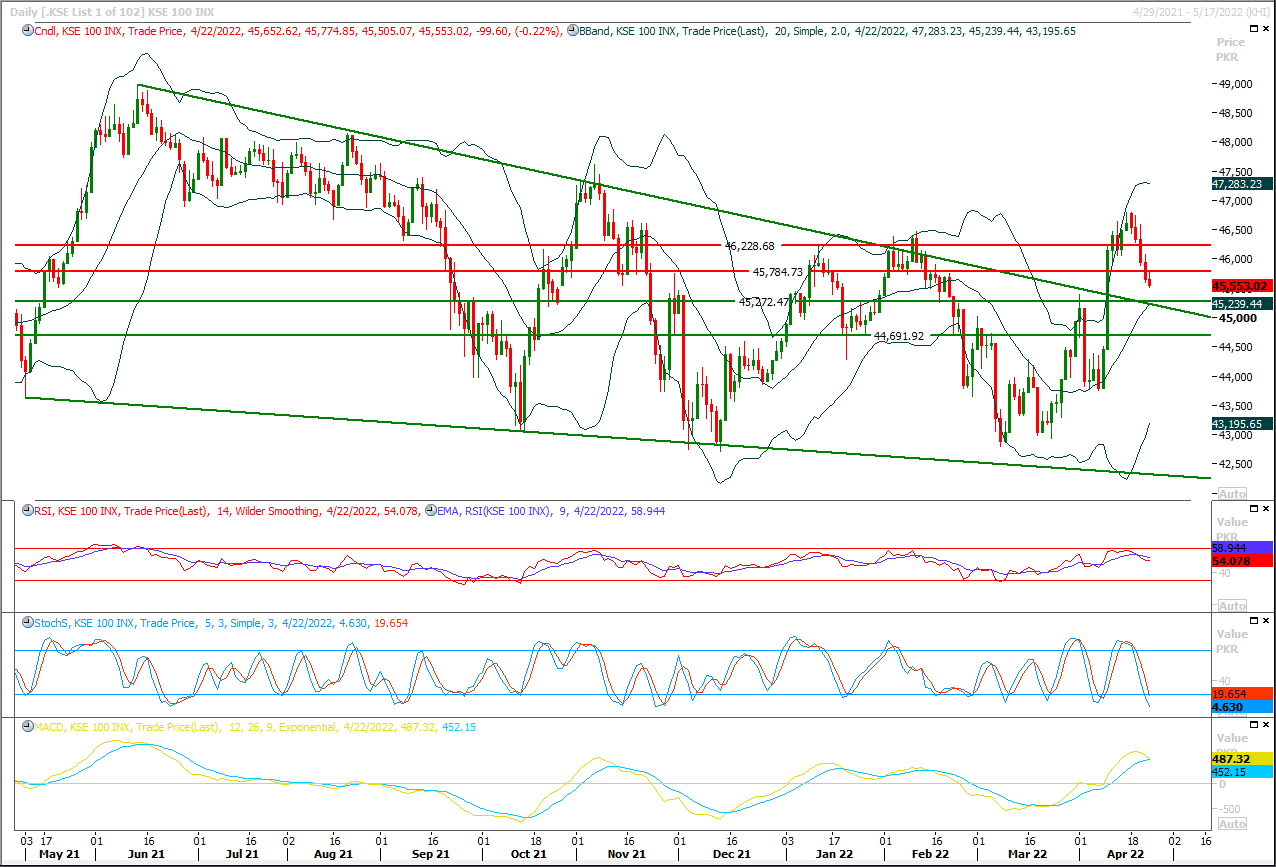

The Benchmark KSE100 index have reached a crucial level while taking correction of its last bullish rally and it's expected that it would try to establish ground initially above 50% correction level which falls at 45,200pts during current trading session while breakout below that region would call for 44,900pts and 44,700pts. Overall a volatile session would be witnessed today because hourly momentum indicators are ready for a pullback but daily momentum is still bearish therefore it's recommended to stay cautious. Buying in chunks could be beneficial in this region with strict stop loss of 44,700pts for short term trading purpose and index would start a sharp rally if it would succeed in maintaining above 45,200pts which may lead index towards 45,780pts and breakout above this region would call for 46,200pts. On longer run index still have succeeded in maintaining above resistant trend line of its previous descending wedge and whole this bearish run would be considered as retesting of this line in case of maintaining above 45,200pts. But today's closing below 45,200pts would push index into a sluggish zone which would need some healthy volumes to start recovery in coming days.

