Technical Overview

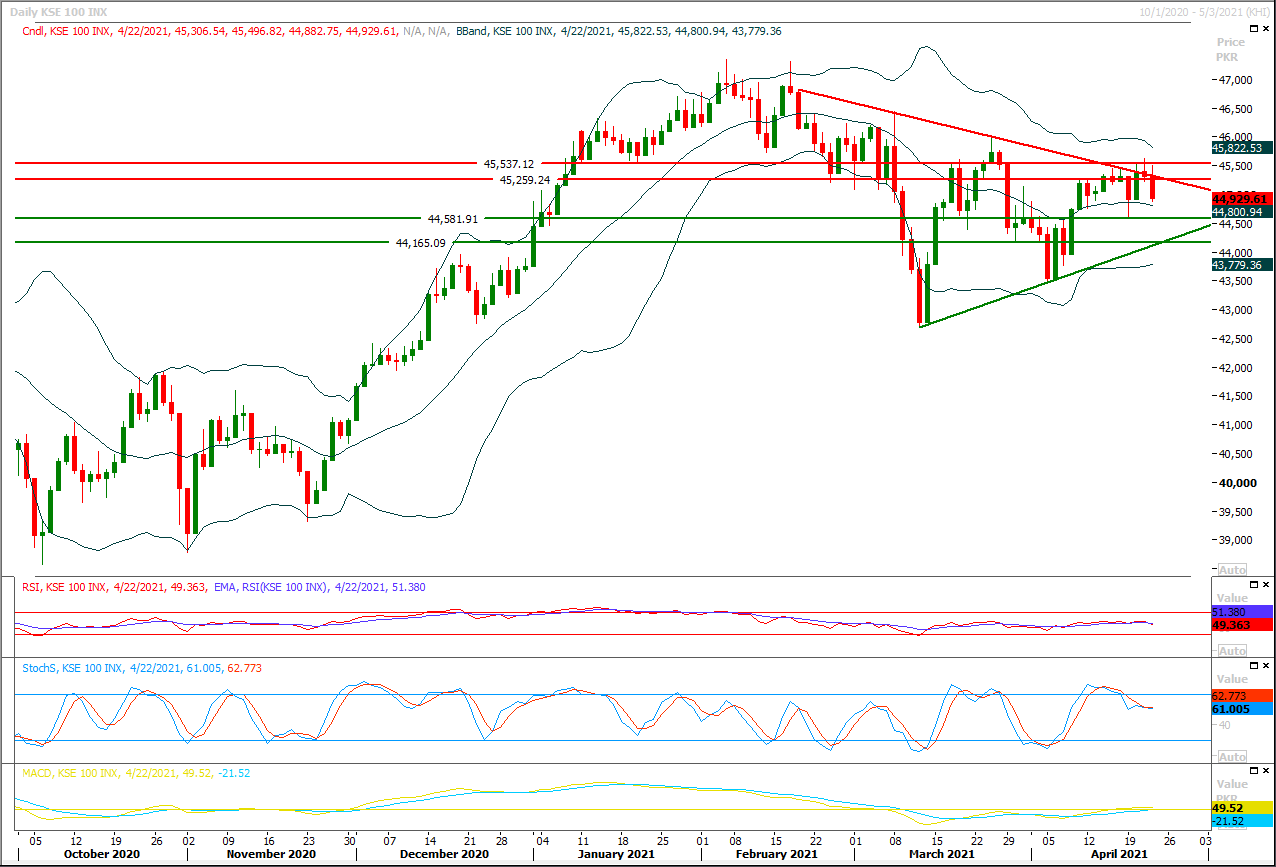

The Benchmark KSE100 index have created an evening shooting star on daily chart in response of bullish engulfing pattern which converted that engulfing into a cheat pattern, as of now it's expected that index would remain under pressure because its being capped by resistant trend line of its triangle along with a horizontal resistant region at very crucial levels. Meanwhile daily momentum indicators have changed their direction towards bearish side which would add further pressure on index. Initially it's expected that index would try to continue its bearish journey towards 44,600pts while breakout below that region would call for 44,320pts. In case of pull back index would face initial resistance at 45,200pts which would be followed by 45,550pts. It's recommended to stay cautious and selling on strength could be beneficial with strict stop loss. Index seems to target its supportive regions once again therefore it's recommended to avoid initiating new long positions during current trading session.

