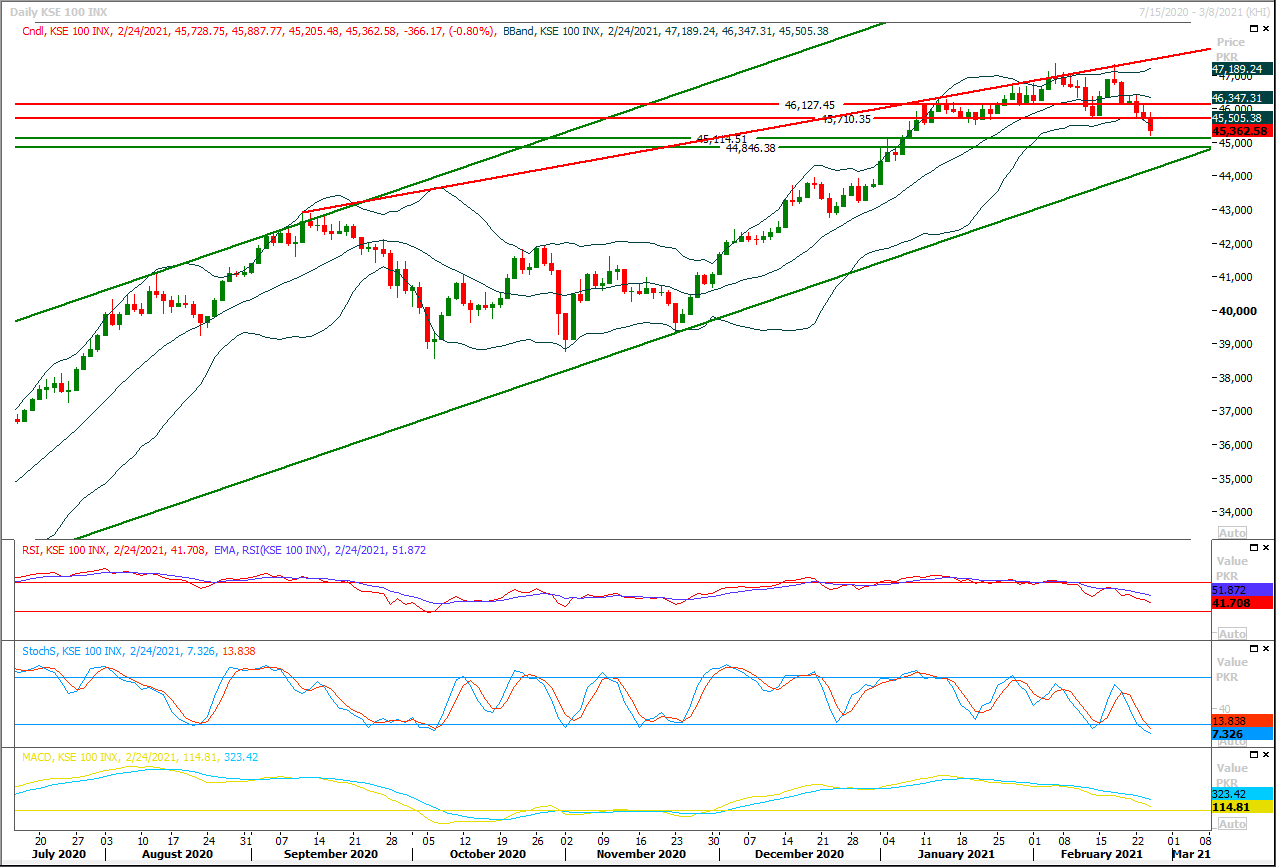

The Benchmark KSE100 index have succeeded in penetration below its major supportive region of 45,500pts during last trading session but meanwhile hourly Stochastic and MAORSI have generated bullish crossovers on same time which indicates that an intraday bullish spike could be witnessed during current trading session and index would try to retest is previous supportive regions as resistant ones during current trading session. Therefore buying with strict stop loss could be beneficial for day trading. As of now it's expected that index would try to open with a positive gap would try to target 45,550pts-45,700pts region initially while breakout above this region would call for 45,860pts-45,980pts region. But overall sentiment would remain bearish on short term basis as long as index is trading below 46,350pts and current pull back would be considered as corrective move of recent bearish rally. While on flip side in case of rejection from its resistant regions index would slide towards 45,100pts where a strong horizontal supportive region would try to pump some fresh volumes into market while breakout below that region would call for 44,800pts and 44,500pts in coming days. This week's closing below 44,800pts would push index for a deeper correction in coming week.

