Technical Overview

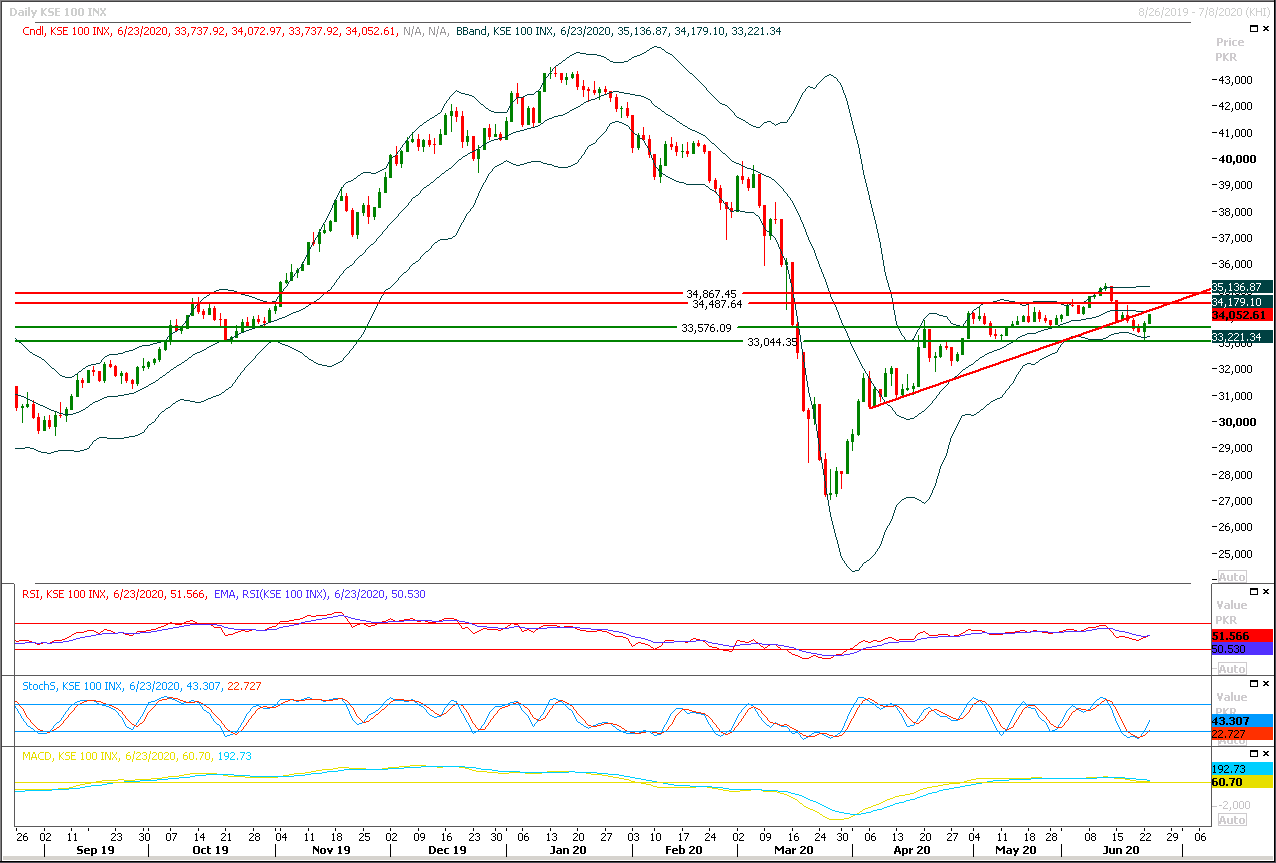

The Benchmark KSE100 index have continued its bullish sentiment during last trading session and have succeed in closing above 34,000pts again. As of now index have major resistant regions ahead at 34,300pts and 34,500pts where it would capped by a rising trend line along with a horizontal supportive region. Meanwhile daily momentum indicators are in bullish mode and these would try to push index further upward but it's recommended to stay cautious because a fight between bulls and bears is going on for June closing and it's expected that index would try to close month in positive zone if it would succeed in penetration above 34,500pts in coming two days, in case of breakout above 34,500pts index would try to target 35,200pts. It's recommended to adopt swing trading until index succeed in closing above 35,200pts on daily or weekly chart because a weekly bullish engulfing pattern or piercing line formation could take place if index would close above 34,500pts and these formations would create a cheat pattern in response of previous weekly evening star and some volatile moves could be witnessed till month end.

While in case of rejection from its resistant regions index would start losing momentum and would start sliding towards 33,500pts and 33,000pts. Initial bearish phase would start once index would succeed in closing below 33,000pts and a free fall towards 32,300-32,100pts would be witnessed.

