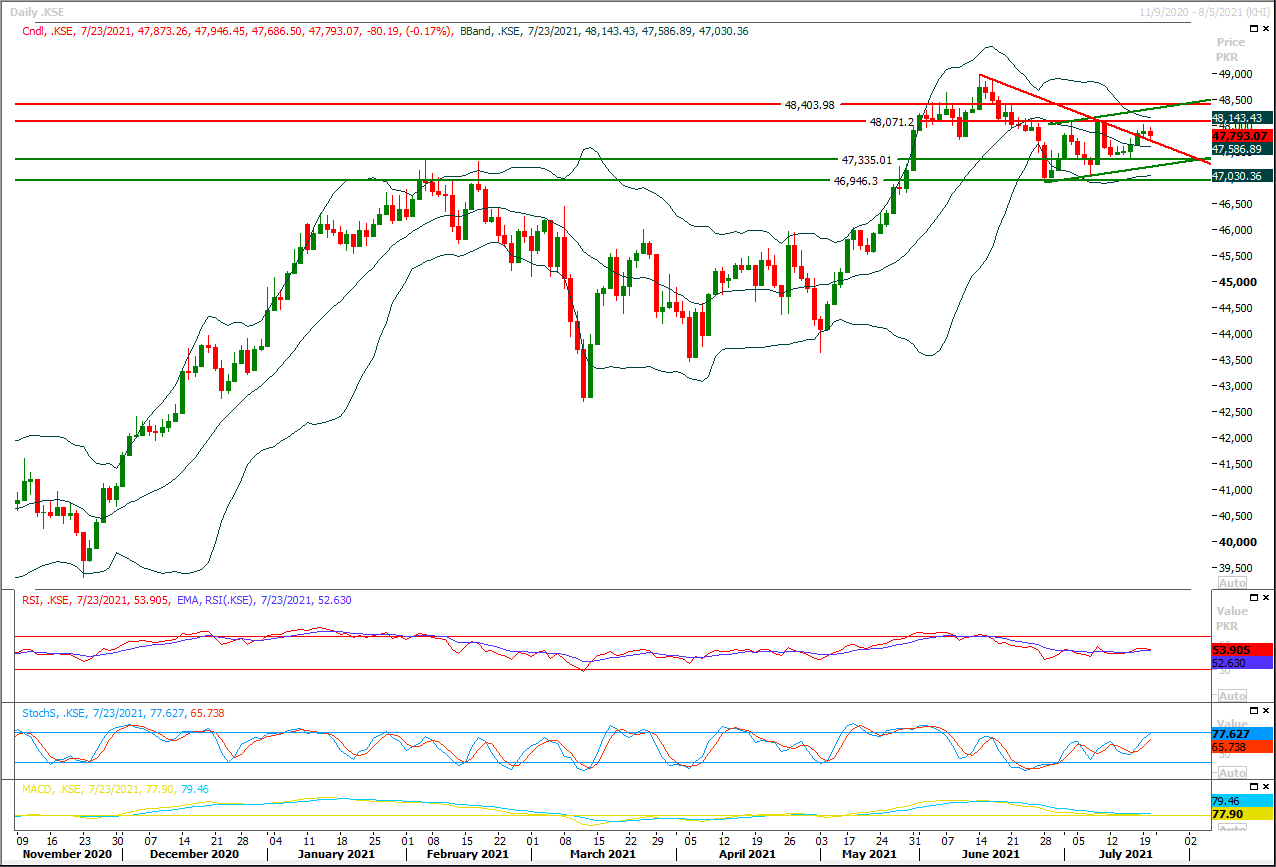

The Benchmark KSE100 index had succeeded in penetration above its resistant trend line on daily chart and now its retesting that line by taking a dip, as of now it's expected that index would try to 47,550pts initially but breakout below that region would push index towards a further dip. Meanwhile it's expected that index would try to take a spike on intraday basis and initially it would try to target 47,950pts and 48,065pts but it would remain range bound until it would not succeed in closing above 48,300pts. Hourly and daily momentum indicators are in bullish mode and it's expected that index would try to establish ground above its supportive regions therefore it's recommended to stay on long side with strict stop loss of 47,500pts. If index would succeed in maintaining above supportive trend line of its triangle on daily chart then it may try to extend its previous high in coming days but it's recommended to post trailing stop loss on existing long positions, because if index would not succeed in closing above 48,300pts on daily chart then it may face some serious selling pressure.

