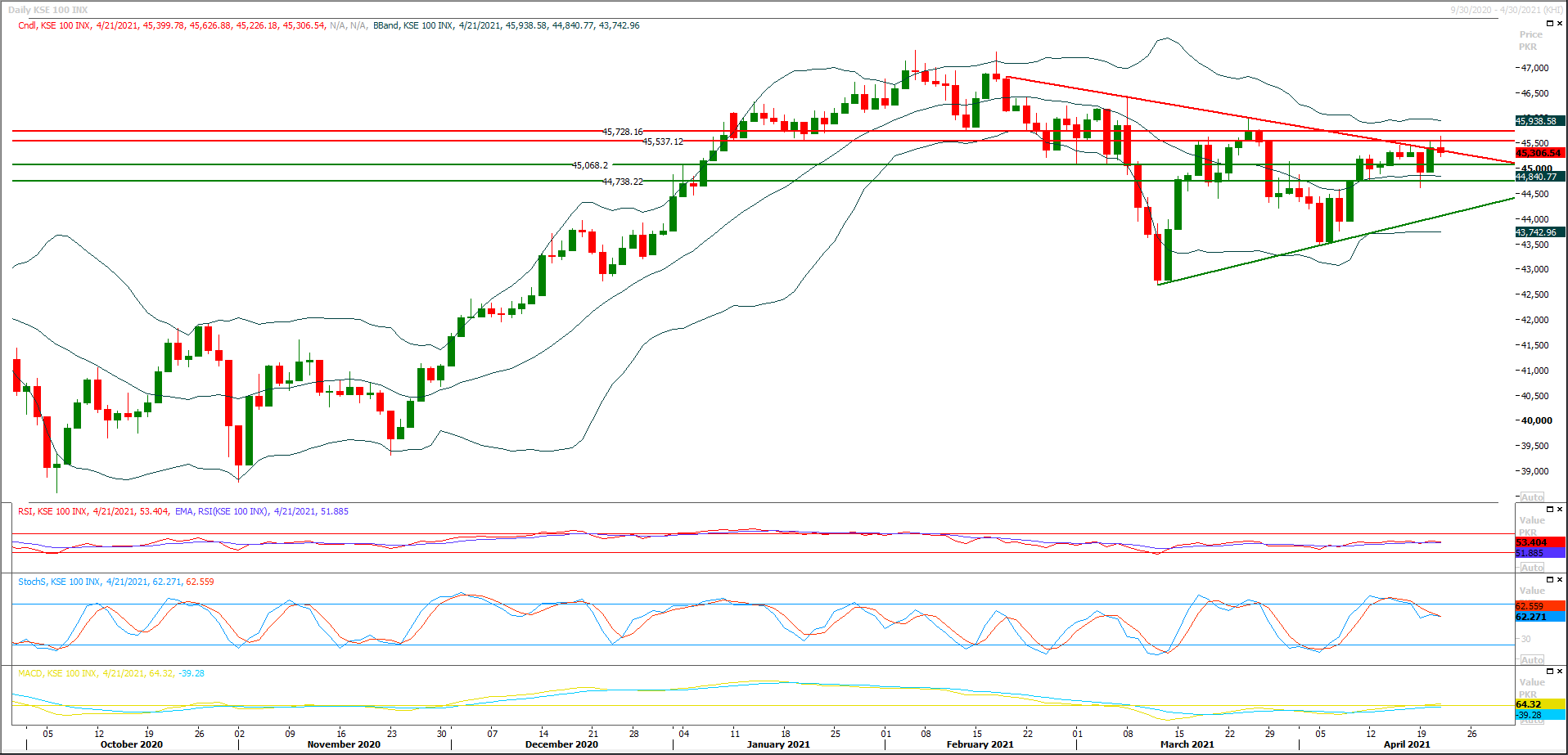

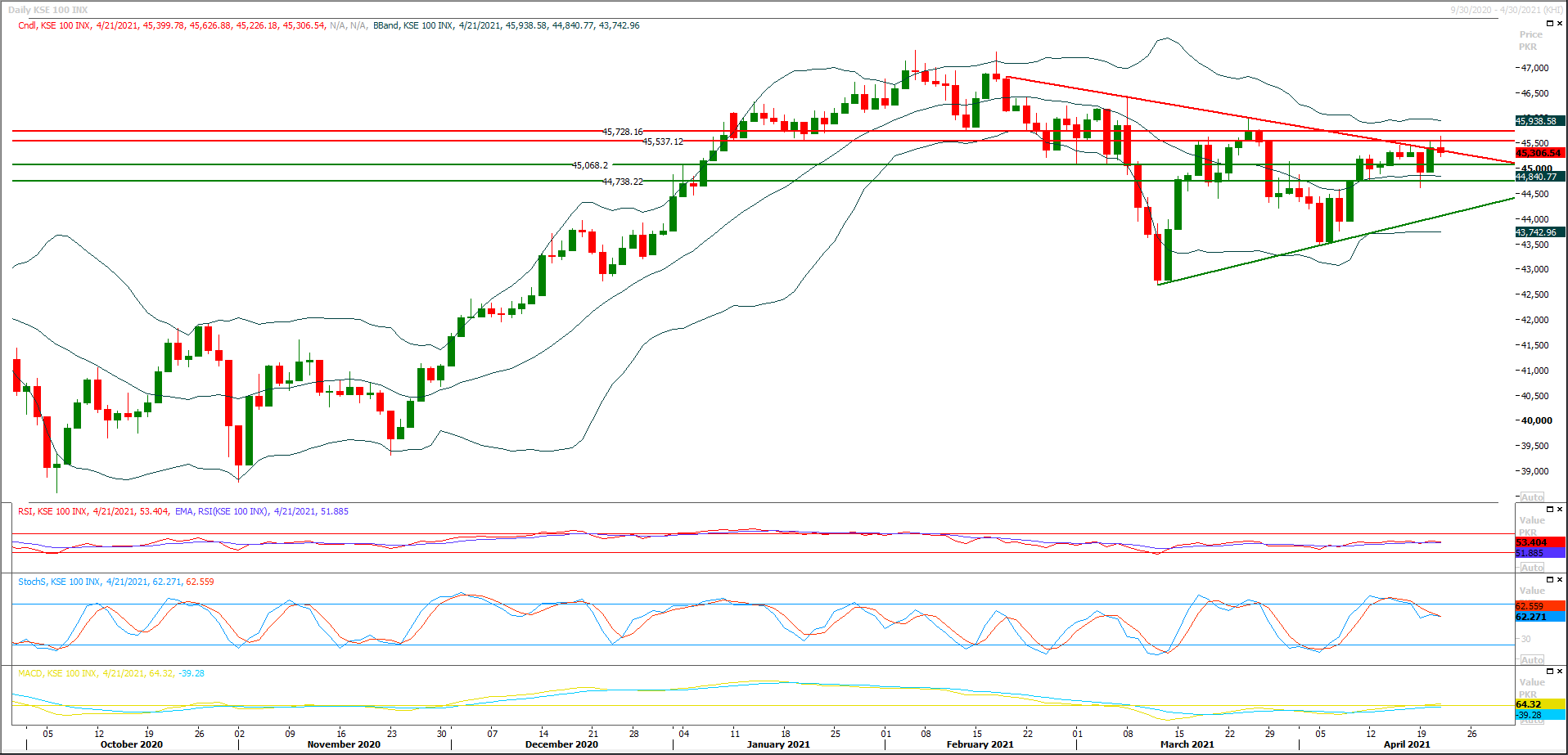

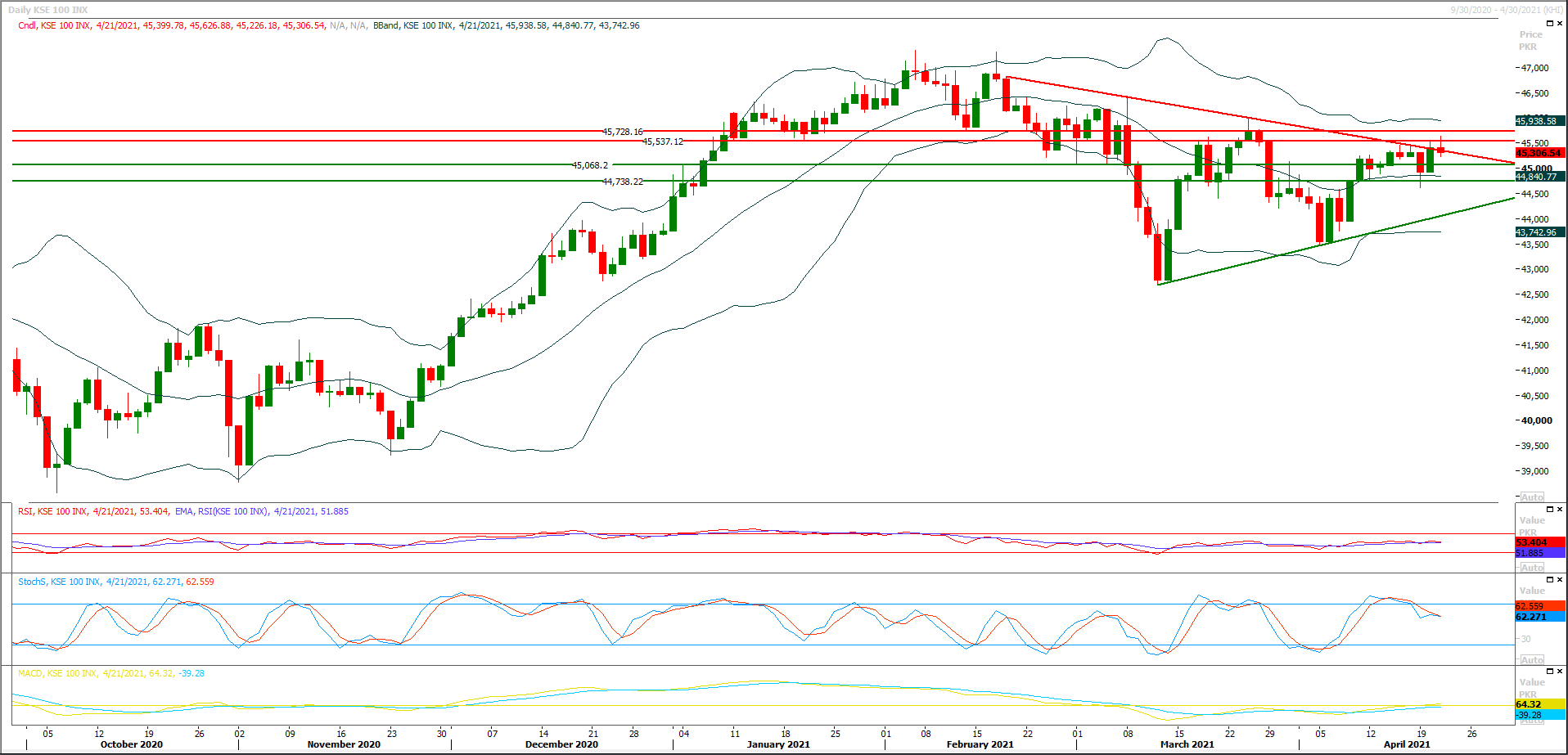

Technical Overview

The Benchmark KSE100 index is being caged in a triangle on daily chart and after a false penetration of this triangle during last trading session index again closed inside this region which increased uncertainty for current trading session. Currently it's recommended to stay cautious and wait for either breakout above 45,700pts or below 45,000pts to initiate new positions otherwise swing trading between these two levels could be beneficial with strict stop loss on respective side. Index have created a hammer on daily chart in response of previous bullish engulfing pattern which converted bullish sentiment into a cheat pattern. Meanwhile daily stochastic and MAORSI are still in bearish mode and hourly momentum indicators are also in bearish direction therefore it's recommended to post trailing stop loss on existing long positions.

Regional Markets

Asia joins global equity rebound; oil slips on COVID-19 worries

Asian stocks rose on Thursday, extending a rebound in global markets following a sharp selloff earlier this week, while oil prices eased again on worries about rising COVID-19 cases in some parts of the world. Japan led gains, with the Nikkei 225 rallying 1.7%, after sliding 2% in each of the last two sessions. MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.4%, following a 0.9% decline the previous day. Chinese blue chips rose 0.3%. "Overall I think markets are still skewed to taking on risk, and I don't think we've seen the final record high by any means in the U.S. stock market or in global equities," said Kyle Rodda, a market analyst at IG in Melbourne.