Regional Markets

Asian stocks open higher as Fed's Powell nixes inflation fears

Asian stocks perked up on Thursday after U.S. Federal Reserve Chair Jerome Powell reaffirmed interest rates would stay low, calming market fears that higher inflation might prompt the central bank to tighten the monetary spigot. Australia’s S&P/ASX 200 rose 0.90% in early trade while Japan’s Nikkei 225 added 1.37%. Hong Kong’s Hang Seng index futures rose 0.92%.MSCI’s gauge of stocks across the globe gained 0.12%, as rising stocks on Wall Street pushed the global benchmark to reverse early losses. The Dow Jones Industrial Average set a record high rising 1.35% to 31,961.86 while the S&P 500 gained 1.14%. The Nasdaq index, which fell as much as 1.3% earlier in the session, regained its footing by early afternoon and closed up 0.99%.

Read More...

Business News

Pakistan gets $1.1bn financing to import oil, LNG

With sub-optimal utilisation of earlier $4.5 billion worth of three-year financing framework, Pakistan and the International Islamic Trade Finance Corporation (ITFC) on Wednesday signed a $1.1bn trade financing facility for the current year. Under the Annual Financing Plan, “ITFC will mobilise trade financing of $1.1bn during the year 2021”, said an official statement after the signing ceremony. The financing available through this facility will be utilised by the Pakistan State Oil (PSO), Pak-Arab Refinery Ltd (Parco) and Pakistan LNG Ltd (PLL) for the import of crude oil, refined petroleum products and LNG during the year 2021 and help augment foreign currency reserves of the country and provide resources to meet the oil import bill.

Read More...

PAC orders USC’s two-year audit

The Public Accounts Committee on Wednesday ordered two-year performance audit of the Utility Stores Corporation as the Auditor General of Pakistan informed the PAC that audit of subsidies to the USC during Covid-19 and report of the last financial year were ready for laying before parliament. USC managing director Umer Lodhi briefed the PAC on the losses and sale of substandard edible oil. The auditors pointed out that under the Pakistan Standard and Quality Control Authority (PSQCA) rules, it was mandatory for the USC management to get quality control certification before displaying the eatables and edible oil on shelves for onward sale. USC secretary Afzal Latif said the PSQCA certification was required for the manufacturers, and not for the retailers

Read More...

Nepra reduces ROE of three nuclear power generation plants of 931MW

National Electric Power Regulatory Authority (Nepra) has reduced the Return On Equity (ROE) of three nuclear power generation plants of 931MW which will result in saving of approximately Rs 2.05 billion annually for next 25-37 years. Nepra, in a landmark decision, has reduced the Return On Equity (ROE) component of three nuclear power generation plants including C-2, C-3 and C-4 and has slashed the tariff by Re. 0.2515 per unit, said a notification issued here by NEPRA. The Nepra decision regarding Chashma Nuclear Power Plant Unit-2,3 and 4 having a cumulative net capacity of 931MW will result in saving of Rs2.05 billion per year (average Re. 0.2515/unit) for the remaining life of the nuclear power plants i.e. 25-37 years approximately, said the notification. It is apprised that the above nuclear power generation plants, in line with Cabinet Committee on Energy (CCOE) decision of 27th August 2020,

Read More...

FBR to publish Active Taxpayers’ List for 2020 on March 1

Federal Board of Revenue will publish the Active Taxpayers’ List for Tax Year 2020 on 1st March, 2021 in accordance with the provisions of Rule 81B of Income Tax Rules, 2002. Presently, FBR’s Active Taxpayers List (ATL) is linked with income tax returns for Tax Year 2019. The Active Taxpayers List (ATL) is a central record of online Income Tax Return filers for the previous Tax Year. ATL is published every financial year on the 1st March and is valid up to the last day of February of the next financial year. A person on the ATL can avail many benefits. They are not subjected to withholding tax on cash withdrawals, other banking transactions, payment of fee to educational institutions etc. Similarly, for such persons, tax on imports, dividends, goods, services & contracts, profit on debt, prize & winnings, purchase of motor vehicles, purchase and sale of property etc. is withheld at a lesser rate.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.