Regional Markets

Asia stocks sidelined as funds flock to Wall St

Asian shares struggled to rally on Monday as super-strong U.S. corporate earnings sucked funds out of emerging markets and into Wall Street, where records were falling almost daily. More than one third of S&P 500 is set to report quarterly results this week, headlined by Facebook Inc, Tesla Inc, Apple Inc, Alphabet Inc, Microsoft Corp and Amazon.com. With just over a fifth of the S&P 500 having reported, 88% of firms have beaten the consensus of analysts' expectations. That is a major reason global money managers have poured more than $900 billion into U.S. funds in the first half of 2021. Oliver Jones, a senior markets economist at Capital Economics, noted U.S. earnings were projected to be roughly 50% higher in 2023 than they were in the year immediately prior to the pandemic, significantly more than was anticipated in most other major economies.

Read More...

Business News

Petroleum Div fails to sign PCAs for three blocks

The Petroleum Division has failed to sign Petroleum Concession Agreements (PCAs) for three blocks despite passage of six months as the country’s gas production has declined by 700mmcfd while the oil production decreased by almost 26000 bopd. It is a matter of great concern that despite a lapse of more than 180 days, Petroleum Concession Agreement (PCA) for Nowshera block has not so far not been executed with Oil and Gas Development Company Limited (OGDCL) and precious time of six months has been wasted away, official source told The Nation. Khyber Pakhtunkhwa government has raised the issue of not signing of Petroleum Concession Agreement (PCA) for Nowshera block with Petroleum Division and has written a letter in this regard, the source said.

Read More...

Chinese company to set up smartphone assembly unit in Pakistan

Xiaomi, the second biggest smartphone company in the world, is planning to set up its assembly unit in Pakistan in the next 3-4 months, creating employment opportunities as well as making smartphones more accessible to people across the country. According to global analytics firm Canalys, Xiaomi became the world’s second largest smartphone vendor behind Samsung, surpassing Apple in Q2 2021, China Economic Net (CEN) reported. Its shipments jumped 83per cent year-on-year to hit a 17per cent global market share during the quarter, per data from Canalys. If this level of growth continues to evolve at its current pace, the China-based tech giant may soon trump Samsung like it did one over Apple, and can become the world’s biggest smartphone vendor before the end of this year.

Read More...

‘Political consensus’ urged for average gas pricing

Amid system challenges, the Petroleum Division is seeking an average national basket price for natural gas — both local and imported — through a distant ‘political consensus’ even though it has fixed price commitments with various consumer groups. This comes at a time when the energy sector is facing serious gas and electricity shortages and both gas and power companies are struggling with their financials to ensure smooth supplies. The federal government has been asking the provinces for introduction of weighted average cost of gas (WACOG) by moving away from ring-fenced pricing and supply of local gas and imported liquefied natural gas (LNG) to various consumer categories.

Read More...

Pakistan earns $1908m from IT services’ export in 11 months

Pakistan earned $1908.125 million by providing different information technology (IT) services in various countries during the first eleven months of fiscal year 2020-21. This shows growth of 47.13 per cent when compared to $1296.930 million earned through provision of services during the corresponding period of fiscal year 2019-20, Pakistan Bureau of Statistics (PBS) reported. During the period under review, the computer services grew by 49.91 per cent as it surged from $996.880 million last fiscal year to $1494.405 million during July-May (2020-21). Among the computer services, the exports of software consultancy services witnessed increase of 32.18 per cent, from $377.134 million to $498.500 million while the export and import of computer software related services also rose by 29.24 per cent, from $286.088 million to $369.648 million. The exports of hardware consultancy services decreased by 72.49 per cent from, $1.919 million to $0.528 million whereas the exports of repair and maintenance services also decline by 65.52 per cent from $1.456 million to $0.502 million

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.