Stocks around the world rebounded on Friday, the U.S. dollar fell and oil prices dipped as investors welcomed talk of renewed diplomacy after Russia's invasion of Ukraine, and as coordinated Western sanctions left Russia's energy sector largely untouched. On Thursday, worries about the invasion lifted oil prices past $100 a barrel for the first time since 2014. Wall Street's indexes extended the previous session's rally with Nasdaq and the S&P 500 registering gains for the week. The MSCI World Index closed up 2.43%; for the week it was down 0.7%. Russian President Vladimir Putin urged Ukraine's military to overthrow its political leaders and negotiate peace. Authorities in Kyiv called on citizens to help defend the capital.

Read More...The business community on Saturday urged the government to control volatility of rupee against the US dollar as the industrial revival and economic growth are not possible without stability of local currency. Pakistan Industrial and Traders Associations Front Senior Vice Chairman Nasir Hameed and Vice Chairman Javed Siddiqi, in a joint statement issued here, said that massive fall of rupee value continued to damage the economy, as the rupee witnessed a huge depreciation against the greenback. Nasir Hameed observed that besides increasing exports and controlling imports the government will have to take administrative measures, as a large demand of cash dollars is seen in the market.

Read More...

External Sector Under Pressure As Current Account Deficit Swells To $1.03b In March

Pakistan’s current account deficit was recorded at $1.03 billion in previous month of March 2022, indicating that there is pressure on the external account sector. According to the latest data of State Bank of Pakistan, the country’s trade deficit in March this year was recorded at $1.03 billion as against $369 million in the same period of the previous year. Meanwhile, on monthly basis, the current deficit has swelled by 98 percent to $1.03 billion in March 2022 as compared to $519 million in February this year. The SBP has expressed satisfaction over the current account deficit figures in March. “Despite high global commodity prices, the turnaround in the current account continues, with a deficit of $1b in Mar, $500m lower than the average during FY22. Moreover, the non-oil balance remained in surplus for the 2nd consecutive month,” The central bank said on social media.

Read More...

IMF officials to discuss petrol, power subsidies in May visit

The announcement comes as Finance Minister Miftah Ismail, after landing in Washington to attend the spring meetings of the World Bank and the IMF, had his first meetings with senior IMF officials in which he later said the Fund had "talked about removing the subsidy on fuel". The press release said the Pakistani delegation held several meetings with IMF officials — including IMF Deputy Managing Director Antoinette Sayeh, Director Middle East and Central Asia Department Jihad Azour and Pakistan Mission Chief Nathan Porter — in which they discussed pathways to complete the seventh review. In 2019, the IMF approved a $6 billion loan for Pakistan but concerns about the pace of IMF-mandated reforms delayed its disbursements. The sixth review was completed in February when the IMF also agreed to immediately release $1bn for Pakistan.

Read More...

IMF agrees to add $2bn to ongoing programme

The International Monetary Fund (IMF) has agreed to increase the size of its $6 billion loan programme by $2bn and extend it for another year to prop up Pakistan’s balance of payments position and foreign exchange reserves. Finance Minister Miftah Ismail said on Sunday that Pakistan had asked the IMF to enhance its bailout package from the remaining $3bn to $5bn. Addressing a news conference at the Pakistan Embassy in Washington, the minister said that the IMF will send a staff-level delegation to Pakistan for talks on this request. Technical talks on Pakistan’s proposal are expected to begin from Tuesday.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.