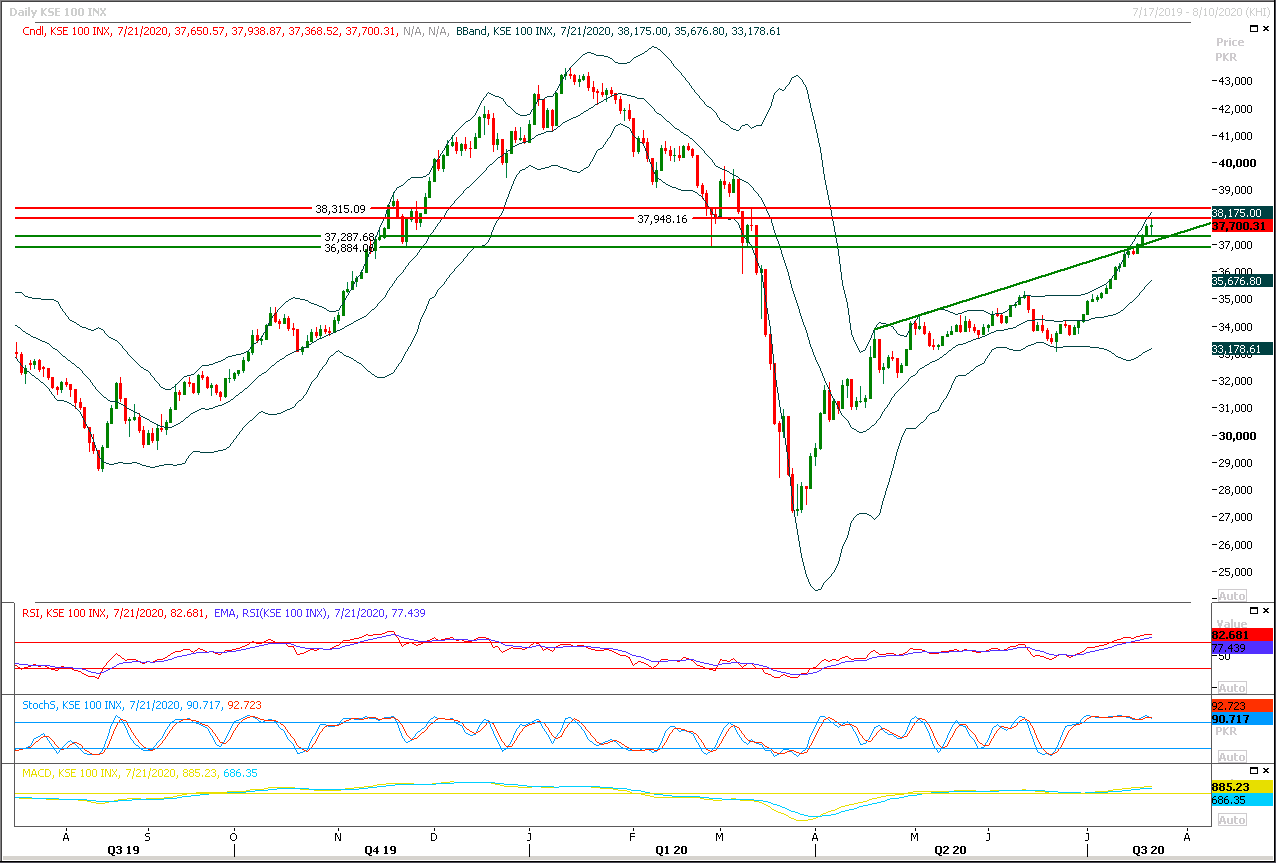

Technical Overview

The Benchmark KSE100 index have faced rejection from a strong horizontal resistant region at 37,950pts during last trading session therefore today some kind of uncertainty would be witnessed initially and investors are advised to adopt swing trading until index succeeds in closing above 38,000pts on hourly chart. A doji formation have been formatted on daily chart and index needs to close above high of previous candle to continue its bullish momentum otherwise pressure would start piling up on intraday and short term basis. Today's closing in negative zone could invite bears who would try to push index towards a correction. Meanwhile today's closing below 37,500pts would generate an evening shooting star on daily chart which would be dangerous at this crucial level. It's recommended to trade with strict stop loss until index succeed in giving a breakout above 38,000pts meanwhile breakout above 38,000pts would call for 37,300 and 38,700pts in coming days. While on flipside in case of bearish pressure index would try to find some ground at 37,500pts initially and then at 37,200pts.

