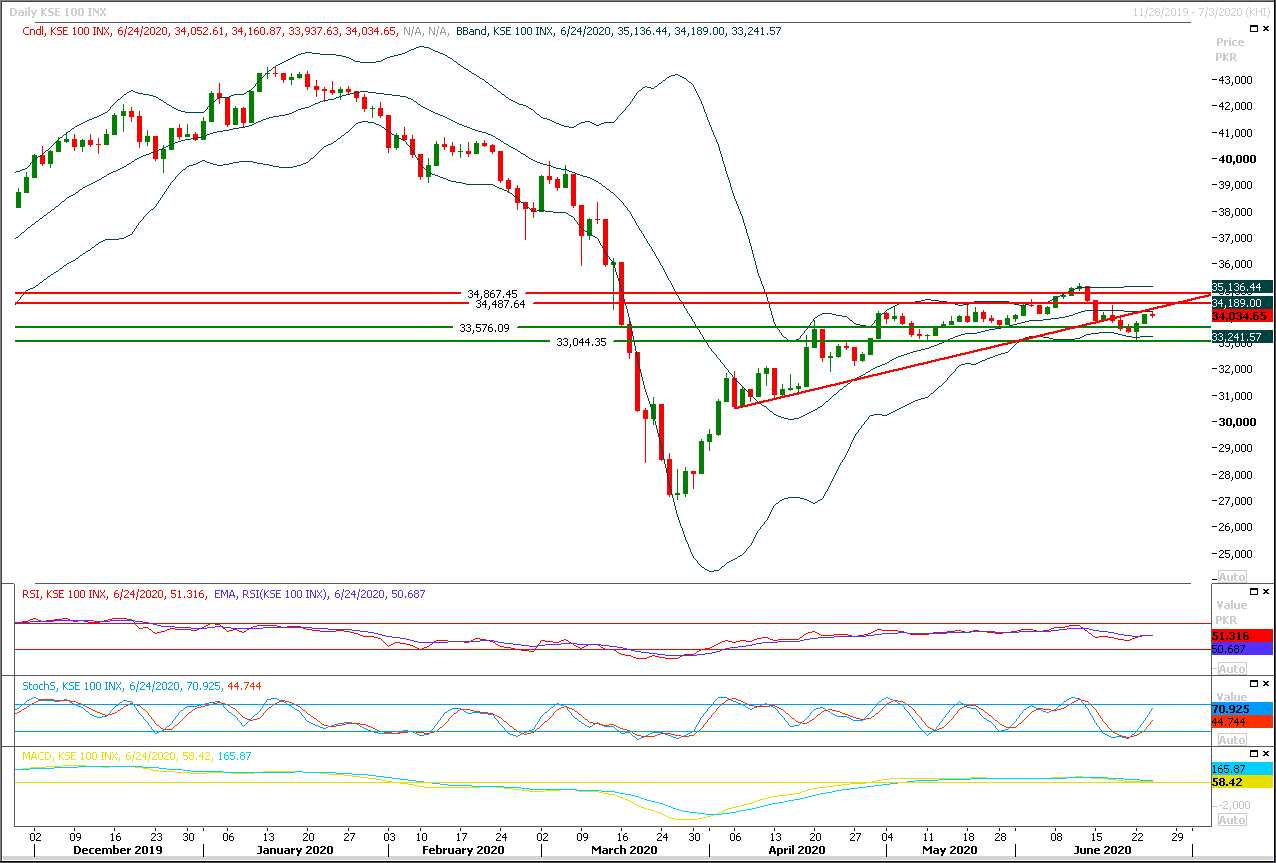

Technical Overview

The Benchmark KSE100 index is being capped by a rising trend line along with a horizontal resistant region at 34,370pts & 34,500pts. This trend line previously have reacted as a strong supportive region and now it would try to react as a strong resistant region and index would face uncertainty until it would not succeed in closing above this line. It's recommended to stay cautious and post trailing stop loss on existing long positions because if index would not succeed in penetration above its resistant regions during current trading session then it would try to slide towards 33,760pts and 33,500pts. Intraday momentum indicators have changed their direction towards bearish side therefore selling on strength with strict stop loss could be beneficial and if index would succeed in closing below 34,000pts for next two days then bearish sentiment would start getting strength.

