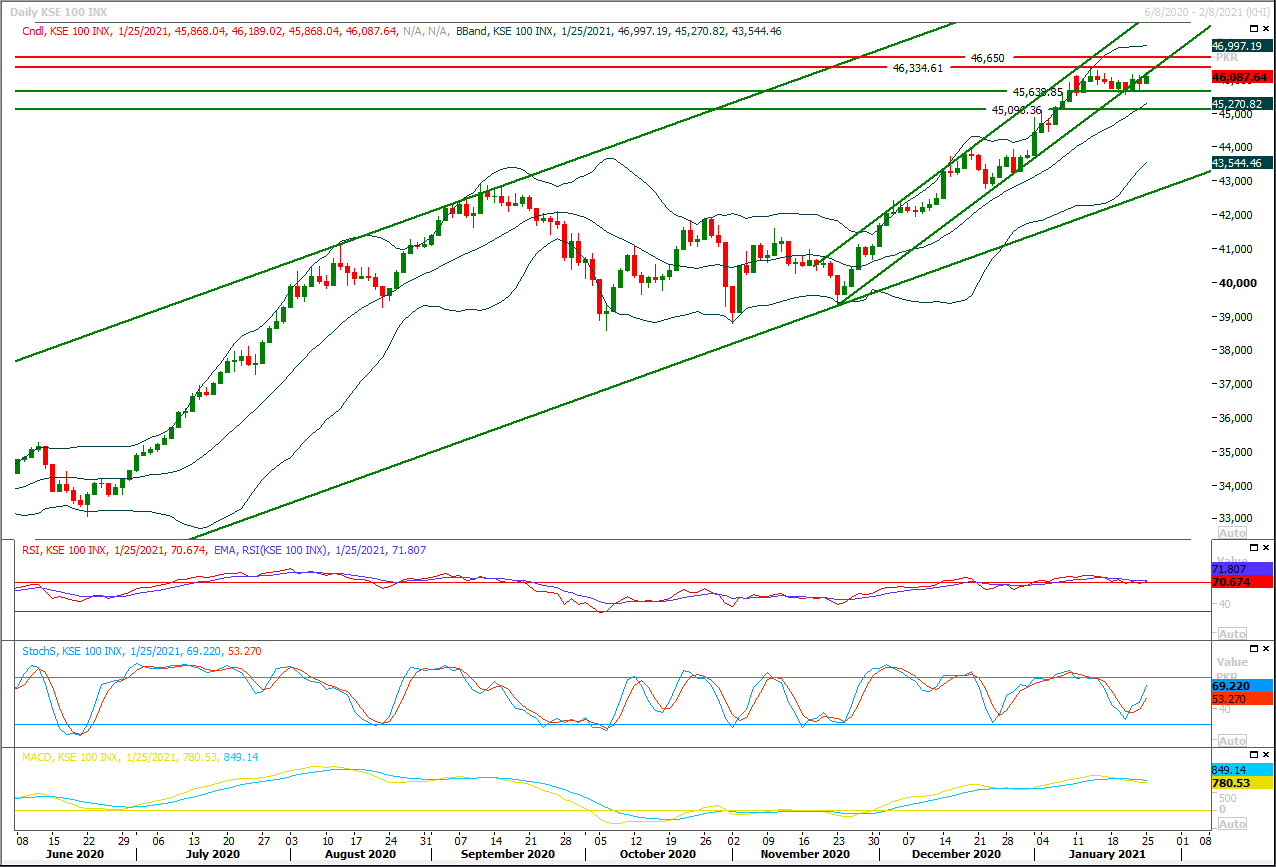

Technical Overview

The Benchmark KSE100 index is trying to penetrate below supportive trend line of its ascending price channel on daily chart since last three days, meanwhile its facing rejection from a strong horizontal resistant region. As of now it's expected that index would face initial resistance at 46,190pts and in case of penetration above this region index would call for 46,350pts and 46,545pts. It's expected that index would remain under pressure after retesting its resistant regions and overall a volatile session could be witnessed therefore it's recommended to stay on selling side, while selling between 46,100pts-46,350pts with strict stop loss of 46,600pts could be beneficial for coming days. After two consecutive Doji formations on weekly chart index have entered uncertain region and it would remain under pressure until it would not succeed in closing above 46,600pts. In case of rejection from its resistant regions index could slide downward till 45,500pts initially where it would try to establish ground above a strong horizontal supportive region but breakout below that region would call for fresh bearish rally for correction of its last bullish spike on weekly chart which may prolong towards 44,500pts or 42,500pts in coming days. Currently index have completed 5th primary wave of its bullish Elliot wave which started from 27,000pts after 74.6% expansion of its third wave. While on longer run index also have completed 74.6% correction of its previous bearish Elliot wave which started from 53,127pts and ended at 27,046pts. Overall scenario is trying to push index for a correction and it can be said that index needs a healthier correction before breakout of 46,500pts-47,000pts.

