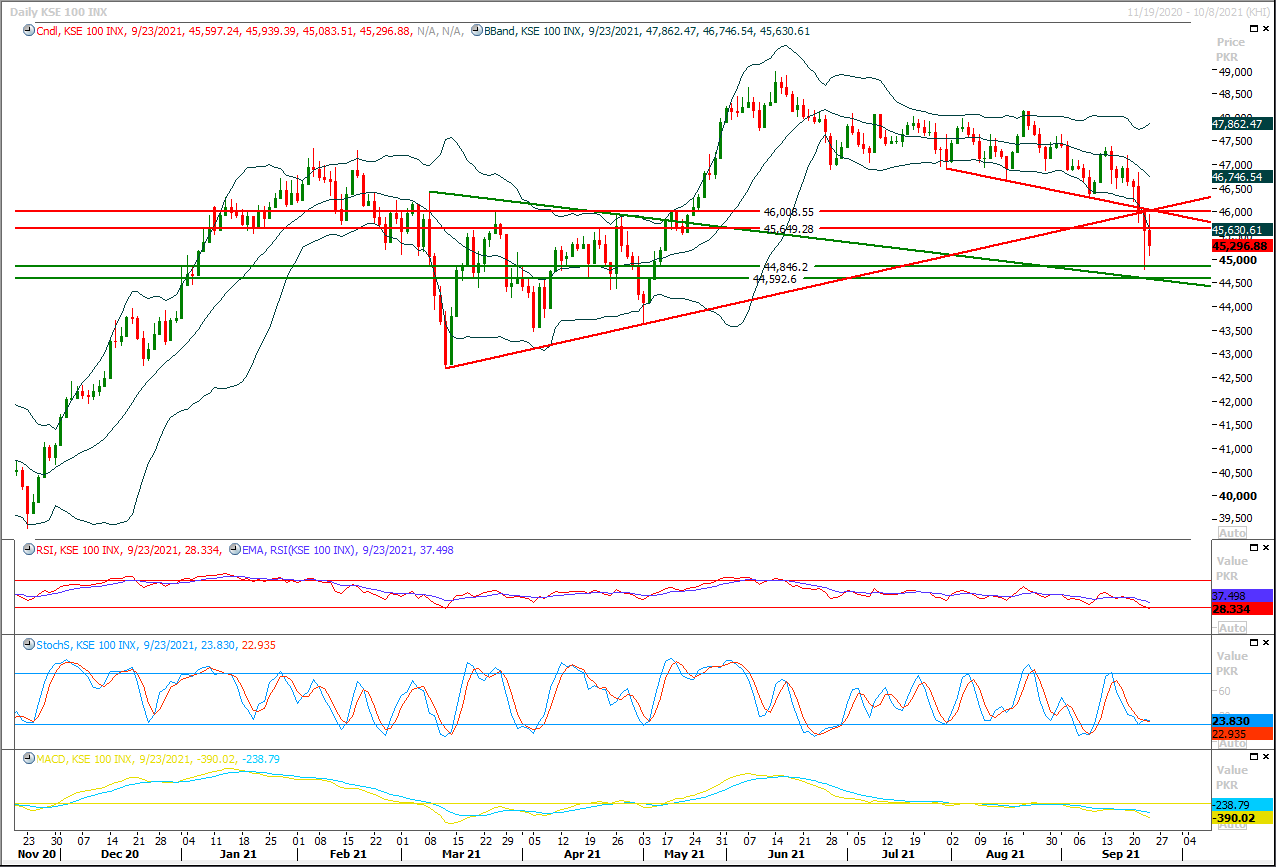

The Benchmark KSE100 index had witnessed some serious waves of volatility during last trading session as it faced rejection from its correction levels of last bearish rally and retested its previous supportive regions as resistant ones. As of now it's expected that index may expand its bearish correction initially towards 50% expansion level which falls at 44,900pts and penetration below this region would call for 44,670pts. Being last trading day of the week today's closing matters a lot as today's closing below 45,630pts would push index into bearish zone on short term basis. Currently hourly, daily and weekly momentum indicators are in bearish mode therefore it's recommended to adopt selling on strength with strict stop loss. On intraday basis index seems to open with a negative note and later on it would try to establish a double bottom on daily chart around 44,850pts from where it would try to bounce back but in case of failure it would slide further downward till 44,500pts. While on flip side it would face initial resistance at 45,630pts which would be followed by 46,000pts. Overall sentiment would remain bearish as long as its trading below 46,000pts where supportive trend line of its previous daily descending wedge formation would react as major resistant region and today's closing below 45,630 would open doors for 43,500pts in coming week.

Regional Markets

Inspiration4 benefactor-commander under quarantine with COVID-19-positive family

Days after completing his historic ride into space as part of the first all-civilian crew to reach Earth orbit, billionaire e-commerce mogul and mission commander Jared Isaacman is back at home, and unexpectedly back in quarantine."I came back to Earth with a house full of COVID," Isaacman, 38, said in an interview from his home in Easton, Pennsylvania, on Thursday, five days after he and his Inspiration4 crewmates safely splashed down in the Atlantic.

Read More...

Business News

ECC approves Kamyab Pakistan Programme, sugar import

The Economic Coordination Committee (ECC) of the Cabinet on Thursday approved the Kamyab Pakistan Programme for onward submission before the cabinet and sugar imports.Federal Minister for Finance and Revenue Shaukat Tarin presided over the meeting of the ECC. Finance Division presented an updated summary regarding Kamyab Pakistan Programme (KPP) before ECC yesterday. The programme has been streamlined in consultation with stakeholders to disburse microcredit for uplifting marginalised segments of the society.

Read More...

Tax evasion of Rs460 million unearthed

In a drive to curb tax evasion, Directorate of Intelligence & Investigation, Inland Revenue (I&I-IR), Lahore conducted a raid on the business premises of a steel mill located at Ferozwala, District Sheikhupura and unearthed estimated tax evasion of Rs. 400 million. The steel mill was engaged in the manufacturing of steel bars ingots and billets. During the initial investigation, it was revealed that the steel mill had filed Nil Sales Tax/ FED Returns for one year, however, electricity meter installed at the premises showed huge consumption of electricity during that period.

Read More...

Govt facing pressure on external sector amid claims of economic stability

Despite making tall claims of achieving economic stability, the PTI government is facing pressure on the external sector that is likely to result in a higher than projected current account deficit in current fiscal year.The government, which was celebrating the surplus current account few months back, is now facing pressure in controlling the deficit - the gap between country’s higher foreign expenditures and sluggish income. Independent economists believed that government might face the similar situation that PML-N government faced in its last year of the five years constitutional tenure when current account deficit swelled to around $20 billion.

Read More...

SBP puts brakes on financing for imported vehicles

Ballooning trade and current account deficits have forced the State Bank of Pakistan (SBP) to slow down import growth with changes in prudential regulations and reduce the financing limit and period, particularly for imported vehicles.The central bank on Thursday revised prudential regulations for consumer financing. “This targeted step will help moderate demand growth in the economy, leading to slower import growth and thus supporting the balance-of-payments,” said the SBP.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.