Technical Overview

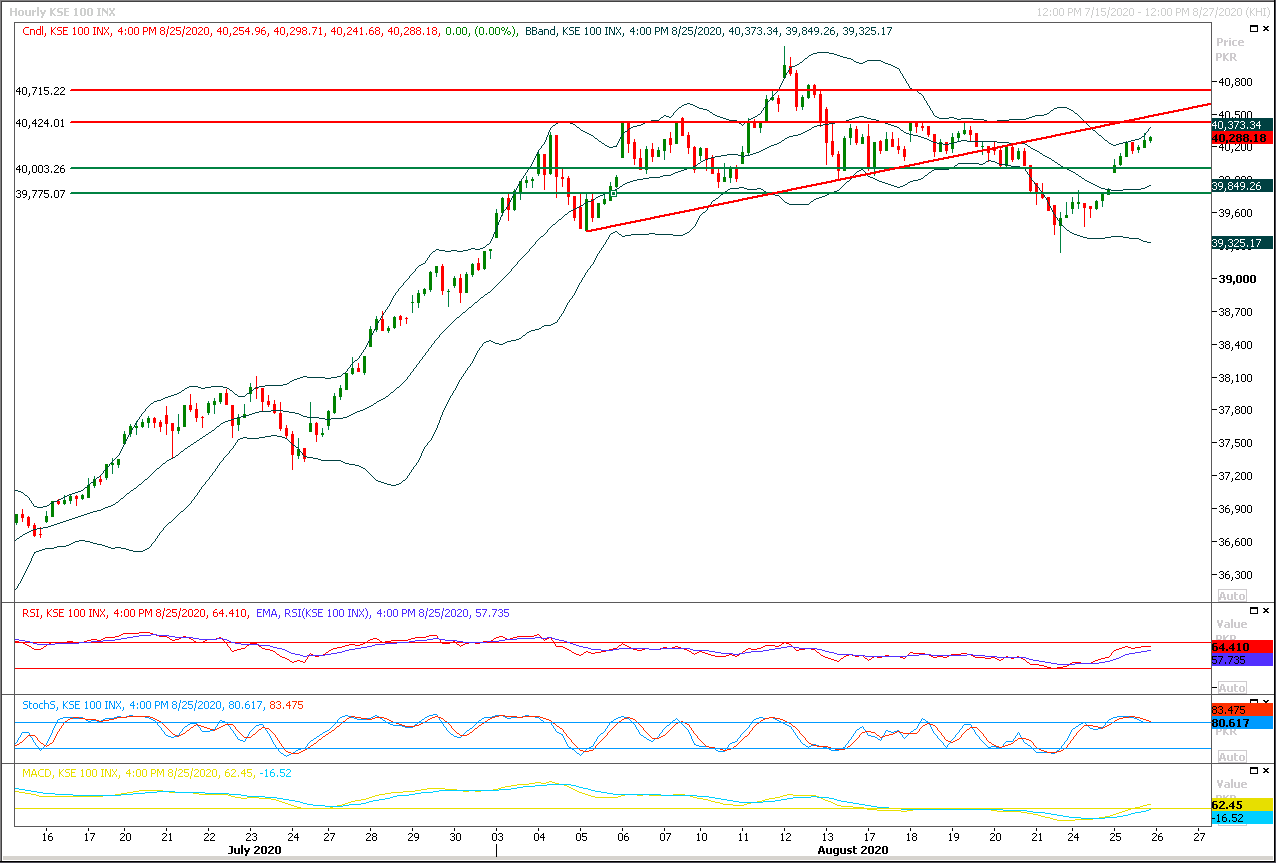

The Benchmark KSE100 index have succeeded in closing above its initial resistant region of 40,000pts during last trading session and now this region would try to act as a supportive region in case of any bearish pressure. As of now it's expected that a volatile session would be witnessed during current trading session because index is still trading below its major resistant regions of 40,500pts and 40,760pts and these regions would try to add selling pressure on index therefore swing trading could be beneficial and for day trading selling on strength is recommended. In case of bearish pressure index would try to find ground at 40,000pts and 39,800pts.

Regional Markets

Asian shares slip from two-year top as economic strains pile up

Asian stocks eased from a two-year high on Wednesday, as a mixed bag of economic data had investors a touch more circumspect about the global recovery, while oil jumped to a five-month peak owing to a hurricane disrupting output in the Gulf of Mexico. MSCI’s broadest index of Asia-Pacific shares outside Japan edged down 0.1% after hitting its highest since mid-2018 on Tuesday. Japan’s Nikkei was off 0.1%. The U.S. dollar nursed small losses in currency trading, though moves were muted ahead of a key Thursday speech from Federal Reserve Chairman Jerome Powell in which he is expected to outline the central bank’s next steps.

Read More...

Business News

Petroleum products consumption wanes by 20.62 per cent

The consumption of petroleum products in the country declined by 20.62 per cent to 19.56 million tonnes during 2018-19 as compared to previous year’s 24.64 million tonnes. The contraction in consumption was observed in all main sectors including power, which suffered huge decline of 56.72 per cent to 2.76 million tonnes during FY 2018-19 as compared to 6.37 million tonnes in FY 2017-18, followed by industrial sector, which observed lower consumption by 30.16 per cent and transport sector showed a fall of 6.01 per cent, said Ogra’s State of the Regulated Petroleum Industry Report 2018-19.

Read More...

CDC to facilitate NRPs to invest in capital market

Central Depository Company of Pakistan Limited (CDC) would facilitate investment by Non-Resident Pakistanis (NRPs) in the Pakistan Stock Market through Roshan Digital Account with designated large-scale banks said CDC CEO Badiuddin Akber. He further stated that Roshan Digital Account is a remarkable step taken by the State Bank of Pakistan to facilitate Overseas Pakistanis. Similarly, allowing NRPs to invest in Stock Market through Roshan Digital Account is a further facilitation for NRPs which is the result of SECP’s vision to create ease of doing business for investors. He applauded the collaborative efforts of both SECP and SBP through which this important milestone was achieved.

Read More...

Increase of Rs0.86/unit under fuel price adjustment proposed

Central Power Purchasing Agency (CPPA) has proposed an increase of Rs0.86 per unit, under fuel price adjustment, for the month of July 2020 for Ex-Wapda DISCOs. The petition for tariff increase for July 2020 has been filed by CPPA on behalf of ex-Wapda distribution companies (Discos). The CPPA claimed an additional cost of Rs0.8615 per unit under base tariff 2015-16. The CPPA in its petition said, it had charged consumers a reference fuel tariff of Rs3.5420 per unit in July while the actual fuel cost turned out to be higher. Hence, it should be allowed to charge Rs0.8615 per unit additional cost from consumers next month. According to the data provided to NEPRA the energy generation in July 2020 was recorded at 42928 GWh.

Read More...

Share of Punjab in gas consumption increased by 1 per cent in 2018-19

Despite 9.4 percent decrease in natural gas production in Punjab during 2018-19, the share of the province in gas consumption was increased by 1 percent from 50 percent to 51 percent while the share of other provinces reduced or remained the same. The share of Sindh in the consumption of gas decreased from 39 to 38%, while in Balochistan and KP it remained the same at 2% and 9% respectively during 2018-19, said Ogra’s State of the Regulated Petroleum Industry Report 2018-19.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.