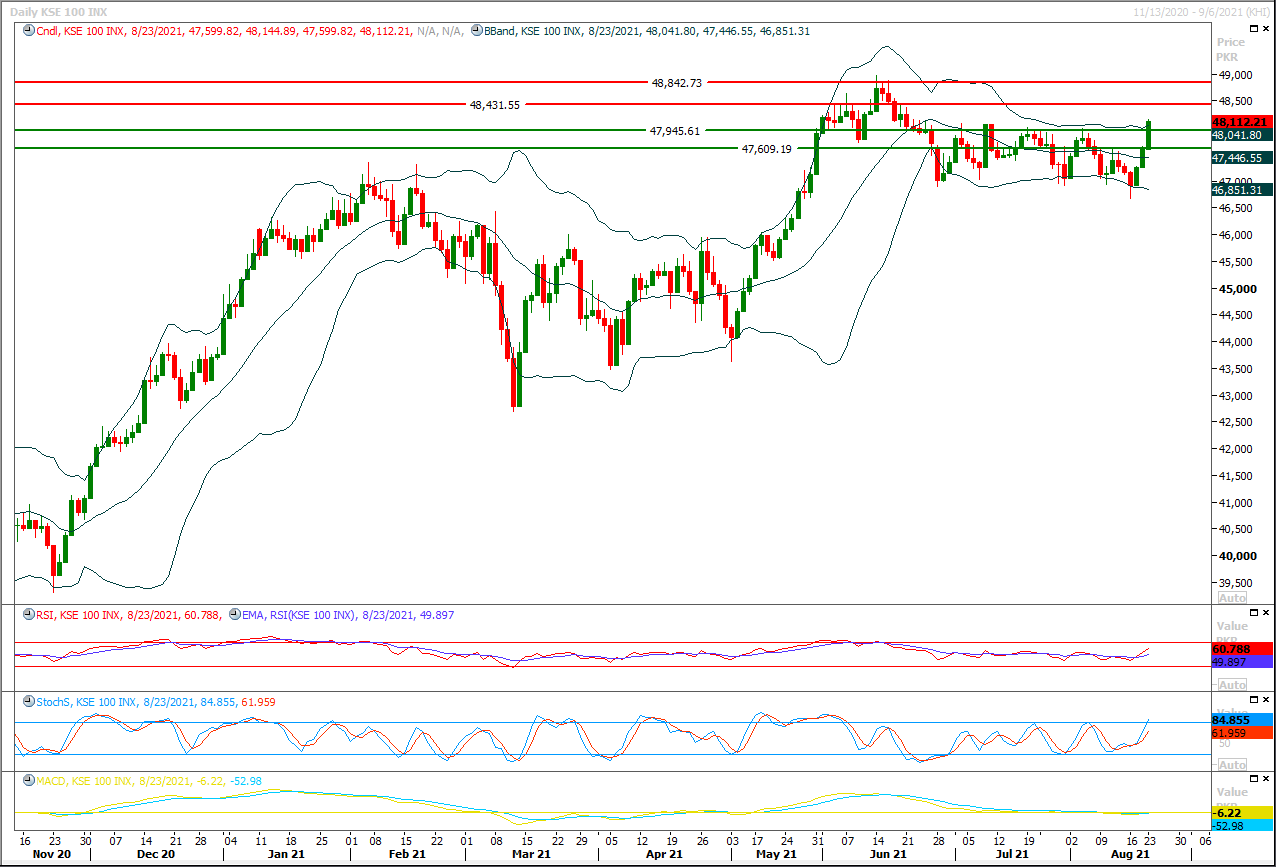

The Benchmark KSE100 index have given bullish breakout of its descending price channel on hourly and daily charts during last trading session meanwhile confirmation of a bullish engulfing pattern have take place on daily chart therefore it's expected that index may try to continue its bullish sentiment during current trading session but it needs to stay cautious because index have major resistant regions ahead in next 300-500 points on bullish side. Initially it's expected that index may try to open with a positive gap but it would face resistance at 48,430pts where its being capped by a strong horizontal resistant region, while breakout above this region would call for 45,660pts and 48,840pts where a daily and weekly double top would try to cap current bullish sentiment along with a strong horizontal resistant region. Meanwhile daily momentum indicators have change their direction towards bullish side which indicates that short term trend would convert into bullish side. While hourly momentum indicators are showing some bearish signs and if index would not succeed in maintaining above 47,945pts till day end today then it may face some pressure. On flip side index would try to establish ground above 47,945pts which would be followed by 47,600pts and 47,500pts in case of bearish pressure. Overall a volatile session could be witnessed but it's recommended to stay on long side with strict stop loss.

Regional Markets

Asian stocks rally on extended Wall St bounce, easing Fed taper worries

Asian stocks rose on Tuesday on an extended bounce on Wall Street as investors drew comfort from full approval granted to the PfizerBioNTech vaccine and on easing worries of an imminent tapering of stimulus by the Federal Reserve.The dollar was licking its wounds after its sharpest one- day fall since May, which spurred a 5% rally in oil prices on Monday.MSCI's broadest index of Asia-Pacific shares outside Japan rose 1.2%, with Japan and South Korean indexes jumping more than 1%.

Read More...

Business News

Committee formed to address issues related to ghee, oil industry

Federal Minister for Finance and Revenue Shaukat Tarin on Monday has constituted a committee to workout arrangement for streamlining the collection of sales tax and a predictable pricing formula for of edible oil/ghee in domestic markets.Finance minister made these remarks in a meeting with a delegation of Pakistan Vanaspati Manufacturers Association (PVMA). Federal Minister for Industries and Production Makhdoom Khusro Bakhtiar, SAPM on Finance and Revenue Dr Waqar Masood, Secretary M/o Industries and Production, Chairman FBR and other senior officers participated in the meeting.

Read More...

IMF’s historic funding takes effect, $2.7bn for Pakistan

The International Monetary Fund’s (IMF) largest-ever allocation of $650 billion in Special Drawing Rights (SDR) became effective on Monday and can bring about $2.7 billion of additional funding for Pakistan as well.“The largest allocation in history … is a significant shot in the arm for the world,” IMF Managing Director Kristalina Georgieva said in a statement issued in Washington. “If used wisely, (this is) a unique opportunity to combat this unprecedented crisis.

Read More...

Clearance of capacity expansion plan delayed

The Cabinet Committee on Energy (CCoE) did not clear the long-term Indicative Generation Capacity Expansion Plan (IGCEP) 2021-2030 on Monday after provinces, particularly Sindh and Khyber Pakhtunkhwa, raised concerns that Power Division had not considered their priority projects before moving the case to the Council of Common Interests (CCI).Planning Minister Asad Umar had called a single-point agenda meeting of the CCoE and invited provincial energy ministers to finalise a draft plan before formally seeking its approval from the CCI within two weeks.

Read More...

Survey finds ‘record improvement’ in business confidence

Overall business confidence in Pakistan underwent “record improvement” in recent months, according to a survey conducted by the Overseas Investors Chamber of Commerce and Industry (OICCI).The Business Confidence Index (BCI) Survey that the OICCI conducted across the country from May to July showed the overall Business Confidence Score (BCS) stood at nine per cent, up from minus 50pc in the preceding survey held in May 2020.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.