Technical Overview

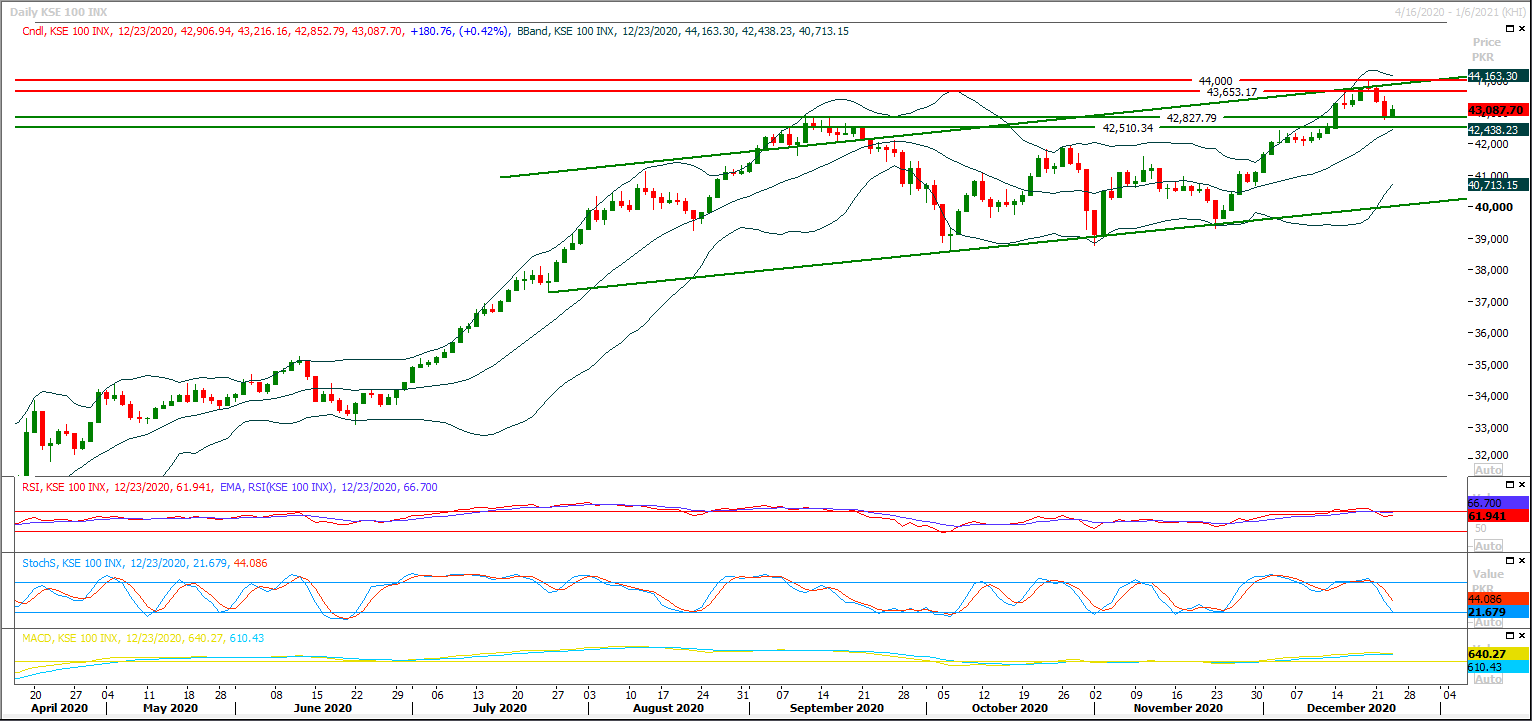

The Benchmark KSE100 index had bounced back after getting support from a rising trend line along with a horizontal supportive region on hourly chart during last trading session. Meanwhile its being rejected by resistant trend line of its bullish price channel therefore current pull back could be considered a retesting of this line until index would not succeed in closing above this line at 44,000pts. Now it's heading towards correction levels of its previous bearish rally and to retest supportive trend line of its previous bullish price channel on hourly chart. It would be considered in correction mode and would remain under pressure on intraday basis until it would not succeed in closing above 43,500pts where 61.8% correction of its last bearish rally would complete. For current trading session index have initial resistance at 43,350pts where its being capped by a strong horizontal resistant region along with 50% correction, while breakout above this region would call for 43,500pts. Meanwhile hourly and daily momentum indicators are still bearish therefore it's recommended to stay cautious and post trailing stop loss on existing positions. On flip side in case of bearish reversal index would try to establish ground between 42,860pts-42,600pts where its being supported by a rising trend line but breakout below that region would push index further downward till 42,200pts. Weekly Bollinger Band is squeezed and have become more or less which indicates that index is going to give a breakout in either direction meanwhile weekly momentum indicators would changed their direction towards bearish side and today's closing below 43,000pts would add further pressure on these indicators therefore it's recommended to adopt wait and see strategy for a breakout of either above 44,200pts or below 42,500pts before initiating new positions for short-mid-term trading.

