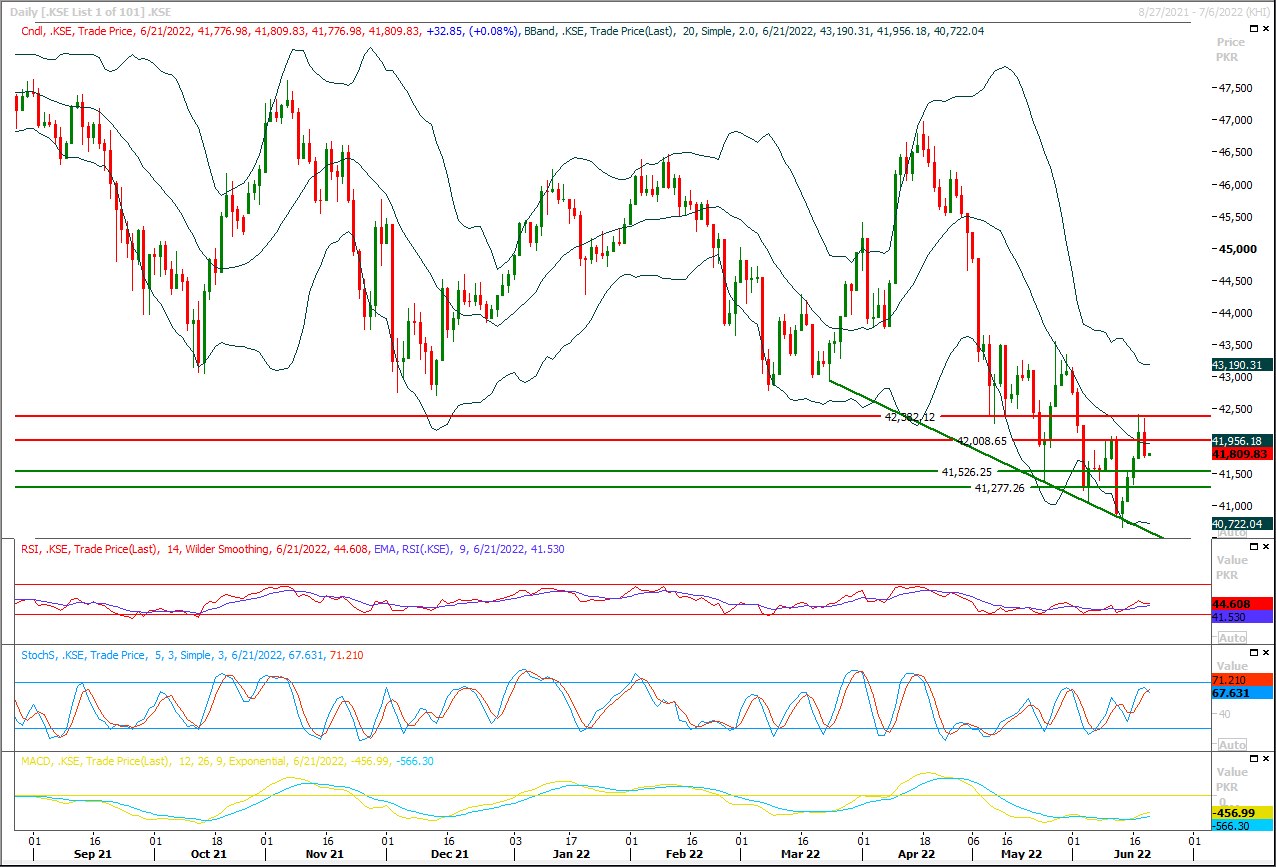

The Benchmark KSE100 index had faced rejection from a horizontal resistant region during last trading session and once again slide below 41,900pts on daily closing basis. As of now it's expected that index would try to bounce back on intraday basis and it would try to target 42,000pts initially and breakout above this region will call for 42,380pts. While on flip side in case of bearish pressure index would try to establish ground above 41,530pts and breakout below this region would call for 41,270pts and 41,000pts. Overall sentiment would remain range bound as long as index is trading between 40,780pts to 43,500pts region. Currently intraday and daily momentum indicators are in bullish mode and if index would succeed in closing above 42,200pts then its next targets would be 43,500pts in coming days.

