Technical Overview

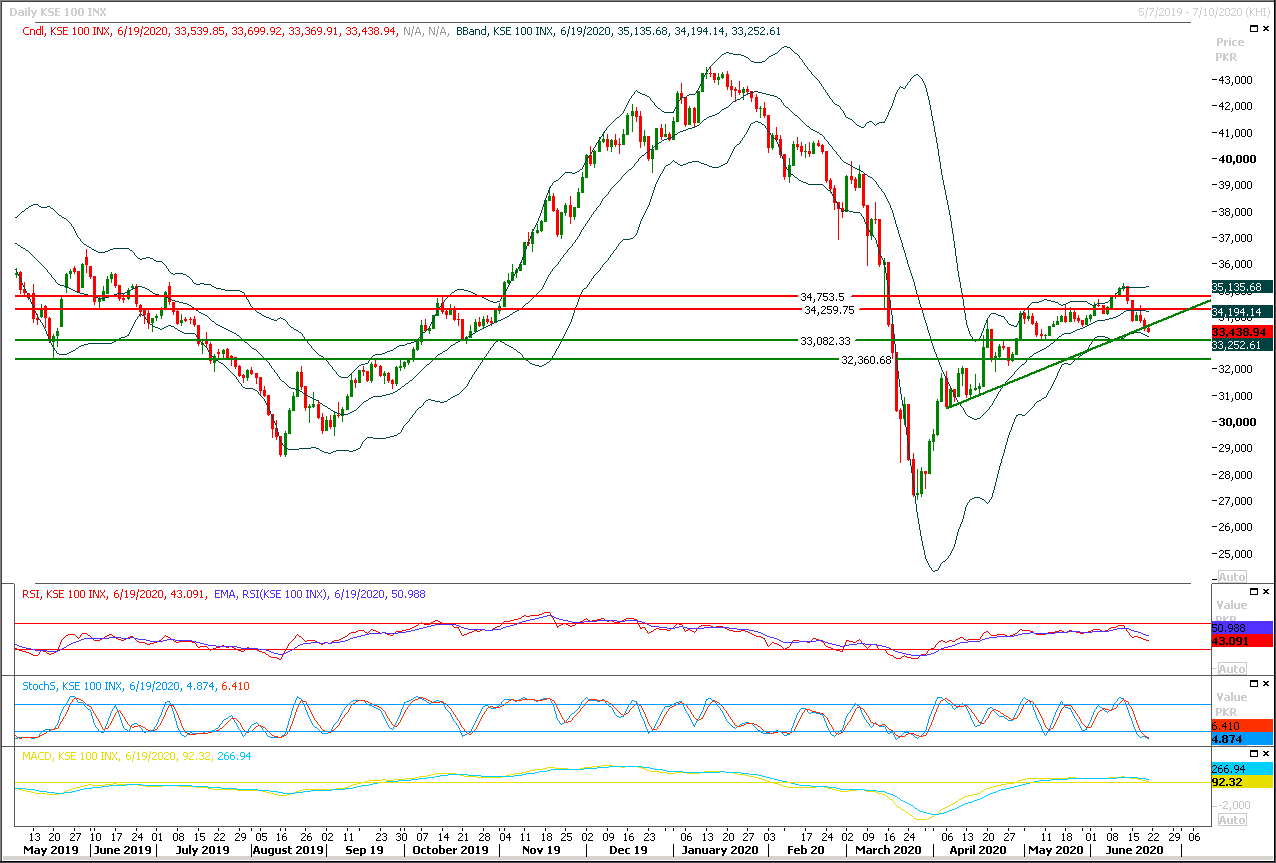

The Benchmark KSE100 index have succeeded in sliding below its major supportive region of 33,500pts during last trading session and have formatted a weekly evening shooting star. Weekly momentum indicators have changed their direction towards bearish side but its recommended to stay cautious while trading during first two days of current week because index could try to retest a rising trend line which have been penetrated during last trading session, mean while a strong supportive region is standing ahead at 33,000pts therefore it's recommended to adopt swing trading with strict stop loss on both sides until index succeed in closing below that region because this penetration could convert into a cheat patter if index could not succeed to maintain below its rising trend line. For current trading session it's expected that index would try to take an intraday spike initially but it would face major resistances between 33,600pts-33,800pts therefore selling on strength with strict stop loss of 34,000pts could be beneficial after initial spike. Mean while if index would succeed in sliding below 33,000pts then sharp decline towards 32,300pts would be witnessed in coming days.

