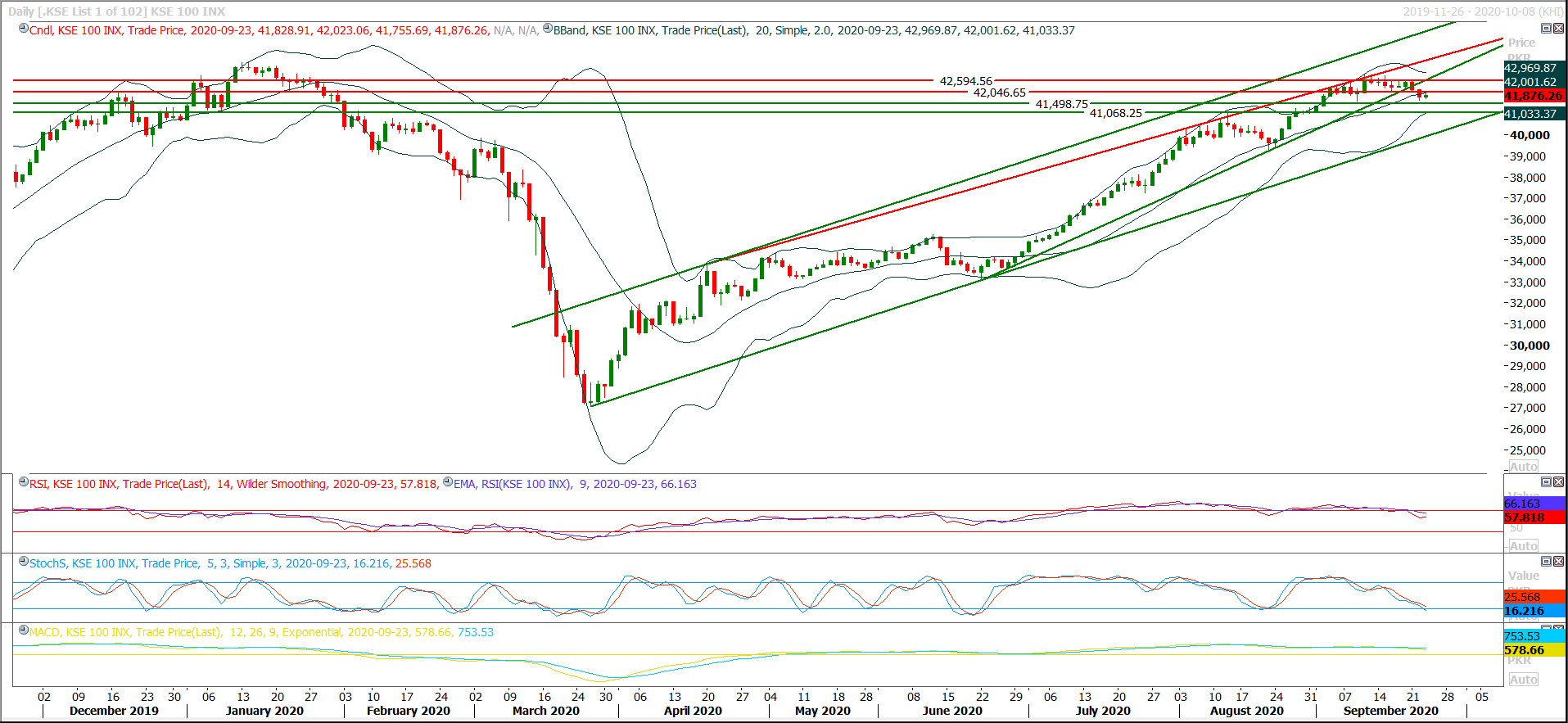

Technical Overview

The Benchmark KSE100 index have tried to retest supportive trend line of its rising wedge during last trading session but face major resistance at 42,000pts and now it’s expected that index would face some serious pressure during current trading session therefore it’s recommended to start selling on strength with strict stop loss of 42,200pts. Meanwhile it would try to expand intraday correction of its last bearish rally towards 41,500pts and breakout of that region would push index beyond 41,300pts. Daily and hourly momentum indicators are already in bearish mode and bears would try to push index further hard after breakout of 41,500pts. While on flip side in case of bullish pull back index would face major resistances at 42,050pts and 42,230pts. It would remain under pressure until it would not succeed in closing above 42,500pts on daily chart. While on a wider note index is still moving in a bullish price channel on daily chart and it would be considered range bound between 40,200pts to 42,500pts until breakout of either side would take place.

