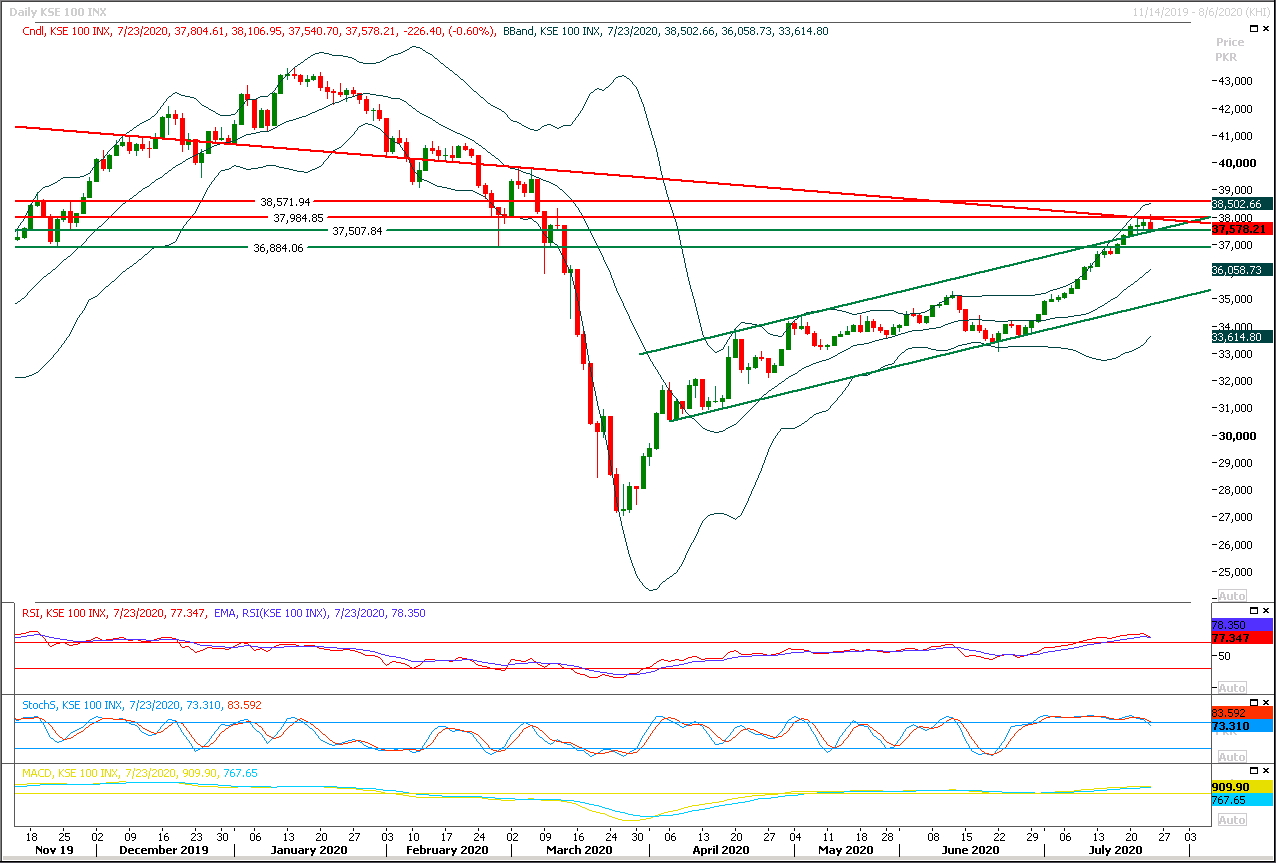

Technical Overview

The Benchmark KSE100 index is trying to enter into its previous bullish price channel after facing rejection from its strong resistant regions. As of now intraday momentum indicators have changed their direction towards bearish side after breakout of its hourly rising wedge in bearish direction and now today's closing in negative zone would push daily momentums into bearish zone as well. It's recommended to stay on selling side and start adding positions to short side once index succeeds in sliding below 37,260pts. Today's closing between 37,360pts-37,260pts would push weekly chart into uncertainty zone as well because a hammer would take place and short term investors would also start offloading their positions after this formation would take place.

