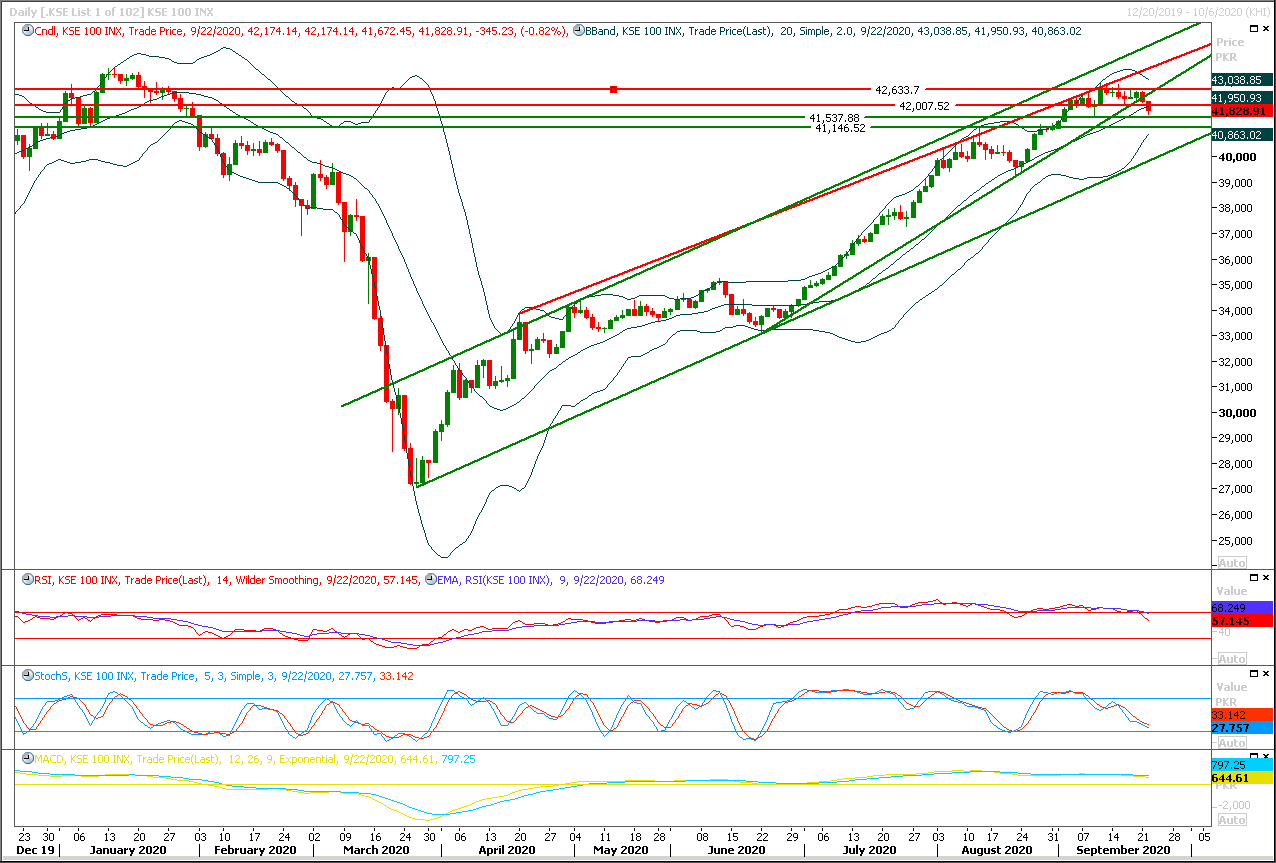

Technical Overview

The Benchmark KSE100 index have given a bearish breakout of its rising wedge on daily chart but before continuing its bearish journey it's expected that index would try to retest supportive trend line of that wedge by taking a spike during current trading session. As of now it's expected that index would try to bounce back before 41,500pts to retest its wedge therefore buying on dip could be beneficial with strict stop loss. For current trading session index have its initial resistant region ahead at 42,050pts while breakout above that region would call for 42,300pts and 42,500pts. Index would be considered in range bound situation between 41,300pts and 42,500pts until a clear breakout of either side. Daily and hourly momentum indicators are still in bearish mode therefore initiating long positions for short to mid-term holding are not recommended but for day trading it could be beneficial. In case of rejection from its resistant regions index would try to continue its bearish journey towards 41,300pts and 41,000pts.

Regional Markets

Asian stocks set to gain after Wall Street's tech bounce

Asian stocks were set to open higher on Wednesday after tech-fueled Wall Street gains although focus is shifting to renewed U.S.-Sino tensions, which could weigh on investor sentiment. In Asia, Japan’s markets reopen on Wednesday after a two-day public holiday, which could trigger some volatility. The Reserve Bank of New Zealand also announces its monetary policy decision, although analysts expect the official cash rate to remain unchanged at 0.25%. Australian S&P/ASX 200 futures YAPcm1 rose 1.04% in early trading while Hong Kong's Hang Seng index futures .HSIHSIc1 lost 0.22%. Emerging market stocks lost 0.69%. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS closed 1.01% lower.

Read More...

Business News

AGP recovers Rs 5.655B in first two months of current fiscal year

The Office of Auditor General of Pakistan (AGP) has made recoveries of Rs 5.655 billion from various federal and provincial departments during the first two months of the current fiscal year (2020-21). According to the latest data of AGP Office, the recoveries from federal government departments stood at Rs 5.411 billion whereas that from provincial and district offices stood at Rs 243.9 million. The break up figures show that the highest recovery during the period under review was made by Director General Audit Petroleum and Natural Resource, Lahore that recovered Rs 3.757 billion followed by Director General Postal & Telecommunication Lahore that recovered Rs 541.56 million.

Read More...

Unemployment, prices of daily essentials increase due to Covid-19, says survey

A latest survey conducted by Dun & Bradstreet Pakistan and Gallup Pakistan has revealed that unemployment has increased in the country due to Covid-19 situation and prices of daily essentials have surged significantly in the last 6 months. Dun & Bradstreet Pakistan and Gallup Pakistan have launched their inaugural report titled ‘Pakistan Consumer Confidence Index (CCI)’. The CCI report has been developed by assessing consumers’ confidence about the economy as well as their personal financial situation. The Index covers four key parameters i.e., household financial situation, country’s economic condition, unemployment, and household savings.

Read More...

SECP approves disclosure framework under global principles

In adherence to internationally recognized standards of regulation and oversight, the Securities and Exchange Commission of Pakistan (SECP) has approved disclosure framework to provide participants and general public with sufficient information for better understanding of FMIs, regulatory, supervisory, and oversight policies of SECP with respect to FMIs and complete regulatory and operational landscape. The disclosure framework has been prepared in accordance with the PFMIs that pertain to standards of governance, risk management and protection of interests of participants.

Read More...

LCCI wants further reduction in policy rate

The LCCI Tuesday said the SBP should reconsider its decision to maintain the policy rate at seven per cent. In a statement issued here, LCCI President Irfan Iqbal Sheikh, Senior Vice President Ali Hussam Asghar, Vice President Mian Zahid Jawaid Ahmed said that due to COVID-19, the business community especially the SMEs were expecting that the SBP would further reduce the policy rate to provide breathing space to industrial sector, which was already struggling. They said it was important for the much-needed new investment in the industrial sector, adding that a note-worthy cut in the policy rate would help the industrial sector to keep the ball rolling.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.