Technical Overview

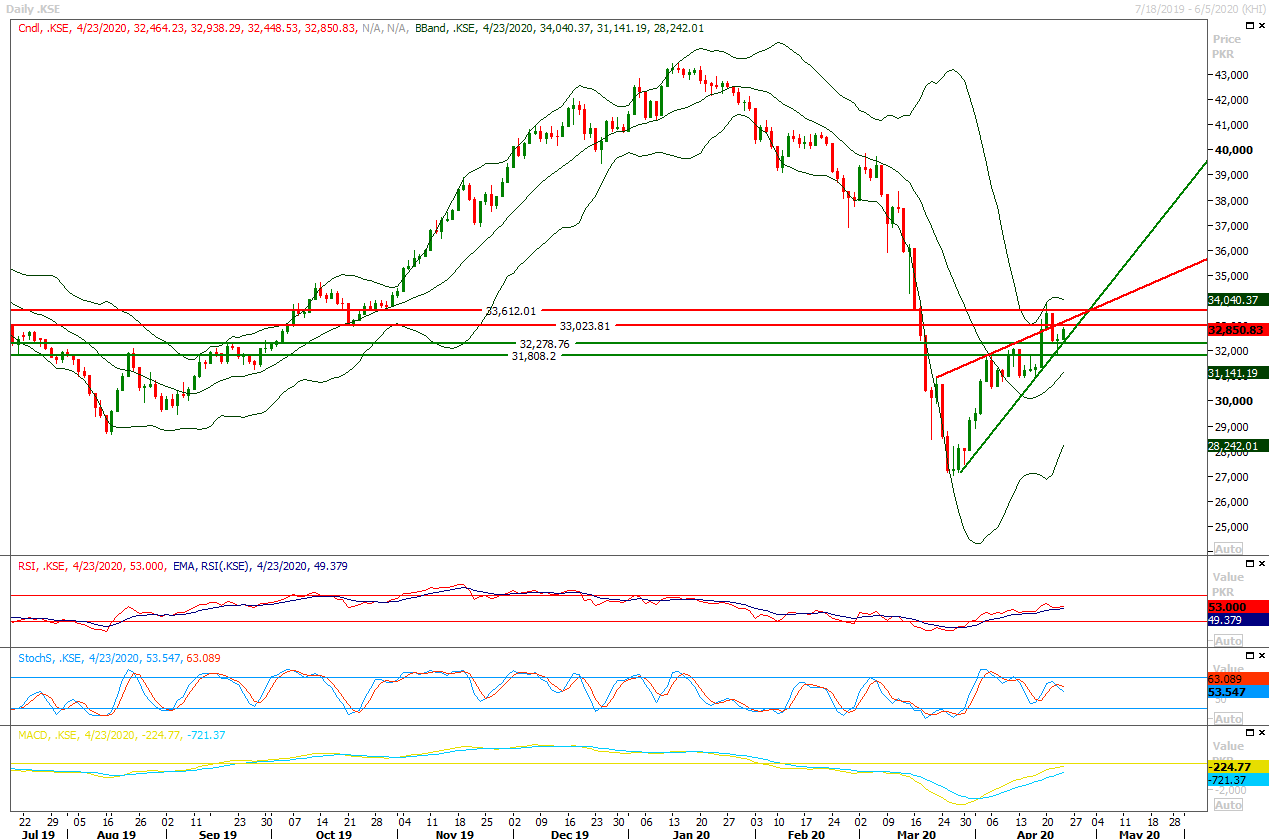

The Benchmark KSE100 index is caged in a rising wedge on daily and hourly chart while completion of its bearish correction and formation of a morning shooting star have failed during last trading session. As of now index would face its initial resistance between 33,000-33,100pts where a horizontal resistant region along with a resistant trend line would try to cap its bullish momentum and if it would succeed in closing above said trend line on even hourly basis then next target would be 33,600pts. It's recommended to stay cautious because a some kind of fight between bulls and bears could be witnessed during current trading session which may result in a volatile trading session. Today's closing is very important because a doji formation is being completed on weekly chart and if index would succeed in closing above 33,500pts during current trading session then it would face some serious pressure in next week.

While on flip side in case of bearish pressure index would try to find some ground at 32,500pts and 32,200pts. Index would remain range bound until it would not succeed either in closing above 34,000pts or below 32,000pts. Breakout below 32,000pts would call for 31,700pts and then 30,500pts.

Regional Markets

Asian shares fall on coronavirus drug, economic damage concerns

Asian shares and U.S. stock futures fell on Friday, spurred by doubts about progress in the development of drugs to treat COVID-19 and new evidence of U.S. economic damage caused by the coronavirus pandemic. MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.4%. U.S. stock futures, the S&P 500 e-minis, were down 0.72%. Shares in China, where the coronavirus first emerged late last year, fell 0.25%. The S&P 500 and the Nasdaq turned negative at the close on Thursday after a report that Gilead Sciences Inc’s antiviral drug remdesivier had failed to help severely ill COVID-19 patients in its first clinical trial. Gilead said the findings were inconclusive because the study conducted in China was terminated early.

Read More...

Business News

Lenders’ help lowers Pakistan’s financing risks: Moody’s

The financial support from the International Monetary Fund (IMF) and other multilaterals has lowered Pakistan’s financing risks from the coronavirus-related economic shock even though its fiscal deficit may touch double digits. “The substantial financial support from official-sector creditors reduces Pakistan’s financing risks,” said the Moody’s investors service on Thursday, adding that the fiscal stimulus announced by the government could widen the country’s budget deficit to 9.5-10 per cent of GDP.

Read More...

Current account deficit shrinks 73pc in nine months

Current account deficit during the first three quarters of current fiscal year shrank by 73 per cent to $2.768 billion compared to $10.284bn in the same period last fiscal year, data released by the State Bank of Pakistan (SBP) showed on Thursday. The current account deficit in the current and last fiscal years has fallen from its peak of $20bn in FY18 mainly on account of falling imports. The SBP data showed the deficit in March was just $6 million compared to $283m in the corresponding month of last year. The details showed that exports of goods during the nine months under review remained relatively unchanged at $18.256bn compared to $18.051bn last year.

Read More...

WB sees 23pc cut in Pakistan’s remittances

The World Bank says that remittances to Pakistan in 2020 are projected to decline by 23 per cent, totalling about $17 billion, compared with $22.5bn remitted in 2019, in the wake of the economic crisis caused by the Covid-19 outbreak. And, the bank warns, this crisis could be long, deep, and pervasive when viewed through a migration lens. The latest issue of World Bank publication, Migration and Development Brief focusing on the Covid-19 crisis, says that the outbreak has affected both international and internal migration in the South Asia region.

Read More...

Pakistan earns $887 million from IT services’ export

Pakistan earned $887.470 million by providing different information technology (IT) services in various countries during the first eight months of current financial year 2019-20. This shows growth of 26.24 percent when compared to $702.990 million earned through provision of services during the corresponding period of fiscal year 2018-19, Pakistan Bureau of Statistics (PBS) reported. During the period under review, the computer services grew by 31.57 percent as it surged from $514.740 million last year to $677.230 million during July-February (2019-20). Among the computer services, the exports of software consultancy services witnessed increase of 18.94 percent, from $230.254 million to $273.854 million while the export and import of computer software related services also rose by 13.41 percent, from $187.150 million to $212.254 million.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.