Regional Markets

Asian markets shake off U.S. tax worries to push higher

Asian shares rose on Friday after the European Central Bank left policy unchanged, extending a rebound following a sharp selloff earlier in the week, but gains were capped as investors considered the impact of a possible U.S. capital gains tax hike. The ECB's decision to keep copious stimulus flowing came despite its prediction of a strong rebound in the euro zone economy from mid-year as COVID-19 infections are brought under control. In Asia on Friday morning MSCI's broadest index of Asia-Pacific shares outside Japan shook off early small losses to rise 0.1%. Chinese blue-chip shares rose 0.33%, Hong Kong's Hang Seng (.HSI) rose 0.55% and Seoul's Kospi (.KS11) added 0.16%. Japan's Nikkei stock index slid 0.68%.

Read More...

Business News

Chinese investors keen to invest in mining, power sectors

A visiting delegation of Chinese investors from Sichuan Province on Thursday expressed keen interest for investing in different sectors of Pakistan’s economy, particularly exploiting huge opportunities existing in power generation and mining sectors. The delegation visited Federation of Pakistan Chambers of Commerce and Industry (FPCCI) and met with Chairman Haji Quran Ali and Coordinator Miza Abdul Rahman. Chinese investors expressed their desire to invest in mining, minerals sector and small power projects as there was broad investment potential in the fields of mines and minerals, hydropower, agriculture, tourism, construction and industry. Speaking on the occasion, Qurban Ali called upon the foreign investors to take advantage of these opportunities, adding that FPCCI will facilitate them.

Read More...

CCoE endorses National Electricity Policy 2021 for submission to cabinet

The Cabinet Committee on Energy endorsed and recommended the National Electricity Policy 2021 and Indicative Generation Capacity Expansion Plan (IGCEP) for presentation to the Cabinet. The CCoE was requested by the power division that since the exercise for preparation of the plan for the year 2020 (for a 27 years period) has not reached fruition so far, it is proposed that the exercise should be abandoned and a new exercise for the year 2021 may be initiated, official source told The Nation. A meeting of the Cabinet Committee on Energy (CCoE) was held under the chairmanship of Federal Minister for Planning, Development, and Special Initiatives Asad Umar here on Thursday.

Read More...

Govt starts process of raising power tariff to generate Rs1tr revenue

The government has started the process of increasing electricity tariffs to generate more than Rs1 trillion additional revenue for distribution companies of ex-Wapda to meet their revenue requirements for the fiscal year 2020-21. The increases are being sought on account of annual adjustments, indexations of distribution margins for FY2020-21 and some prior-year adjustments in line with agreements reached with international lending agencies. As part of the process, the National Electric Power Regulatory Authority (Nepra) on Thursday conducted a public hearing on the tariff increase petitions of three major distribution companies (Discos) from Faisalabad, Lahore and Islamabad. The hearing on petitions of other Discos would follow over the next few weeks.

Read More...

Regulators tighten noose on money laundering

The State Bank of Pakistan (SBP) and the Securities and Exchange Commission of Pakistan (SECP) on Thursday signed a Letter of Understanding (LoU) to tighten their joint supervisory role against money laundering and terror financing. The SBP and SECP have amended the Terms of Reference (ToR) of their Joint Task Force (JTF) on financial conglomerates to further strengthen the supervisory cooperation, inter alia, in Anti-Money Laundering, Combating the Financing of Terrorism and Countering Proliferation Financing (AML/CFT/CPF) supervision at financial-group level. SBP Governor Dr Reza Baqir and SECP Chairman Aamir Khan signed the LoU for amendments in the ToR.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.