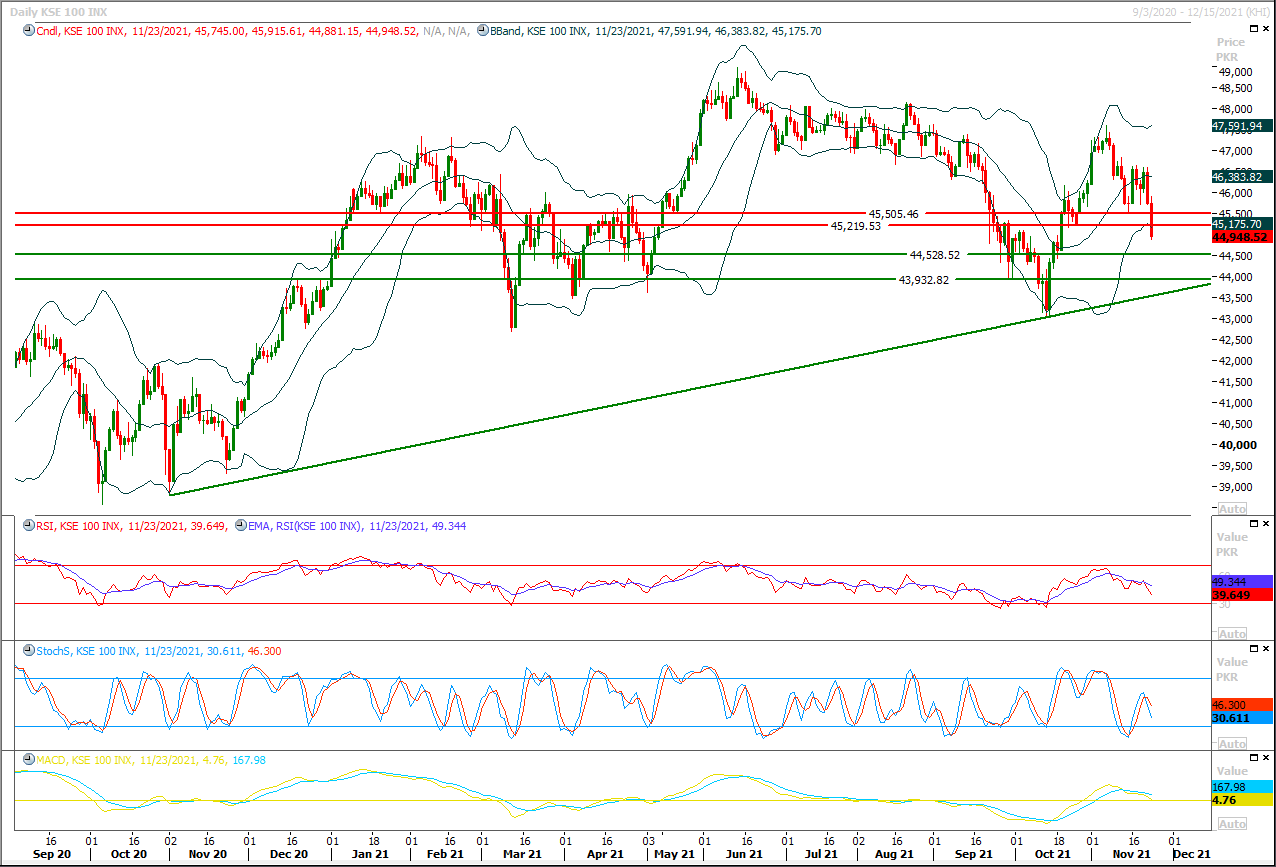

The Benchmark KSE100 index had continued its bearish journey for confirmation of a daily bearish engulfing pattern on daily chart, meanwhile it slides below its major supportive region of 45,200pts. As of now it's expected that index may show some volatile moves during current trading session because hourly momentum indicators are showing some recovery signs therefore it's recommended to stay cautious and adopt swing trading for day trading. Currently index would try to establish ground above 44,700pts initially and breakout below this region would call for 44,500pts while on flip side in case of recovery index would face initial resistance at 45,200pts while breakout above this region would call for 45,500pts. Daily momentum indicators are in bearish mode therefore it's recommended to stay cautious and avoid initiating new long positions for short term trading until index gave a clear reversal sign.

Singapore's economy is expected to grow about 7% in 2021, at the top of the official forecast range, and will expand at a slower pace next year as an uneven recovery continues across sectors, the government said on Wednesday.Gross domestic product grew 7.1% year-on-year in the third quarter, the Ministry of Trade and Industry said, higher than the 6.5% growth seen in the government's advance estimate.Analysts had expected a 6.5% increase, according to a Reuters poll.The economy is expected to grow 3% to 5% next year. The MTI had previously forecast a GDP growth range of 6% to 7% for 2021.

Read More...Adviser to the Prime Minister on Finance and Revenue Mr Shaukat Tarin, presided over the second meeting of the Governing Council (GC) of Pakistan Single Window (PSW) held at Finance Division.The Federal Minister for Science and Technology Mr Shibli Faraz, Secretary Commerce, Secretary Science and Technology, Governor SBP, Secretary to the Governing Council/Member Customs, FBR and senior officers from other ministries attended the meeting.The Secretary of the Governing Council gave detailed presentation on the progress, achievements, goals, milestones and challenges under PSW programme.

Read More...

PM Imran launches system to check tax evasion in sugar industry

Prime Minister Imran Khan on Tuesday inaugurated a track and trace system (TTS) of the Federal Board of Revenue (FBR).The TTS will help the government monitor the movement of sugar from factories in order to check tax evasion.The sugar industry has emerged as the second sector after cigarettes to be brought under the electronic monitoring system. The FBR is planning to bring the beverage, cement, fertiliser, iron and petroleum sectors under this system.Speaking on the occasion, the prime minister said that people had no trust in the tax system of the country, but he did not elaborate on the measures his government had taken for restoring people’s confidence in the tax system over the past three years.

Read More...

Competition Commission of Pakistan resumes probe into cooking oil, ghee sector

The Competition Commission of Pakistan (CCP) has resumed its inquiry in the cooking oil and ghee sector after the Supreme Court of Pakistan admitted for hearing its leave to appeal against, and suspended, the decision of the Islamabad High Court (IHC).The Supreme Court on Monday has suspended the Islamabad High Court’s judgment restraining the Competition Commission of Pakistan (CCP) inquiry against the ghee and oil mills. A three-judge bench, headed by Justice Umar Ata Bandial heard the CCP appeal against the IHC verdict. Faisal Siddiqui, representing the CCP, had said that many complaints about increase in edible items’ prices were received on the PM Portal and by the Punjab government.

Read More...

Central bank wants savings accounts profit rate hiked to 7.25pc

The profit rate on savings accounts will rise by 1.5 percentage points to a minimum of 7.25 per cent by Dec 1, the State Bank said on Monday.The announcement came after the central bank raised the policy rate last week to 8.75pc from 7.25pc.The central bank through a social media platform also asked customers to file a complaint with their bank if it gives less profit on the savings account.In case of non-compliance by the bank, the SBP asked the depositors to contact its customer complaint help desk.For opening a savings account, the SBP informed the customers to visit the bank of their choice. From January 2022, it has been made mandatory for banks.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.