Regional Markets

Asian stocks weaken on stimulus worries, dollar holds firm

Asian stocks dipped on Tuesday, retreating from record highs as lingering concerns about potential roadblocks to the Biden administration’s $1.9 trillion stimulus weighed on sentiment, dragging U.S. Treasury yields to three-weeks lows. The lower risk appetite lent some support to the dollar against a basket of currencies, while oil prices edged down. In a sea of red seen across Asian markets, South Korea and Hong Kong topped losers and fell 1.7% each, Japan slipped 0.6% and Chinese stocks shed 1.5%. All have touched milestone highs this month. MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.7% to 722.7 but was not far off from a record high struck on Monday and is still up 9% so far this year. Australian stock markets were closed for a national public holiday. E-mini futures for the S&P 500 slipped 0.26%.

Read More...

Business News

Sale, production of cars up in 1st half

The sale and production of cars in the country has witnessed an increase of 13.42 and 1.93 percent respectively during the first half of financial year 2020-21 as compared to corresponding period of last year. During the period under review, as many as 67,026 cars were sold against the sale of 59,094 units while the production of cars increased from 60,862 units to 62,041 units, showing growth of 13.42 and 1.93 percent respectively, according to Pakistan Automobile Manufacturing Association (PAMA). Among cars, the sale of Honda cars showed increase of 72.90 percent from 6,916 units in last year to 11,958 units during current year under review while Suzuki Swift sale dipped by 12.14 percent from 1,136 units to 998 units during FY 2020-21.

Read More...

Ogra invites fresh applications for new RLNG-based CNG stations

Oil and Gas Regulatory Authority (OGRA) has sought fresh applications from the interested parties for the establishment of new re-gasified liquefied natural gas (RLNG)-based CNG stations. “All applicants who have not been granted any licence so far are advised to submit fresh requests for the licence to operate on RLNG along with requisite/updated documents if required,” the authority said in an advertisement published in national dailies titled “To Whom It May Concern.” OGRA, in the public add, informed that the Economic Coordination Committee of the Cabinet had approved to grant new CNG licenses on RLNG ‘only’ and clarified “the licence cannot claim for its conversion to indigenous gas.”

Read More...

Only 4.62pc of allocated funds utilised on 300 new projects

The Senate Standing Committee on Planning, Development and Special Initiatives was Monday informed that only 4.62 percent of the allocated funds, in the PSDP 2020-21, were utilised on 300 new projects during first two quarters of the current fiscal. The Senate Standing Committee on Planning, Development and Special Initiatives, which met with Agha Shahzeb Durrani in the chair, reviewed in detail the allocated, released and utilised funds during the first two quarters of the ongoing fiscal 2020-21. It was informed that the total number of the projects in the PSDP 2020-21 is 998. The total cost of the 998 projects is Rs 8293 billion which include 650 billion PSDP allocations and Rs 5756 throw forward. Of the total 998 projects 300 are new projects while the remaining 698 were running projects.

Read More...

CDWP approves 2 projects worth Rs3.25 billion

Central Development Working Party (CDWP) meeting on Monday approved 02 projects worth Rs 3.25 billion. Central Development Working Party (CDWP), which met with Deputy Chairman Planning Commission Mohammad Jehanzeb Khan in the chair, has approved 02 projects related to devolution & area development and water resource worth Rs 3.25 billion. The forum also agreed on one concept clearance proposal worth Rs. 808 million under the JICA for further proceeding. Secretary Planning Mathar Niaz Rana, senior officials from Planning Commission and Federal Ministries/Divisions also participated in the meeting while representatives from provincial governments participated through video conference. Projects related to devolution & area development and water resources were presented in the meeting.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.