid-19 relief fund to power sector debt repayments

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday allowed talks on extension of debt repayment period of power plants — in both public and private sector — from the existing 10-year period to 20 years for about 65 paisa per unit cut in average capacity tariff and approved diversion of about Rs10 billion from Corona Relief Package to power sector interest payments. The ECC meeting, presided by Adviser to PM on Finance & Revenue Dr Abdul Hafeez Shaikh also decided against rescheduling of foreign commercial debt as it allowed signing of memorandums of understanding for about $2.04bn debt relief with G-20 members.

Read More...

Rs432bn loan payments deferred so far: SBP

The State Bank of Pakistan (SBP) said on Wednesday that Rs432 billion of principal repayments of loans have been deferred under its refinancing scheme for protecting businesses from the impact of Covid-19. Last month, it also introduced a scheme in collaboration with Pakistan Banks Association for deferment of principal amount. To avail this relaxation, borrowers were advised to submit a written request to the banks before June 30. The debtors will continue to service the mark-up amount as per agreed terms and conditions.

Read More...

Wapda chief eyes dam diversions’ completion in three years

Amid the launch of the construction of Diamer-Bhasha dam, the government on Wednesday said the decision to build it as a ‘roller compact concrete (RCC)’ structure was based on 20-year intensive scrutiny of technical and geological reports and feasibility studies by an international panel of experts. Speaking at a news conference, Wapda chairman retired Lt Gen Muzammil Hussain said the project was initially among a list of 8-10 major projects identified by a Canadian consultant in the early 1980s and the choice for RCC dam was based on pre-feasibility and feasibility studies of the time.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.