While on flip side in case of bullish spike resistant regions are still intact and these would try to cap index between 37,900-38,000pts and index would remain bearish until it would not succeed in closing above 38,200pts on daily chart.

Regional Markets

Oil rises on weaker dollar, but virus woes and U.S.-China tensions weigh

Oil edged up on Friday as the dollar fell to an almost two-year low, although demand concerns stemming from rising coronavirus cases and U.S.-China tensions kept a lid on prices.The dollar slid to 22-month lows against a basket of currencies .DXY. A weaker dollar usually spurs buying of commodities priced in the greenback, like oil, because they become cheaper for holders of other currencies. Brent crude LCOc1 rose 15 cents, or 0.4%, to $43.46 a barrel by 0137 GMT, and U.S. West Texas Intermediate (WTI) crude CLc1 rose by 12 cents, or 0.3%, to $41.19. “Crude prices are attempting to stabilize as expectations still remain high that Congress will be successful in delivering another pandemic relief package” for the United States, said Edward Moya, senior market analyst at OANDA in New York. “Yesterday’s U.S. economic data showed that the economic recovery is struggling and pretty much guarantees more federal aid is coming.”

Read More...

Business News

Nepra provides relief of Rs4.46 billion to power consumers

National Electric Power Regulatory Authority (Nepra) has provided accumulated relief of Rs 4.46 billion to the power consumers as it has decided power tariff for eight months (November 2019 to June 2020) for EX-WAPDA distribution companies (Discos). The decision was taken in a public hearing conducted by the NEPRA on CPPA petition for the monthly fuel charges adjustment for the eight months period from November 2019 to June 2020 for XWDISCOs. In the hearing, NEPRA had decided increase in electricity rates for five months (November, December, January, February and March) with accumulated impact of Rs 4.86 per unit and allowed accumulated decrease of Rs 3.09 per unit for three months (April, May and June). However, after making adjustment in tariff hike and reduction in electricity rates for eight months, the power regulator said that power consumers would have accumulated relief of Rs 4.46 billion.

Read More...

Food ministry, CCP to launch action to tackle collusive market practices of wheat cartels

Ministry of National Food Security and Research (MNFSR) in collaboration with Competition Commission of Pakistan (CCP) will chalk out an action plan to tackle collusive market practices of wheat cartels in the country. Decision to this effect was taken in a meeting held between Secretary MNFSR Omer Hameed Khan and Chairperson Competition Commission of Pakistan Rahat Kunain here on Thursday, said a press release issued here on Thursday. MNFSR was working hard to eliminate gap between supply and demand of wheat and discouraging any mal practices, it said. During the meeting, it was discussed that Punjab has announced its interim wheat policy on July, 2 and Sindh Government may announce its “Wheat Release Policy”, without further delay. Government is exploring GTG wheat procurement/import from Central Asian Countries.

Read More...

Pakistan signs financing agreements valuing $750m with WB, AIIB for RISE programme

Pakistan has signed two financing agreements valuing $750 million with the World Bank (WB) and the Asian Infrastructure Development Bank (AIIB) for the Resilient Institutions for Sustainable Economy (RISE) programme. The World Bank will extend financing of $500 million and Asian Infrastructure Investment Bank (AIIB) will provide co-financing of $250 million for the RISE programme. Ministry of Economic Affairs Secretary Noor Ahmed signed the two loan agreements on behalf of Government of Pakistan while World Bank (WB) Country Director Patchamuthu Illangovan and Asian Infrastructure Investment Bank (AIIB)Vice President Mr. Konstantin Limitovsriy signed agreements on behalf of the WB and AIIB respectively.

Read More...

Soomro asks banks to provide procedural support for privatisation

Federal Minister Mohammad Mian Soomro on Thursday asked the financial sector to participate as lenders to successfully complete the subject transaction for the Privatisation process in the country. Federal Minister Mohammad Mian Soomro and Special Assistant to Prime Minister (SAPM) Nadeem Baber met with the heads of international and local banks in Karachi, said a press release issued by Ministry of Privatisation here. The meeting was attended by, Board members, members of financial advisory consortium(FAC), deputy governor State Bank , presidents and group chiefs of NBP, MCB, UBL, ABL, Habib Metropolitan, Bank Al Habib, Bank Alflah, Bank of Punjab, HBL, Meezan Bank and Faysal Bank.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.