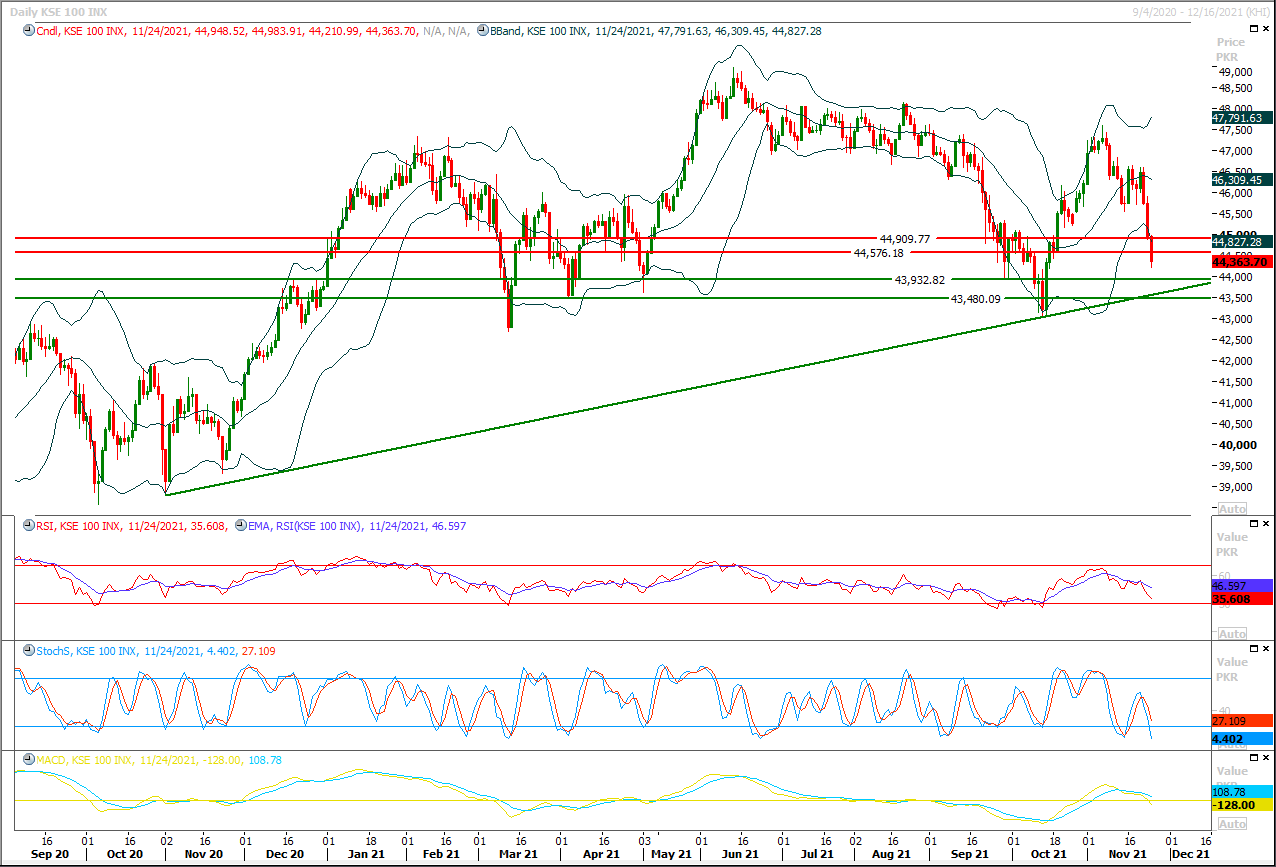

The Benchmark KSE100 index had witnessed a volatile trading session yesterday but closed with a bearish note at day end. As of now it's expected that index would initially continue its bearish journey towards 44,200pts and 43,900pts where it would try to establish ground on strong horizontal supportive regions but breakout below these regions would call for 43,500pts and 42,800pts in coming days therefore it's recommended to stay cautious and avoid initiating new long positions for short term trading until index gave a clear reversal sign. Currently in case of bullish pull back index would face initial resistance at 44,580pts where it's being capped by a strong horizontal resistant region while breakout above this region would call for 44,900pts and 45,200pts. Momentum indicators on daily and hourly charts are in bearish mode and these would try to push index further downward but it needs to stay cautious because index have a major supportive regions ahead at 44,200pts and 43,500pts on weekly chart. Overall it would be considered as range bound as long as its trading above 42,800pts and closing below this region would call for a serious bearish rally.

Australian business investment slipped in the third quarter as pandemic lockdowns shut many firms, though future spending plans proved surprisingly resilient and a rapid recovery is expected now that most restrictions have been lifted.Figures from the Australian Bureau of Statistics out on Thursday showed capital expenditure fell a real 2.2% in the third quarter to A$32.7 billion in line with market forecasts of a 2.0% drop.Spending plans for the year to end June 2022 were upgraded to A$138.6 billion, above most analysts' estimates and a sign business confidence had weathered the disruptions well.

Read More...The agriculture department has invited applications from canola growers by December 10, 2021 for production competition under Prime Minister’s Agriculture Emergency Programme. A spokesman for the agriculture (extension) department said on Wednesday the growers who cultivated canola crops over 3 acres or more land were eligible to apply for competition in Faisalabad, Jhang, Toba Tek Singh, Sargodha, Bahawalgagar, Bahawalpur, Kasur, Khanewal, Lodhran, Mianwali, Multan, Muzaffargarh, Okara and Vehari. “The application forms are available in the office of Deputy Director Agriculture Office or the same can be downloaded from the website www.agripunjab.gov.pk whereas its photocopy can also be used”, he said.

Read More...

NPMC expects further decline in wheat flour, sugar prices in days to come

The National Price Monitoring Committee (NPMC) on Wednesday expressed satisfaction over the decline in prices of two basic food commodities, wheat flour and sugar, in the country and expected further decline in the days to come.Adviser to Prime Minister on Finance and Revenue, Shaukat Tarin presided over the National Price Monitoring Committee (NPMC) meeting held at the Finance Division.The NPMC reviewed the prices of daily use commodities and essential food items in the country. The Secretary Finance updated NPMC that the prices of the wheat flour bags remained consistent at Rs. 1100 per 20 kg.

Read More...

Ecnec okays Rs190bn road infrastructure projects

The Executive Committee of the National Economic Council (Ecnec) on Wednesday approved Rs190.215 billion worth of projects related to road infrastructure and acquisition of self-reliance in satellite technologies in Pakistan.A meeting of Ecnec, chaired by Minister for Planning and Development Asad Umar and attended by Minister for Industries Khusro Bakhtiar and federal secretaries, approved the Pakistan Optical Remote Sensing Satellite (PRSS-02) project of Space and Upper Atmosphere Research Commission (Suparco) worth Rs27.913bn.

Read More...

SBP sees 4-5pc GDP growth in FY22

The State Bank of Pakistan (SBP) has declared that addressing deep-rooted structural impediments is crucial for sustaining and improving the current growth momentum.“These impediments include consistent decline in the yield of important crops (especially cotton); insufficient export coverage of imports, low and declining productivity of labor, stagnant tax-to-GDP ratio, anemic investment-to-GDP ratio, and the rising fiscal burden of the power sector,” stated the SBP in its annual report, which was issued on Wednesday.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.