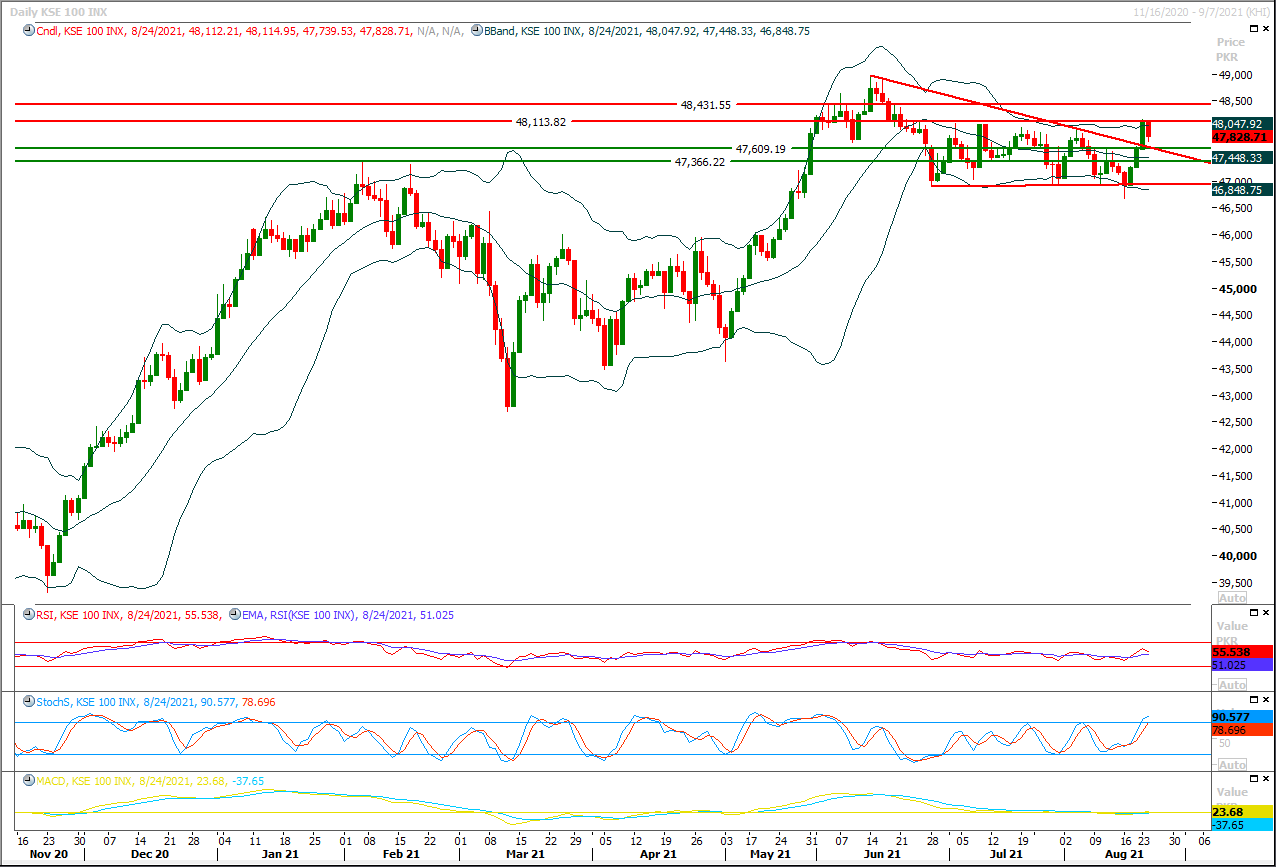

The Benchmark KSE100 index had moved downward after facing rejection from a horizontal resistant region during last trading session and now it's expected that it would try to establish ground above resistant trend line of its previous triangle which falls at 47,570pts for current trading session. Index would be considered in retesting phase of its previous resistant levels as long as its trading above 47,500pts therefore it's recommended to stay cautious and post trailing stop loss on existing long positions, breakout below this region would call for 47,350pts and further downward. Meanwhile daily momentum indicators have started losing strength after dark could formation of last trading session therefore it's recommended to adopt wait and see strategy before initiating new long positions for short term trading and once index would succeed in establishing ground above its previous resistant regions then it would be recommended to start adding new positions otherwise index may slide more downward. For current trading session index have resistant regions ahead at 48,165pts which would be followed by 48,300pts and 48,450pts in case of bullish recovery.

Regional Markets

Stocks hold gains on easing Fed taper worries as Powell speech awaited

Asian shares held onto their recent gains on Wednesday after last week's pummelling, as global equities rebounded thanks to a combination of positive COVID-19 vaccine news and easing worries over tapering of Federal Reserve stimulus.MSCI's broadest index of Asia-Pacific shares outside Japan was last off slightly, but still up 3.7% so far this week. The index fell to its lowest in 2021 at the end of the previous week.Markets were mixed with Australian shares gaining 0.16%, but Chinese blue chips losing 0.24%.

Read More...

Business News

Senate body expresses concerns over charges on bank transactions

The Senate Standing Committee on Finance and Revenue on Tuesday has expressed serious concerns over the issue of charges on transactions of funds by banks.Meeting of the Senate Standing Committee on Finance was held at Parliament House under the chairmanship of Senator Muhammad Talha Mehmood. The issue of charges on transactions of funds by banks was discussed in the meeting. Senator Saleem Mandviwala said that the proposal to transfer money from banks was rejected in the budget. Charges have been levied on transactions above Rs25,000.

Read More...

PLL receives expensive bids for LNG cargoes

In yet another round of spot tendering, Pakistan received very expensive bids for seven cargoes of Liquefied Natural Gas (LNG) deliveries in October and November that may have to be rejected by the board of directors of state-run Pakistan LNG Ltd (PLL).Bids opened by the PLL, a total of three bidders were technically qualified for seven LNG cargoes between Oct 7 and Nov 27. Together they submitted a total of 10 bids — one by PetroChina, two by Total Gas & Power and seven by Vitol Bahrain. PetroChina made the highest bid of $25 per unit for Oct 27-28 delivery slot.

Read More...

FBR gets 6th head in three years as PM’s aide on finance quits

In yet another major reshuffle in its economic team, Pakistan Tehreek-i-Insaf government on Tuesday removed the chairman of the Federal Board of Revenue (FBR) while the special assistant to the prime minister (SAPM) on finance and revenue said he had resigned.Informed sources said FBR chairman Asim Ahmad, who was fifth in the row in almost three years, was removed after a major cyberattack on taxpayers’ data, which was archived and managed by the FBR for automation, while SAPM Dr Waqar Masood Khan was asked to quit since he was seen as a follower of the ‘status quo’.

Read More...

Tarin says industrial input must be at affordable prices

Federal Minister for Finance Shaukat Tarin on Tuesday stressed the need for providing industrial inputs, such as cement and steel, at affordable prices to carry forward the momentum of economic recovery amid Covid-19 as well as in the post-Covid-19 scenario.He emphasised the need to reduce the prices of cement as the cement industry was of paramount importance due to its backward and forward integration with the construction sector as a whole.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.