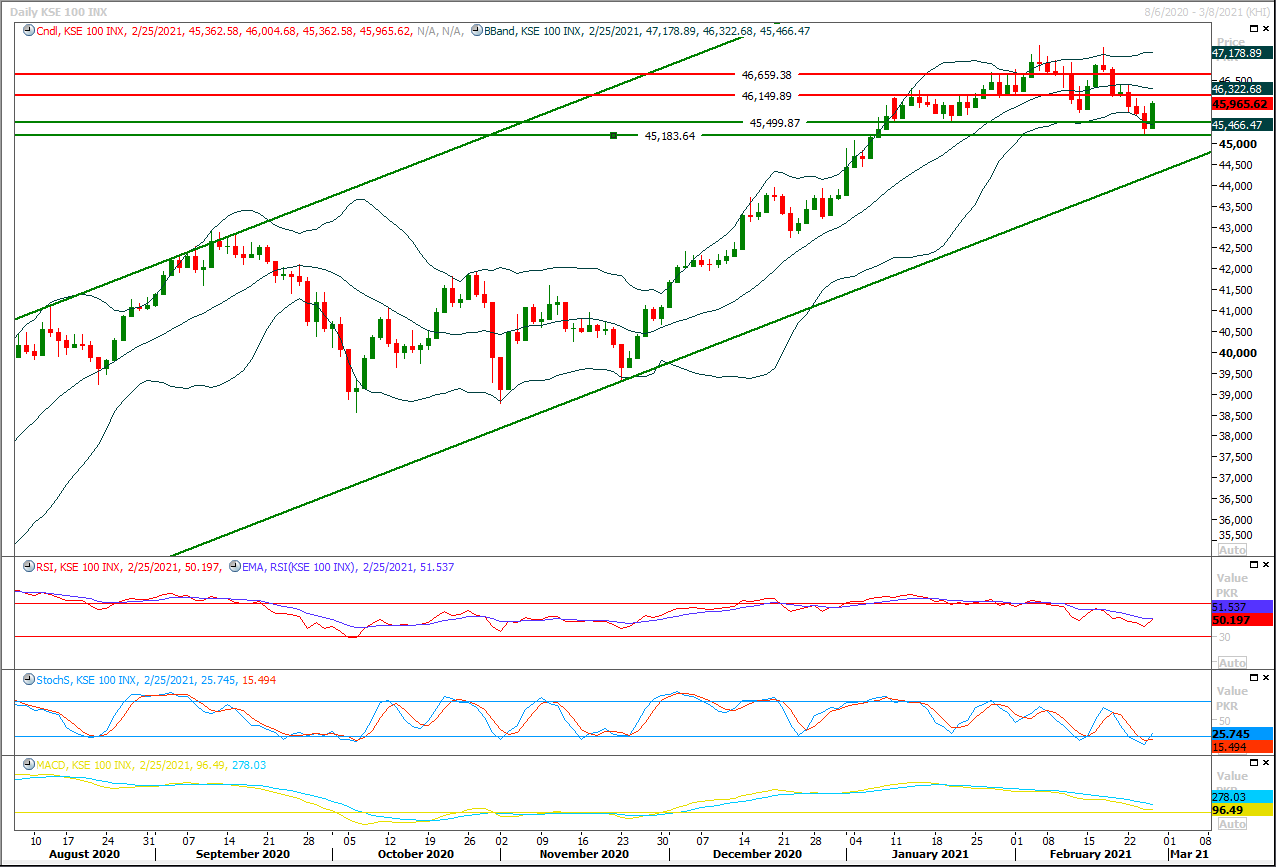

The Benchmark KSE100 index have recovered aggressively during last trading session but still could not succeed in closing above its initial resistant region of 46,000pts, meanwhile a bullish engulfing pattern have taken place on daily chart but it could turn into a cheat pattern if index would not succeed in maintaining above 46,150pts till day end today. As of now it's expected that index would face strong resistance between 46,000pts-46,150pts where its being capped by strong horizontal resistances, while in case of breakout above this region index would face rejection from its next resistant region which fall at 46,350pts therefore its recommended to stay cautious and start profit taking from existing long positions. Daily and weekly momentum indicators are still in bearish mode while hourly stochastic is ready for a bearish crossover therefore it's expected that index could take a dip during current trading session therefore selling on strength with strict stop loss could be beneficial for day trading. For current trading session index have initial supportive region at 45,500pts while breakout below that region would call for 45,100pts and 44,800pts in coming days. Today's closing below 45,500pts would change market sentiment for short term which may lead index towards a deeper correction in coming days. Overall a double hammer is taking place on weekly chart which indicates start of a major uncertain region therefore it's recommended to post trailing stop loss on existing positions.

