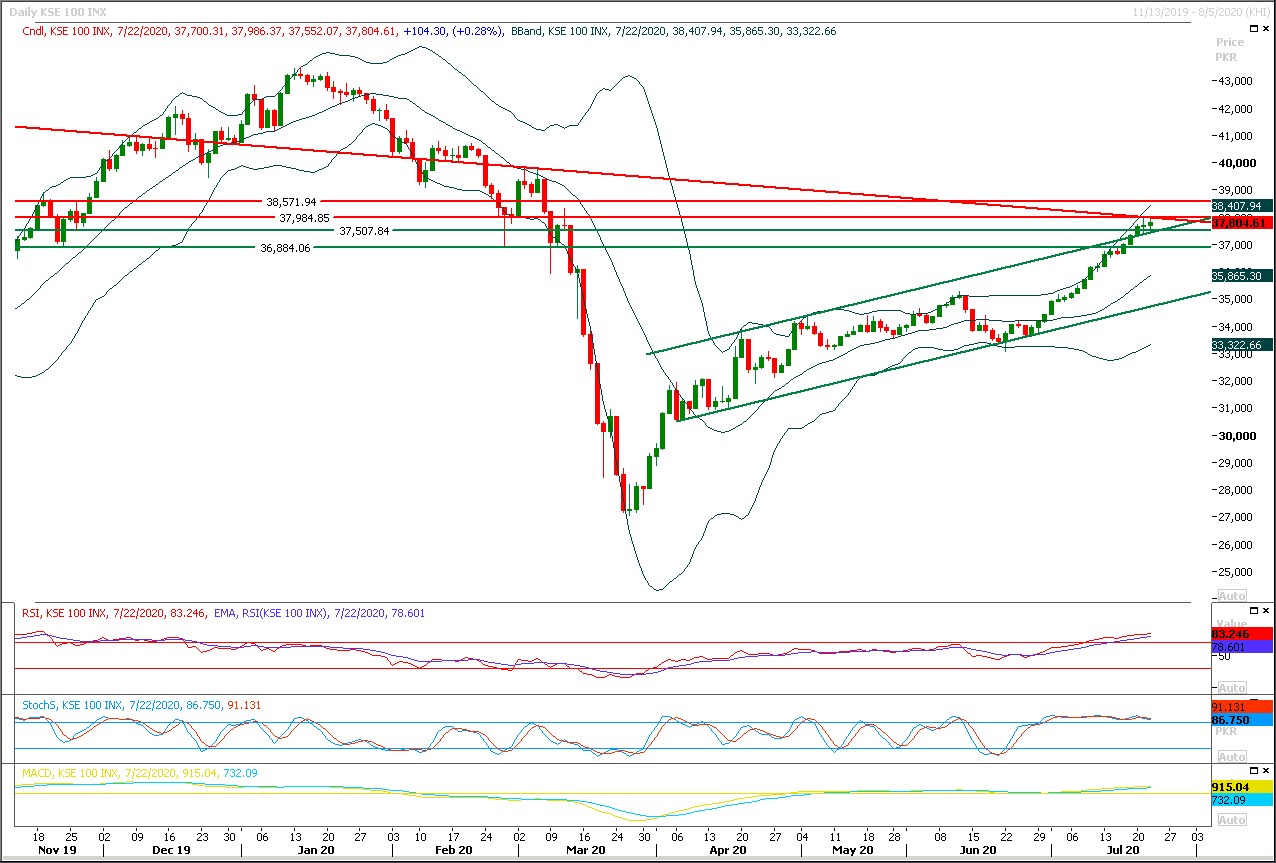

Technical Overview

The Benchmark KSE100 index is trying to continue its bullish momentum after breakout of its rising wedge in upward direction on daily chart but it's being capped by a strong horizontal resistant region along with a descending trend line on daily and weekly charts below 38,000pts and these objects would try to push index to retest the wedge again in coming days. Meanwhile index have formatted another rising wedge inside its bullish price channel on hourly chart and it's trying bounce back to retest resistant trend line of that wedge after getting support from supportive trend line and a horizontal supportive region inside its bullish price channel. On intraday basis index needs to close above 38,040-38,087pts on hourly chart to give bullish breakout and if it would succeed in closing above these regions then its next targets would be 38,370pts initially and later on it would try to touch 38,550pts during this week.