Regional Markets

Stocks try to shake off second wave virus fears

U.S. stock futures erased losses and Asian stocks held flat on Monday, trying to shake off worries that rising coronavirus cases in the United States could scupper a quick economic rebound from the massive downturn triggered by the pandemic.U.S. S&P 500 futures ESc1 rose 0.4%, having erased early losses of 1.05% while Japan's Nikkei .N225 also eked out gains of 0.1%, similarly recovering from early losses. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was almost flat while mainland Chinese stocks .CSI300 ticked up 0.3% to 3-1/2-month highs. After a brutal sell-off earlier this year, share prices had risen globally over the past three months, helped by massive stimulus around the world and hopes the worst of the pandemic was over. “The market is surprisingly resilient. Perhaps many investors think the uptrend is in place. But we need to keep an eye on rising coronavirus infections in some countries,” said Hirokazu Kabeya, chief global strategist at Daiwa Securities.

Read More...

Business News

ADB signs $359m loan agreements for Sindh projects

The Asian Development Bank (ADB) and the government have signed two loan agreements amounting to $359 million relating to the bus rapid transit (BRT) project in Karachi and the Sindh secondary education improvement project. Secretary of Economic Affairs Division Noor Ahmed and ADB Country Director for Pakistan Xiaohong Yang signed the agreements here on Saturday. Minister for Economic Affairs Makhdoom Khusro Bakhtiar witnessed the signing of documents. For the development of 26.6km BRT Red Line corridor, the ADB signed financing agreement of $284m. The ADB has committed to providing $235m as loan while Green Climate Fund (GCF) will provide $37.2m as loan and $11.8m as grant for the BRT project. The project will feature innovative energy and climate resilience characteristics that will enhance access to quality public transport for the port city.

Read More...

Fuel shortage to persist as industry calls for pricing reform

The fuel shortage in the country is not likely to abate in the month of June, industry insiders tell Dawn, especially if sales remain elevated and pricing reform remains elusive. All eyes in the industry are now on a crucial meeting scheduled to be held on Monday that will formulate the recommendation for reform of the oil pricing mechanism being used in the country. The industry is unanimous in pointing to the pricing mechanism as a key enabler of manipulative behaviour in the oil marketing sector. “The long gap between one price adjustment and the next creates space for short-term manipulators to operate,” one senior industry source tells Dawn. On Monday, a key sub-committee of the powerful Economic Coordination Committee is going to sit down and decide what to recommend to the government by way of oil pricing reform. The sub-committee consists of the special adviser to the PM on petroleum Nadeem Babar, Adviser on Government Reforms Dr Ishrat Hussain and Adviser on Commerce Razak Dawood.

Read More...

Pakistan’s $2.41bn debt payments to be rescheduled

Pakistan will reschedule $2.41 billion worth of debt repayments in 2020 under the Debt Service Suspension Initiative (DSSI). The initiative will help the country “enable an effective crisis response. Borrowers therefore commit to use freed-up resources to increase social, health, or economic spending in response to the [Covid-19] crisis,” the World Bank said in a statement accompanying the release of the country specific data on the rescheduling. Pakistan is the second largest beneficiary of the initiative following Angola. According to the World Bank figures, the country’s total debt servicing due in 2020 is $8.974bn, of which official multilateral stands at $3.4bn, official bilateral $4.32bn, non-official $850 million and $362.5m is to bondholders. The $2.41bn rescheduling will decrease the country’s debt service payments to $6.53bn during the year, translating into savings of 0.9 per cent of the GDP.

Read More...

Privatisation of 2 RLNG power plants, HEC on cards, to contribute Rs100b

Islamabad-Privatisation transactions of Heavy Electrical Complex (HEC), Haveli BahadarShah and Balloki RLNG power plants are likely to be completed in second quarter of fiscal 2020-21. A meeting to review ongoing Privatisation of public entities was held here with Federal Minister Mohammed Mian Soomro in chair was informed that for Nandipur Power Plant, Financial Advisors are hired, and due diligence of FA is in progress and likely to be completed during the FY 2020-21. The Finance Bill for the FY 2020-21 has incorporated Rs100 Billion Privatisation proceeds as part of the ‘Non-Tax Revenue Receipts’ for the FY 2020-21.It was informed that due diligence for various entities is in final stage, likewise the procurement process for appointment of Financial Advisors is also at advance stages for certain entities.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.