Regional Markets

Asian shares tumble as global recovery hopes falter

Asian shares fell on Thursday following a slump on Wall Street overnight, as a series of warnings from U.S. Federal Reserve officials underscored investor worries over the resilience of the economic recovery. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS tumbled 1.35% in the morning session on broad losses across the region. Chinese blue-chips .CSI300 dropped 1.09%, Hong Kong's Hang Seng .HSI fell 1.72%, Seoul's KOSPI .KS11 sank 1.73% and Australian shares .AXJO were 1.18% lower. Japan's Nikkei .N225 fell 0.74%.

Read More...

Business News

ECC okays Rs3.85 billion for salaries of Pakistan Steel Mills employees

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday has approved Rs3.85 billion for salaries of Pakistan Steel Mills (PSM) for current fiscal year and removed duties on selected HS Codes of textile sector. The ECC, which was chaired by Adviser to Prime Minister Abdul Hafeez Shaikh, has approved removal of Additional Customs Duties (ACDs) and Regulatory Duties (RDs) on selected HS Codes of textile sector, including fibers, yarns and fabrics of Nylon, Viscose, Acrylic, Rayon, Silk, Wool and vegetable based fibers like Hemp etc. The rationalisation has been done with an objective of increasing the share of MMF (Man Made fibers) for better per unit prices in the international markets, product diversification and, most importantly, value addition in our textile sector.

Read More...

FBR achieves another milestone in improving service delivery standards

In compliance with the vision of the Prime Minister for provision of best facilities to the taxpayers and to implement the directions of Advisor to PM on Finance and Revenue Dr. Abdul Hafeez Shaikh, FBR has achieved another milestone in improving service delivery standards by launching Urdu versions of Income Tax Return for salaried individuals (wizard view), simplified single page Tax Return for small retailers and wealth statement. Urdu versions of the returns are available on Iris web portal. In its efforts to improve tax systems and taxpayer facilitation standards, FBR will soon be launching Urdu versions of other online Wizard based returns and mobile Tax Asaan app.

Read More...

CPPA once again proposes hike of Re0.98/unit in electricity rate

Central Power Purchasing Agency (CPPA) has once again proposed an increase of Rs0.9846 per unit, under fuel price adjustment, for the month of August 2020 for Ex-Wapda DISCOs. The petition for tariff increase for August 2020 has been filed by CPPA on behalf of ex-Wapda distribution companies (Discos). The CPPA in its petition said, it had charged consumers a reference fuel tariff of Rs3.2045 per unit in August while the actual fuel cost turned out to be higher. Hence, it should be allowed to charge Rs0.9846 per unit additional cost from consumers next month. CPPA has also claimed previous adjustment/supplemental charges of Rs230 million. According to the data provided to NEPRA, the energy generation in August 2020 was recorded at 14630.06 GWh. The total cost of energy generated amounted to Rs59.81 billion. The total electricity sold to Discos was 14199.19 GWh for Rs 59.482 billion.

Read More...

FMPAC fearing considerable rise in urea prices

Fertilizer Manufacturers of Pakistan Advisory Council (FMPAC) is fearing considerable rise in prices of urea if the government implemented the decision of recovering GIDC from fertilizers companies within 24 months. Brig(R) Sher Shah Malik, Executive Director FMPAC, said that the fertilizer industry is making efforts to get to a workable solution but the government is refuting any proposal. He warned that with the legal battle continuing, it is evident that if the court’s decision is implemented as such and no relief is offered, the industry will face serious consequences. Recently, after deliberations the government endorsed the industry’s point of view on GIDC and thereafter issued the “GIDC Ordinance 2019”.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.