Regional Markets

Asian markets roiled as bond rout turns 'lethal'

Asian stocks skidded to one-month lows on Friday as a rout in global bond markets sent yields flying and spooked investors amid fears the heavy losses suffered could trigger distressed selling in other assets.MSCI’s broadest index of Asia-Pacific shares outside Japan slid 2.4% to a one-month low, while Japan’s Nikkei shed 2.5%. Chinese blue chips joined the retreat with a drop of 2.5%. NASDAQ futures fell 0.5% after a sharp drop overnight, while S&P 500 futures eased 0.1%. EUROSTOXX 50 futures lost 1.2% and FTSE futures 1.1%.

Read More...

Business News

FATF keeps Pakistan on grey list until June despite 'significant progress'

The Financial Action Task Force (FATF) on Thursday decided to keep Pakistan on its 'grey list', with the country's status set to be reviewed next at an extraordinary plenary session in June 2021. The announcement was made by FATF President Dr Marcus Pleyer at a press briefing from Paris on the outcomes of the FATF's four-day virtual plenary meeting. "Pakistan remains under increased monitoring," Pleyer said, adding that while Islamabad had made “significant progress”, there remained some “serious deficiencies” in mechanisms to plug terrorism financing."Three out of 27 [points] need to be fully addressed," he said, referring to the action plan agreed to by Pakistan.

Read More...

Chinese delegation meets SCCI chief

President of Sarhad Chamber of Commerce and Industry (SCCI), Sherbaz Bilour has said the Pak-China Economic Corridor project is a glaring example of Pak-China friendship which could bring economic prosperity and development besides changing the destiny of the whole region. Sherbaz Bilour expressed these views while speaking to a Chinese delegation led by Lv Yan, DGM CRBC China, here at the Chamber House On Thursday. SCCI chief said that the Rashakai Special Zone was fully backed by the government of China which has enabled it to attract new investment in the province that will help create more job opportunities. He urged the government to take pragmatic steps and offer incentives to encourage investments in the province.

Read More...

Nepra reserves judgment over petition for Re0.93/unit hike in power tariff

National Electric Power Regulatory Authority (Nepra) has as usual shown concern over the use of expensive furnace oil worth Rs 12 billion for power generation as the regulator reserved judgment over Central Power Purchasing Agency-Guaranteed (CPPA-G) petition for Re0.93 per unit increase in power tariff under monthly Fuel Charge Adjustments (FCA) for January. Nepra has conducted public hearing on CPPA’s petition for Fuel Charge Adjustments (FCA) for the month of January 2021, where it had demanded an increase of Re 0.93 per unit in power tariff. The hearing was presided over by chairman NEPRA, Saif ullah Chatta. In its petition, CPPA-G maintained that the reference fuel charges for January 2021 were estimated at Rs5.7576 per unit whereas the actual fuel charges were Rs 6.6846 per unit, hence an increase of Rs0.9272 per unit had been sought under monthly fuel price adjustment mechanism.

Read More...

FPCCI opposes plan of imposing additional taxes of Rs700b in upcoming budget

The Federation of Pakistan Chambers of Commerce and Industry has rejected the government’s plan of imposing additional taxes of over Rs700 billion in the upcoming federal budget 2021-22 under the International Monetary Fund’s deal. The FPCCI’s Businessmen Panel chairman and apex chamber ex-president Mian Anjum Nisar said that the government and the IMF have reached a staff level agreement to revive the stalled $6 billion programme, as the Fund has announced to disburse $500 million’s third tranche, assigning the task to government to generate additional Rs700 billion from the trade and industry through new taxes in the upcoming budget. He resented that the frequent increase in electricity tariff and petroleum products’ prices along with burden of new taxes on the behest of the International Monetary Fund (IMF) is dangerous game for the economy of the country, as it would make the Pakistani products uncompetitive in the international market.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.