Technical Overview

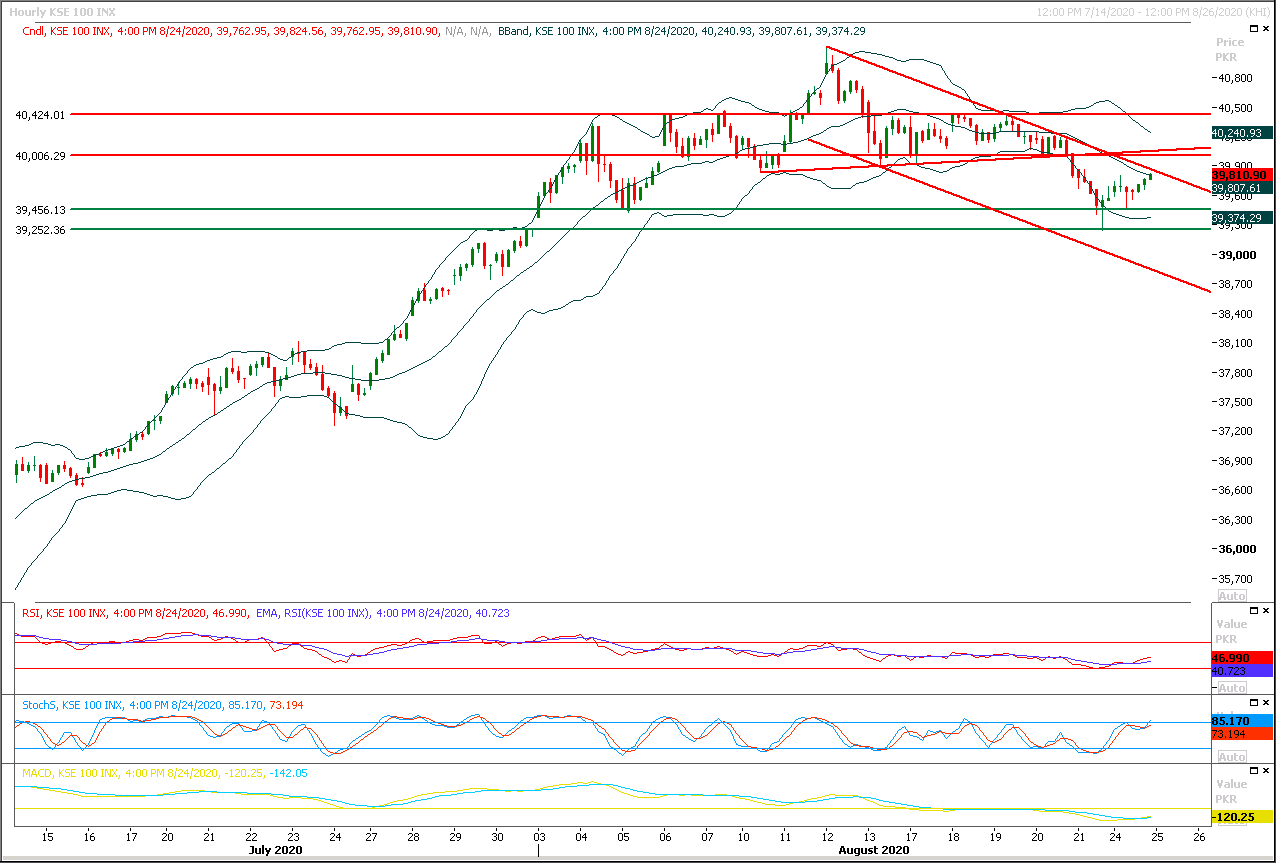

The Benchmark KSE100 index had succeeded in penetration above a resistant region where it was being capped by a resistant trend line on hourly chart, now it's expected that index would try to continue its movement in bullish direction towards 41,000pts initially, while breakout above this region would call for 41,200pts and later on 41,450pts would be target where it would face major resistance. Hourly momentum indicators have started a pullback but daily momentum is still bearish which would try to drag index into negative zone if it would not succeed in closing above 41,200pts in coming days. Impact of weekly evening shooting start would start vanishing if index would succeed in closing above 41,000pts on daily chart therefore it's recommended to stay cautious until a clear breakout of either 41,000pts. On flip side in case of rejection from its resistant regions index would try to find some ground initially at 40,500pts which would be followed by 40,000pts. Over all short term sentiment would remain bullish until index slides below 39,500pts.