Regional Markets

Asian stocks eye gains as Brexit deal hopes grow

Asian shares were set to rise on Thursday ahead of the Christmas break, as global investors cheered a potential Brexit deal and economic recovery prospects, largely ignoring U.S. President Donald Trump’s threat to veto a long-awaited COVID aid package.MSCI’s gauge of global stocks was up 0.02%, having given back some earlier gains in thin holiday trading. Wall Street ended mostly higher, with the Dow Jones Industrial Average closing up 0.38% and the S&P 500 edging 0.07% higher. The Nasdaq Composite declined 0.29%.A raft of mixed U.S. economic data showed lower jobless claims and an uptick in new orders for durable goods, but also a pullback in consumer spending, falling personal income and fading sentiment as the holiday shopping season nears its end amid a resurgent pandemic.

Read More...

Business News

BTAA confirms 27 references involving Rs7.4b filed against benami transactions

In a major development, Benami Transactions Adjudicating Authority (BTAA) has confirmed 27 references involving an amount of Rs7.4 billion filed against benami transactions by the three Anti-Benami Zones in three cities. The references were filed in Islamabad, Karachi, and Lahore which include movable as well as immovable benami properties. These include 5 cases of Benami shares in which Benami transaction of Rs159.644 million was identified, 6 references of Benami immovable properties worth Rs5,849.4 million, one case of Benami bank accounts worth Rs1,040.0 million, and 16 cases of Benami vehicles worth Rs351.55 million. As per law, the Ant-Benami Zones submit references in cases of suspected Benami assets before the Benami Transactions Adjudicating Authority for confirmation/ revocation of attachment of assets and then initiate confiscation proceedings.

Read More...

UAE keen to take bilateral trade, economic relations to higher levels

UAE Ambassador to Pakistan Hamad Obaid Ibrahim Salem Alzaabi said that Pakistan and UAE have great potential to further improve bilateral trade and his country wanted to work on a new economic roadmap with Pakistan to take bilateral trade and economic relations to higher levels. He said this while exchanging views with Sardar Yasir Ilyas Khan, President, Islamabad Chamber of Commerce & Industry during his visit to ICCI. Fatma Azim Senior Vice President and Abdul Rehman Khan Vice President ICCI were also present at the occasion. The UAE Ambassador said that he visited Faisalabad and Sialkot and saw that Pakistan has great potential to export many products to UAE. He urged that Pakistani manufacturers should do proper marketing of their exportable products to boost exports up to their actual potential.

Read More...

SECP approves first Peer-to-Peer lending platform

The Securities and Exchange Commission of Pakistan (SECP), in pursuance of its reforms agenda to support and encourage Fintech revolution in the country, has approved the launch of Pakistan’s first Peer-to-Peer (P2P) lending platform. Finja, venture capital-backed fintech secured the approval under the first cohort of SECP’s Regulatory Sandbox. To highlight the impact of P2P lending and the potential of technology for efficient credit disbursement and expanding financial inclusion, Finja organized an exclusive event here on Wednesday. The Chairman SECP, Aamir Khan was the Chief Guest. Speaking at the occasion Aamir Khan said that the SECP has placed significant focus on serving the Micro Small and Medium Enterprises (MSMEs) as they play a vital role in the economic development of any country.

Read More...

FGEI-CG, FBR sign Letter of Understanding

In line with the vision of Prime Minister of Pakistan for promoting Taxation system in the country, a special signing ceremony of Letter of Understanding (LoU) between Directorate of Federal Government Educational Institution Cantonments-Garrisons (FGEI-CG) and Federal Board of Revenue (FBR) was held on Wednesday at Directorate of Federal Government Educational Institution Cantonments Garrisons. The Ceremony was observed by Member FATE and Spokesperson FBR Syed Nadeem Hussain Rizvi, Director General Directorate of Federal Government Educational Institution Cantonments Garrisons Major General Muhammad Asghar HI (M), Chief FATE Aisha Farooq and Director Administration Directorate of Federal Government Educational Institution Cantonments Garrisons Brigadier Khalid Mahmood Shafi. The Letter of Understanding was signed by Director Administration Directorate of Federal Government Educational Institution Cantonments Garrisons Brigadier Khalid Mahmood Shafi and Chief FATE of FBR Aisha Farooq.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.