Technical Overview

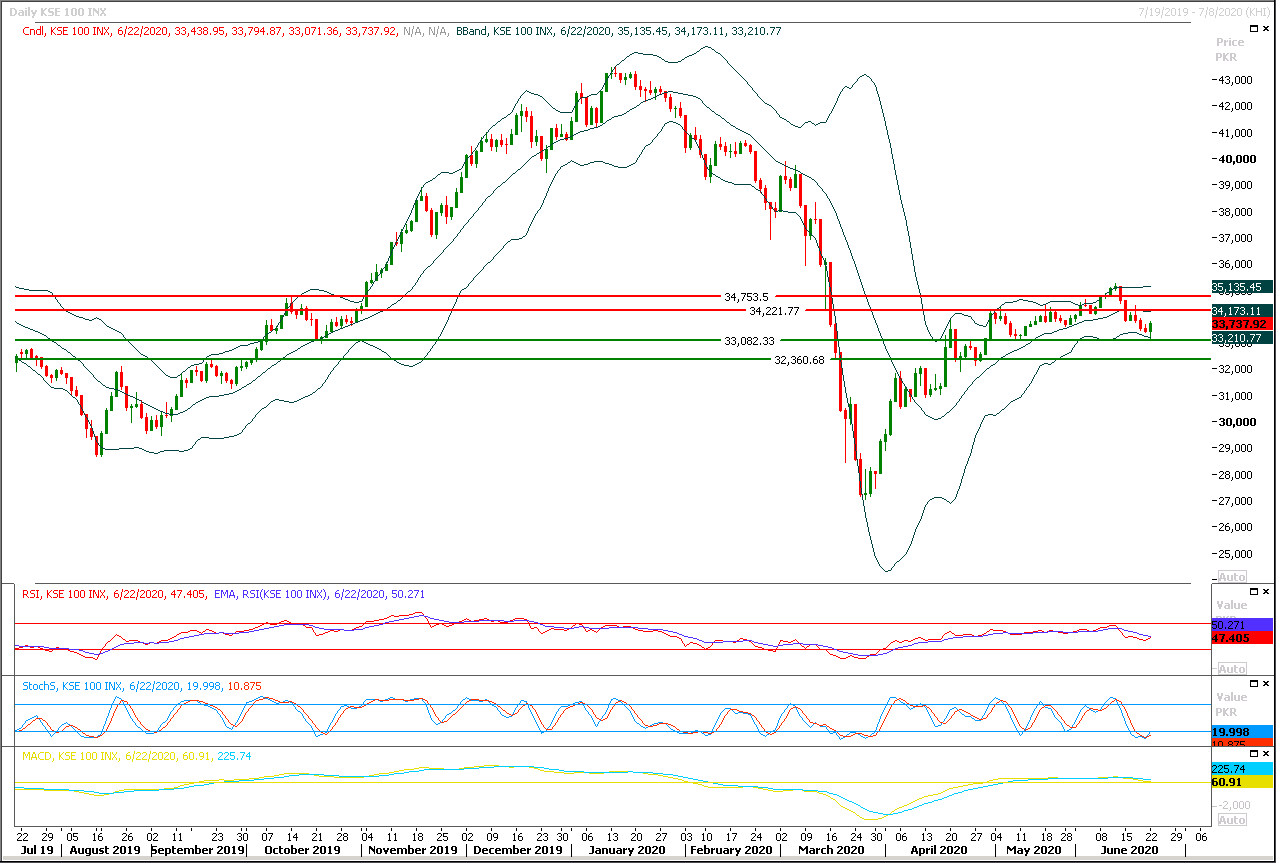

The Benchmark KSE100 index have bounced back after getting support from a strong horizontal supportive region of 33,000pts during last trading session and have created a some kind of bullish engulfing pattern on daily chart. As of now it's expected that index would open with a positive gap and this journey would continue towards 34,000pts or 34,200pts. Current bearish sentiment would start vanishing if index would succeed in closing above 34,000pts on daily chart because in this index would try to close its month in positive zone which would attract bulls to enter market and their entry would trigger a further advance mode towards 34,500-34,700pts initially. It's recommended to stay cautious and buying on dip with strict stop loss could be beneficial. Meanwhile daily momentum indicators are trying to change their direction towards bullish side and once index would succeed in closing above 34,000pts indicator traders would also start participating in bullish side.