Read More...

Business News

SECP publishes Guidance Paper on Convertible Debt Securities

In light of SECP’s commitment to promote capital formation and educate potential issuers and investors about different modes of financing and investment avenues, a Guidance Paper detailing mechanics and elements for issuance of Convertible Debt Securities (CDS) has been published. Convertible debt security is a hybrid instrument having both debt and equity features. Initially it is a fixed-income security that yields interest payments and subsequently can be converted into specified number of equity shares. The conversion from debt security to shares can be done at certain times during the instrument’s life and is usually at the discretion of the security holder/investor. Investors in CDS can benefit from a steady income stream (payment of coupon/profit rate) and repayment of principal at maturity, while retaining the option to share in potentially higher equity values i.e. if the conversion option is exercised.

Read More...

Khusro Bakhtyar asks PM to transfer Sugar Advisory Board to another ministry

Federal Minister for Industries and Production Makhdum Khusro Bakhtyar has asked Prime Minister Imran Khan to transfer the Sugar Advisory Board (SAB) to another ministry to avoid any possible perceived conflict of interest that may arise. “Keeping in view any possible perceived conflict of interest that may arise and in order to ensure that SAB is allowed to operate without public objections, I hereby request that the SAB be transferred to another ministry of the federal government,” said federal minister for Industries and Production in a letter written to