Regional Markets

Asian stocks mostly higher as trade, virus treatment hopes lift mood

Asia’s stock markets were mostly higher on Tuesday as investors cheered signs of progress in U.S.-China trade negotiations and following a fresh Wall Street rally.MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.32% to its highest since early January and sits just a fraction below a two-year high. Japan’s Nikkei was trading 1.5% higher and banking stocks led Australia’s S&P/ASX 200 up 0.58%. The Hang Seng Index in Hong Kong was an outlier in early trade, slipping 0.27% while the Shanghai Composite was 0.15% firmer. Markets worldwide were boosted when U.S. regulators on Sunday authorised the use of blood plasma from recovered COVID-19 patients as a treatment option, helping the S&P 500 1% higher to another record close overnight.

Read More...

Business News

Public debt escalates to Rs36.3 trillion

Pakistan has borrowed $800 million from international lenders in the month of July due to the closed down of most of the economic activities across the country amid COVID-19 pandemic. The country has received only seven per cent of the annual budgeted $12.23 billion for the entire fiscal year 2020-21. However, the borrowing amount of $800 million in July this year has higher than the amount $657 million borrowed in same month of previous year, according to the latest data of Economic Affairs Division (EAD). “In the aftermath of COVID-19 and its persistence in the country the disbursements of project financing from development partners dried up during the last quarter of the outgoing fiscal year 2019-20,” the EAD noted.

Read More...

OGDCL discovers new oil & gas reservoirs in KP

Oil & Gas Development Company Limited (OGDCL) has made a new gas and condensate discovery from its exploratory efforts at Togh Bala 01 Well, in Block No. 3371-10, which is located in district Kohat, Khyber Pakhtunkhwa province. Togh Bala Well # 01 was spudded-in on June 27, 2020 and drilled down to 2172 meters in to Lockhart Formation. The open hole testing was carried out against Lockhart Formation which flowed at the rate of 9.00 MMSCFD gas and 125 barrels per day (BPD) condensate with well head flowing pressure (WHFP) of 1690 Psi at 32/64” choke size. It is highlighted that this is the 2nd consecutive discovery in Kohat Block. The discovery of Togh Bala Well # 01 is the result of aggressive exploration strategy adopted by Kohat JV and it would add to the hydrocarbon reserves base of OGDCL and the country.

Read More...

Govt decides to bring reforms in FBR

The government on Monday has decided to bring reforms in Federal Board of Revenue (FBR). An important meeting was held in the Ministry of Finance to discuss FBR reforms. The meeting was chaired by Advisor to the Prime Minister on Finance & Revenue Abdul Hafeez Sheikh and was attended by Abdul Razak Daood, Advisor to PM on Commerce, Textile and Investment, Dr. Ishrat Hussain, Advisor to PM on Institutional Reforms and Austerity and Secretary Finance Division. The officers included FBR Chairman Muhammad Javed Ghani, Doctor Ashfaq Ahmad, Member IR Operations, Ambreen Iftikhar, Member Reforms & Modernization and Asim Ahmad, Member IT.

Read More...

Current account balance shows surplus of $424 million in July

Pakistan’s current account balance swung into a surplus of $424 million in July 2020 after posting a deficit of $100 million in last month. The current account balance improved by 244 per cent in July as compared to the current account deficit of $613 million in same month a year ago, according to a data released by State Bank of Pakistan (SBP) on Monday. This is the fourth monthly surplus since last October, the Central Bank said in a statement. Strong turnaround is due to a continued recovery in exports and record-high remittances, with support from several policy and administrative initiatives by SBP and government, it added. In July the oversees Pakistanis transferred record remittances worth of $2.768 billion in the corresponding month which is the highest ever amount for the country in a single month while in same month of last year the remittances were recorded at $2.028 billion.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.