While on flip side index would try to find ground at 33,500pts and 33,000pts in case of bearish pressure but negative sentiment would not prevail until index would not succeed in closing below 33,000pts on daily or weekly chart. On longer run index is caged between 33,000pts and 35,200pts and it would remain range bound until breakout of either side would take place.

Regional Markets

Asian stocks swing wildly on U.S.-China trade deal mix-up

Asian shares see-sawed in a wild ride on Tuesday following confusing statements from the White House over the U.S.-China trade deal, with President Donald Trump later clarifying the pact was “fully intact.” Trump soothed nerves when he tweeted: “China trade deal is fully intact. Hopefully they will continue to live up to the terms of the agreement.” In response, China’s blue-chip index regained its losses to be last up 0.3% while Hong Kong’s Hang Seng climbed 0.7%.Australia’s S&P/ASX 200 rose 0.1% while Japan’s Nikkei added 0.8%. Asian stocks have rallied hard since hitting a low in March amid worries about the jolt to the global economy from the coronavirus-driven shutdowns. The gains have been driven by hefty central bank stimulus around the globe and gradual easing of restrictions, although worries about a second wave kept investors jittery.

Read More...

Business News

Senate body urges govt to increase salaries of civil servants by 10 per cent

A parliamentary committee on Monday has recommended the government to increase the salaries of civil servants by 10 percent in order to give them relief. The Senate Standing Committee on Finance and Revenue, which met under the chair of Senator Farooq H Naik, has recommended the government to increase the salaries of civil servants Pakistan has approved a recommendation for an increase in salaries of government employees. The incumbent government in budget for 2020-21 has not increased the salaries and pensions due to the financial constraints. However, the upper house of the parliament has recommended the government to increase salaries by ten percent. It is not binding for the government to accept the budget recommendations of the Senate. The committee has also recommended the government to increase the Federal Excise Duty (FED) on cigarettes. The government has proposed to impose higher taxes on expensive cigarettes and lesser taxes on cheap cigarettes. The committee has also recommended increasing the budget allocation to control locust attack in the country.

Read More...

LTUs/CRTOs/RTOs opening for extended hours

Federal Board of Revenue (FBR) has issued instructions to all the LTUs/CRTOs/RTOs to remain open and observe extended working hours till 09:00 pm on 29th June (Monday) and till 11:00 pm on 30th June, 2020 (Tuesday) to facilitate the taxpayers’ in payment of duties and taxes. FBR has further instructed the Chief Commissioners (IR) to liaise with the State Bank of Pakistan and authorized branches of National Bank of Pakistan to ensure transfer of tax collection by these branches on 30th June to the respective branches of State Bank of Pakistan on the same date and to account the same towards collection for the month of June, 2020.

Read More...

Urea price to go up by Rs200 per bag if gas price increases

The fertilizer industry has warned that the price of urea can go up by Rs 200 per bag in case Ogra upward revises the gas prices as demanded by the gas companies. The gas companies SNGPL and SSGC have filed their petition for determination of gas prices for the year 2020-21. Further, the recent budgetary amendments in tax laws present serious challenges to the fertilizer industry which may require a further increase in urea prices by PKR 200/bag, a spokesman of the industry said. SNGPL has sought an increase in gas prices by around 100% (PKR 622/mmbtu), while SSGC has sought an increase of 20% (PKR 85/mmBTU) to meet their revenue requirements for upcoming fiscal year. If OGRA accepts the petition in its full, this will augment the burden on all industrial sectors and consumers of the country, the spokesman said. As the fertilizer sector will also face this gas price hike and the increase in gas cost would be passed on by the fertilizer industry, this would lead to a significant increase in the prices of essential fertilizers, especially urea.

Read More...

Rupee recovers against dollar

The exchange rate of Pakistani rupee strengthened by five paisas against US dollar in the interbank on Monday to close at Rs 166.58 compared to the last closing of Rs166.63. However, according to Forex Association of Pakistan, the buying and selling rates of Dollar in open market were recorded at Rs 166.3 and Rs 167.3 respectively. The State Bank of Pakistan reported that in interbank, the price of Euro depreciated by 5 paisas to close at Rs 186.75 against the last day’s trading of Rs 186.80. The Japanese remained unchanged at Rs 1.55 whereas a decrease of 46 paisas was witnessed in the exchange rate of British Pound.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.