Regional Markets

Asia markets to open lower on pandemic worries, shrugging off U.S. equities upswing

Asia shares were set to open lower on Wednesday after U.S. President Donald Trump’s comments regarding the country’s surge in novel coronavirus cases outweighed a slight rally on Wall Street.Australian S&P/ASX 200 futures YAPcm1 lost 1.06% in early trading. Japan's Nikkei 225 futures NKc1 added 0.24%, while Hong Kong's Hang Seng index futures .HSI HSIc1 lost 0.34%. E-mini futures for the S&P 500 EScv1 rose 0.13%. Speaking at his first White House briefing focused on the pandemic in months, Trump said the virus will probably get worse before it gets better. Cases have been rising across the United States, with now nearly 141,000 deaths recorded from the disease. Also weighing on markets were comments made earlier in the day by U.S. Secretary of State Mike Pompeo that the United States wants to build a global coalition to counter China, which he accused of exploiting the coronavirus pandemic to further its own interests.Read More...

Business News

Big industry output plunges 25pc in May

The large-scale manufacturing (LSM) output tumbled by 24.8 per cent year-on-year in May, the Pakistan Bureau of Statistics (PBS) reported on Tuesday. It is believed that exchange rate depreciation, contractionary monetary and fiscal policies (before coronavirus outbreak) plunged the LSM in the FY20. Contraction in textile and food, beverages and tobacco, iron and steel, coke and pet roleum products dampened the overall manufacturing in the country. During July-May, the LSM shrank by 10.32pc from a year ago. Sector-wise, production of 11 items under the Oil Companies Advisory Committee went down by 20.87pc during MFY20, 36 items under the Ministry of Industries and Production by 11.78pc while 65 reported by the provincial Bureaus of Statistics fell 4.4pc.

Read More...

CAD shrinks 78pc in 2019-20

The country’s current account deficit in fiscal year 2019-20 fell by 78 per cent mainly on account of significant decline in imports, record high remittances and foreign direct investment during the period under review, latest data issued by the State Bank of Pakistan (SBP) showed on Tuesday. The current account deficit narrowed to $2.966 billion in FY20, down 78.6pc compared to $13.434bn in the previous fiscal year. Meanwhile, in FY18, the current account deficit was $20bn. This massive decline also helped government improve its foreign exchange reserves through a sharp reduction in the import bill. The government had intervened through increasing duties and taxes to cut down the import bill in order to reduce the trade deficit.

Read More...

Mismanagement of fuel supply chain major reason of petrol crisis: IPI

Policy Institute (IPI) on Tuesday blamed mismanagement of the fuel supply chain by the government as a major reason behind the petrol crisis witnessed last month. This was stated in a report – ‘The Petrol Crisis of June 2020’ – launched by the think tank at a media conference here. The report looked into the various dimensions of the crisis by examining the industry data and trends, analyzed the role of the different stakeholders and considered the issues faced by the country’s downstream oil sector. The report has been authored by IPI’s distinguished fellow Dr Ilyas Fazil, who has a vast experience of working in the petroleum sector and has in the past served as CEO of Oil Companies Advisory Council and also as Member (Oil) at Oil and Gas Regulatory Authority.

Read More...

LSM growth contracts by 24.8pc due to slowdown in economic activities

Pakistan’s large-scale manufacturing (LSM) growth shrank by 24.8 percent in May this year due to slowdown in economic activities amid outbreak of Covid-19. The LSM growth declined by 10.32 percent during eleven months (July to May) of the previous fiscal year, which showed that economy had slowed down across various sectors. The government has blamed the recent COVID-19 crisis for contraction in LSM growth, which had brought economic activity to a near-halt, both domestically and globally. The LSM, which has 78 percent share in manufacturing and 9.5 percent in GDP, is continuously recording negative growth from last couple of years.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.