the Prime Minister Imran Khan in last week. He expressed his gratitude for serving the Prime Minister’s Cabinet as the federal minister for Industries and Production. “It is a great honour for me to hold this responsibility of ensuring the prosperity of industrial growth in Pakistan.”

Read More...

Power consumers to get 61-paisa tariff cut for March

After consecutive increases for many months, the electricity rates for consumers of 10 distribution companies (Discos) of Wapda are set to go down by over 61 paisas per unit under monthly fuel cost adjustments for March. The National Electric Power Regulatory Authority (Nepra) will take up for public hearing on April 28 the tariff petition seeking reduction in consumer tariff for Discos on account of fuel cost adjustment of electricity consumed in March. The lower fuel cost, on approval by the regulator, would be adjusted in consumer bills in the upcoming billing month of May.

Read More...

Two officials sacked for fake reports

The Petroleum Division on Wednesday removed from service two officers of Grade-17 and Grade-18 after holding them responsible for illegal and fake inspection reports leading to award of various licences to a number of oil companies. The major penalty was awarded to the two officers of the department of explosives following investigation reports into the June 2020 oil crisis. The Petroleum Division issued two notifications regarding imposition of the major penalty of dismissal from service to Mubeen Ahmed, BS-18, and Raj Kumar, BS-17, on charges of misconduct. The officers have the right to challenge the decision before the appellate authority within 30 days.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.