While no flipside if index would face rejection from its resistant regions and would not succeed in closing above 38,000pts then pressure would start piling up which would try to push index downward and in this case index would try to find some ground at 37,500pts and breakout below that region would call for 37,280-37,200pts region. Therefore it's recommended to stay cautious and post trailing stop loss on existing long positions.

Regional Markets

Asia markets to open lower on pandemic worries, shrugging off U.S. equities upswing

Asia shares were set to open lower on Wednesday after U.S. President Donald Trump’s comments regarding the country’s surge in novel coronavirus cases outweighed a slight rally on Wall Street.Australian S&P/ASX 200 futures YAPcm1 lost 1.06% in early trading. Japan's Nikkei 225 futures NKc1 added 0.24%, while Hong Kong's Hang Seng index futures .HSI HSIc1 lost 0.34%. E-mini futures for the S&P 500 EScv1 rose 0.13%. Speaking at his first White House briefing focused on the pandemic in months, Trump said the virus will probably get worse before it gets better. Cases have been rising across the United States, with now nearly 141,000 deaths recorded from the disease. Also weighing on markets were comments made earlier in the day by U.S. Secretary of State Mike Pompeo that the United States wants to build a global coalition to counter China, which he accused of exploiting the coronavirus pandemic to further its own interests.

Read More...

Business News

ECC sanctions Rs33 billion for markup subsidy for housing finance under NPHDA

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday has approved ‘Mark up subsidy for Housing Finance’ worth Rs33 billion as proposed by Naya Pakistan Housing and Development Authority (NPHDA). The ECC, which was chaired by Adviser to Prime Minister on Finance and Revenue Dr. Abdul Hafeez Shaikh, has approved “Mark up subsidy for Housing Finance”, proposed by Naya Pakistan Housing and Development Authority. Prime Minister Imran Khan on July 10, 2020 had announced special incentives for housing and construction sector to revive economic development amid COVID-19 pandemic. Markup subsidy shall be provided for 10 years on bank financing. Accordingly, end user markup rate on housing units measuring up to five marla will be 5 per cent for first five years and 7 per cent for next five years.

Read More...

Pakistan starts export of jute products to several countries: Dawood

Advisor to the Prime Minister on Commerce and Investment, Abdul Razak Dawood has said that Pakistan has started export of jute products to several countries. The advisor made these remarks in a meeting to review the implementation of plans under the trade policy and other initiatives of the Ministry of Commerce to promote geographical and product diversification to enhance the exports of Pakistan. Talking about the diversification of products, Razak Dawood said, “Export of jute from Pakistan is an inspiring success story as we have tapped into the markets of Egypt, Iraq, Malaysia, Turkey, Italy, Australia and New Zealand.” Dawood underscored that the Ministry of Commerce has a firm belief that reducing duties on raw materials reduces the anti export bias and enhances exports. He added: “The export of jute products from Pakistan is a good example that we can still compete, through importation of raw jute, with countries like India and Bangladesh, which produce jute in abundance.”

Read More...

Rupee gains 27 paisas vs dollar

The exchange rate of Pakistani rupee strengthened by 27 paisas against US dollar in the interbank on Wednesday to close at Rs167.63 as compared to the last closing of Rs167.90. However, according to Forex Association of Pakistan, the buying and selling rates of dollar in open market were recorded at Rs167.6 and Rs168.6 respectively. The State Bank of Pakistan reported that in interbank, the price euro appreciated by 92 paisas to close at Rs193.06 against the last day’s trading of Rs 192.14. The Japanese Yen remained stable at Rs 1.56, whereas a decrease of 97 paisas was witnessed in the exchange rate of British Pound which was traded at Rs 212.10 as compared to its last closing of Rs 213.03.

Read More...

AIIB approves $250m loan to assist Pakistan to mitigate impact of COVID-19

The Asian Infrastructure Investment Bank’s (AIIB) Board of Directors has approved a loan of $250 million to help Pakistan strengthen its response to the social and economic fallout from the COVID-19 pandemic. Cofinanced with the World Bank, this development policy financing will help bolster the government’s Resilient Institutions for Sustainable Economy (RISE) Programme. The RISE Programme is proposed to be supported under the COVID-19 Crisis Recovery Facility of the Bank and co-financed with the World Bank (WB) as a Development Policy Financing (DPF) under the WB’s Policy on Development Policy Financing. The objectives of the proposed Program are to (i) enhance the policy and institutional framework to improve fiscal management; and (ii) improve the regulatory framework to foster growth and competitiveness.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.