Asian stocks slipped in volatile trade on Wednesday, failing to extend Wall Street's rally as persistent worries about interest rates and inflation remained a key focus for investors, while the Japanese yen hit a fresh 24-year low against the dollar.MSCI's broadest index of Asia-Pacific shares outside Japan fell 1%, but was still up 1.39% on the more than five-week low it hit on Monday. Tokyo's Nikkei gave up early gains and was flat.Investors are continuing to assess how worried they need to be about central banks pushing the world economy into recession as they attempt to curtail red hot inflation with interest rate increases.

Read More...The Roshan Digital Account (RDA) on Tuesday received the highest-ever single day inflow of $57 million.In a tweet, the State Bank of Pakistan (SBP) said, “Today marks yet another historic day in #RoshanDigitalAccount, with $57mn in deposit inflows, highest ever daily figure. With this significant increase, total deposits in RDA have crossed $4.5bn. We are humbled by the continuous trust and commitment of our OverseasPakistanis.”The RDA was launched in September 2020 to attract foreign exchange from overseas Pakistanis and provide them with higher returns than are available in the world markets.

Read More...

‘Lifeline’ IMF deal secured

In a breakthrough, Pakistan and the International Monetary Fund (IMF) on Tuesday night reached an understanding on the federal budget for 2022-23, leading to revival of the extended fund facility (EFF) after authorities committed to generate Rs436 billion more taxes and increase petroleum levy gradually up to Rs50 per litre.The understanding was reached during a meeting, held via video link, between the IMF staff mission and the Pakistani economic team, led by Finance Minister Miftah Ismail.Acknowledging that important progress has been made over the FY23 budget, IMF Resident Representative in Pakistan, Esther Perez Ruiz told Dawn: "Discussions between the IMF staff and the authorities on policies to strengthen macroeconomic stability in the coming year continue."

Read More...

Miftah Ismail Assures Relief For Real Estate Sector

Federal Minister for Finance and Revenue, Miftah Ismail here on Tuesday assured real estate stakeholders that their proposal about capital gain tax would be considered by the government.The minister was talking during a meeting with a delegation of DHA Estate Agents Association headed by Chief Patron Mian Irfan, according to press statement issued by the finance ministry. The minister assured the delegation to consider the relief in term of capital gains tax. He directed the Federal Board of Revenue (FBR) to formulate a separate mechanism for facilitating the non-filer oversees Pakistanis to revive business activities in the economy. Highlighting the proposed taxes on the real estate, he minister emphasized the real estate sector to contribute in the economic development of Pakistan. The Finance Minister assured the delegation that government would consider their proposals for the economic betterment of the country.

Read More...

Govt Focuses On Current Debt Situation: Ayaz Sadiq

Pakistan has received $184 billion of Foreign Economic Assistance (FEA) in the form of loans and grants from multilateral and bilateral development partners as well as from international financial and capital markets since 1950. Out of total FEA, the share of loans was around 89% ($164 billion) and grant was 11% ($21 billion). Interestingly, around 40% of the total FEA was received during 2011 to 2020 and 14% during the last 22 months (i.e. from July 2021 to Apr, 2022). This was shared in a seminar organised by Ministry of Economic Affairs, in partnership with United Nations Development Programme (UNDP) to initiate policy discussion and generate recommendations for the Government of Pakistan. Sardar Ayaz Sadiq, Minister for Economic Affairs, welcomed all the participants including policy advisers, representatives of government, members of financial institutions, UN agencies and foreign development partners to deliberate on the current economic situation of the country.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.