Regional Markets

Stocks sell-off as coronavirus surge knocks recovery hopes/h4>

Asia’s stock markets slipped, bonds rose and the U.S. dollar was firm on Thursday as surging U.S. coronavirus cases, global trade tensions and an International Monetary Fund downgrade to economic projections knocked confidence in a recovery. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.7%, Tokyo’s Nikkei slumped 1.4% and Australia’s ASX 200 tumbled 1.8%. U.S. stock futures also declined 0.7% following on from an overnight slide on Wall Street. Markets in Hong Kong and mainland China are closed for public holidays on Thursday. Florida, Oklahoma and South Carolina reported record increases in new cases on Wednesday. Seven other states had record highs earlier in the week and Australia posted its biggest daily rise in infections in two months. The governors of New York, New Jersey and Connecticut ordered travellers from nine other states to quarantine on arrival, a worry for investors who had mostly been expecting an end to pandemic restrictions.

Read More...

Business News

IMF lowers country’s growth forecast to 1pc

The International Monetary Fund (IMF) on Wednesday lowered Pakistan’s growth forecast by half to one per cent for the next fiscal year as the global economy appears to have suffered greater setbacks following the Covid-19 pandemic and shows slower signs of recovery than previously anticipated. On April 14, the IMF had estimated Pakistan’s GDP going negative 1.5pc in the fiscal year 2019-20 and a 2pc growth rate for FY2020-21 in its flagship World Economic Outlook (WEO). The Fund now revised its forecast to -0.4pc for the current fiscal in line with the government’s estimates. However, as part of its WEO update released on Wednesday, the IMF also revised downward its next year’s growth forecast to 1pc from 2pc in April update and the Pakistan government’s target of 2.1pc set for the next fiscal year. The IMF said the global growth was now projected at -4.9pc in 2020, 1.9 percentage points below the April 2020 WEO forecast. Consumption growth, in particular, has been downgraded for most economies, reflecting the larger-than-anticipated disruption to domestic activity.

Read More...

Consumer groups oppose move to hike gas prices by 110pc

Strongly opposing a petition for almost 110 per cent higher gas rates, various stakeholders on Wednesday demanded rather substantial reduction in prices in line with drastic fall in international oil prices. The Oil & Gas Regulatory Authority (Ogra) had called a public hearing on the request of Sui Northern Gas Pipelines Limited (SNGPL) which is seeking almost 110pc increase in prescribed prices for fiscal year 2020-21. The hearing was presided over by Ogra Chairperson Uzma Adil Khan. The SNGPL has sought an increase of Rs622.94 per mmbtu (million British thermal unit) effective from July 1 to meet its estimated revenue requirements of financial year 2020-21. In addition, the company also demanded Rs102 per unit cost of imported gas (LNG) to be transferred to consumers.The representatives of CNG Owners’ Association and All Pakistan Textile Mills Association (Aptma) objected to the huge increase in gas prices. Both parties said the gas prices were required to be reduced to pass on the benefit of lower international oil rates to consumers since the producer prices of gas were directly linked to global oil prices.

Read More...

Current account posts $13m surplus

The country’s current account deficit narrowed to $3.28 billion in the first eleven months of current fiscal year, while declining sharply in May. The State Bank of Pakistan (SBP) on Wednesday said the account posted a surplus of $13 million in May against a deficit of $350m in April. The government has been working hard to bring down record-high the $20bn deficit in FY18 to more manageable levels. During July-May, the deficit fell by 73.6 per cent compared to $12.453bn in the same period last fiscal year. The sharp reduction in import bill led to the narrowing of fiscal deficit in the current fiscal year as exports showed lackluster growth despite government’s incentives to the export-oriented sectors. The data released by the Pakistan Bureau of Statistics (PBS) showed export of goods fell to $20.9bn, down from $22.5bn in the last fiscal year. Meanwhile, imports fell to $38.9bn from $47.8bn last year.

Read More...

WB approves $236 million for Pakistan

The World Bank’s Board of Executive Directors has approved $236 million in grants and credits to support Pakistan’s efforts to enhance learning and healthcare, and address COVID-19 threats to human capital accumulation. The Khyber Pakhtunkhwa Human Capital Investment Project ($200 million) and Balochistan Human Capital Investment Project ($36 million) will improve public services in education and health, which are the building blocks for human capital accumulation. The projects aim to increase the productive capacity of the workforce to bolster future economic growth in Balochistan and Khyber Pakhtunkhwa. Apart from this loan, the State Bank of Pakistan (SBP) on Wednesday has received $1billion — $500 million each from World Bank (WB) and Asian Development Bank (ADB) to facilitate the country during its fight against coronavirus. Pakistan has received this amount under COVID-19 Active Response and Expenditure Support (CARES) program. The CARES program is facilitated by parallel cofinancing of $500 million each from the Asian Infrastructure Bank (AIIB) and the World Bank to support Pakistan in addressing the challenges from COVID-19.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.