Regional Markets

Asia stocks touch four-month top on dogged optimism

Asian shares crept to a four-month high on Wednesday as investors remained stubbornly upbeat on the outlook for a re-opening of the global economy even as cases of the coronavirus looked to be accelerating to new peaks.MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.39% to reach its highest since early March, though turnover was light. Japan’s Nikkei firmed 0.1% and Chinese blue chips 0.3%. Caution was still evident elsewhere with E-Mini futures for the S&P 500 off 0.1% and EUROSTOXX 50 futures easing 0.7%. On Wall Street, the Dow had ended Tuesday 0.5% higher, while the S&P 500 gained 0.43% and the Nasdaq 0.74%. News on the coronavirus was hardly encouraging with several U.S. states seeing record infections and the death toll in Latin America passing 100,000 on Tuesday, according to a Reuters tally.

Read More...

Business News

First detailed view on tax exemptions emerges

An internal report of the Federal Board of Revenue (FBR) on Tuesday showed income tax exemptions and concessions given to businesses and industry in FY20 make up Rs140 billion or 37 per cent of the total income tax exemptions granted in that year. The total stands at Rs378bn. The income tax exemptions and concessions for the sectors — business, industry, agribusiness, energy and mining are in addition to the lower rates of customs duty and sales tax. The estimates come from the first-ever comprehensive report titled “Tax Expenditure 2020” produced by the FBR in which total volume of all tax expenditures under income tax, sales tax and customs duty is estimated at Rs1.150 trillion for FY20. This is around 3pc of the country’s total GDP. According to an FBR official, the report on tax expenditure is a step towards improving budgetary and fiscal transparency.

Read More...

Govt aiming for 4-4.5pc growth over next three years

Expecting successful continuation of the International Monetary Fund (IMF) programme, the government is targeting the national economy to rebound with four per cent to 4.5pc growth over the next three years and total revenues posting a growth rate of 3pc of gross domestic product. Over the same period, the fiscal deficit would be almost halved to 4.8pc of GDP and current expenditure going down to 22pc of GDP from 23.5pc for outgoing fiscal year. This is part of the Medium-Term Budgetary Framework finalised by the Ministry of Finance in consultation with the IMF and presented to the parliament in compliance with the Fiscal Responsibility and Debt Limitation Act, 2005. The finance ministry reiterated its stance that the structural adjustment process had picked up momentum with the initiation of the IMF’s $6 billion facility when the “economic canvas changed drastically in the latter four to six months with increasing effects of the Covid-19 outbreak on economy”. As a result, the projection of economic growth reduced from around 3pc to -0.38pc of GDP, while the overall budget deficit is revised upwards from 7.1pc to 9.1pc of GDP. FBR revenue loss was projected at Rs900bn, exports and remittances were adversely affected, and non-tax revenue was decreased.

Read More...

Global trade set to shrink 18.5pc in second quarter of 2020

Geneva-Global trade is expected to drop around 18.5 per cent year-on-year in the second quarter of 2020 in a huge coronavirus-driven plunge which nonetheless could have been much worse, the WTO said Tuesday. “Initial estimates for the second quarter, when the virus and associated lockdown measures affected a large share of the global population, indicate a year-on-year drop of around 18.5 per cent,” the World Trade Organization said in a statement. The global trade body said that in the first quarter, the volume of merchandise trade shrank by three per cent year-on-year. Giving its initial estimates for the second three months of the year,the expected drop of 18.5 per cent was better than the WTO’s worst predictions. “The fall in trade we are now seeing is historically large -- in fact, it would be the steepest on record. But there is an important silver lining here -- it could have been much worse,” said outgoing WTO director-general Roberto Azevedo. “This is genuinely positive news but we cannot afford to be complacent.” In its annual trade forecast issued on April 20, the WTO forecast volumes would contract by between 13 per cent at best and 32 per cent at worst in 2020

Read More...

Govt to announce its first STPF for boosting exports to $46b

The incumbent government is likely to announce its first Strategic Trade Policy Framework (STPF) in next couple of weeks to double the country’s lower exports. The PTI led coalition government had so far failed to present fresh STPF, as the previous policy was expired in 2018. However, officials informed that ministry of commerce is likely to present the new STPF for next three years in Economic Coordination Committee (ECC) of the Cabinet within next few days. An official of the ministry of commerce informed that draft of STPF is almost ready, which has sent to ministry of finance and State Bank of Pakistan for their input. “It will be likely to present ECC meeting within next couple of weeks,” he added. The government would preset the STPF before the federal cabinet for approval after ECC. Official informed that incumbent government wanted to increase the country’s exports in next five years by giving incentives to exporters. Under the proposed STPF, the government has estimated to enhance the exports to $26 billion in next fiscal year from estimated $23 billion of the ongoing fiscal year. Exports would further increase to $31 billion in 2021-22, $35 billion in 2022-23, $40 billion in 2023-24 and $46 billion in 2024-25.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.