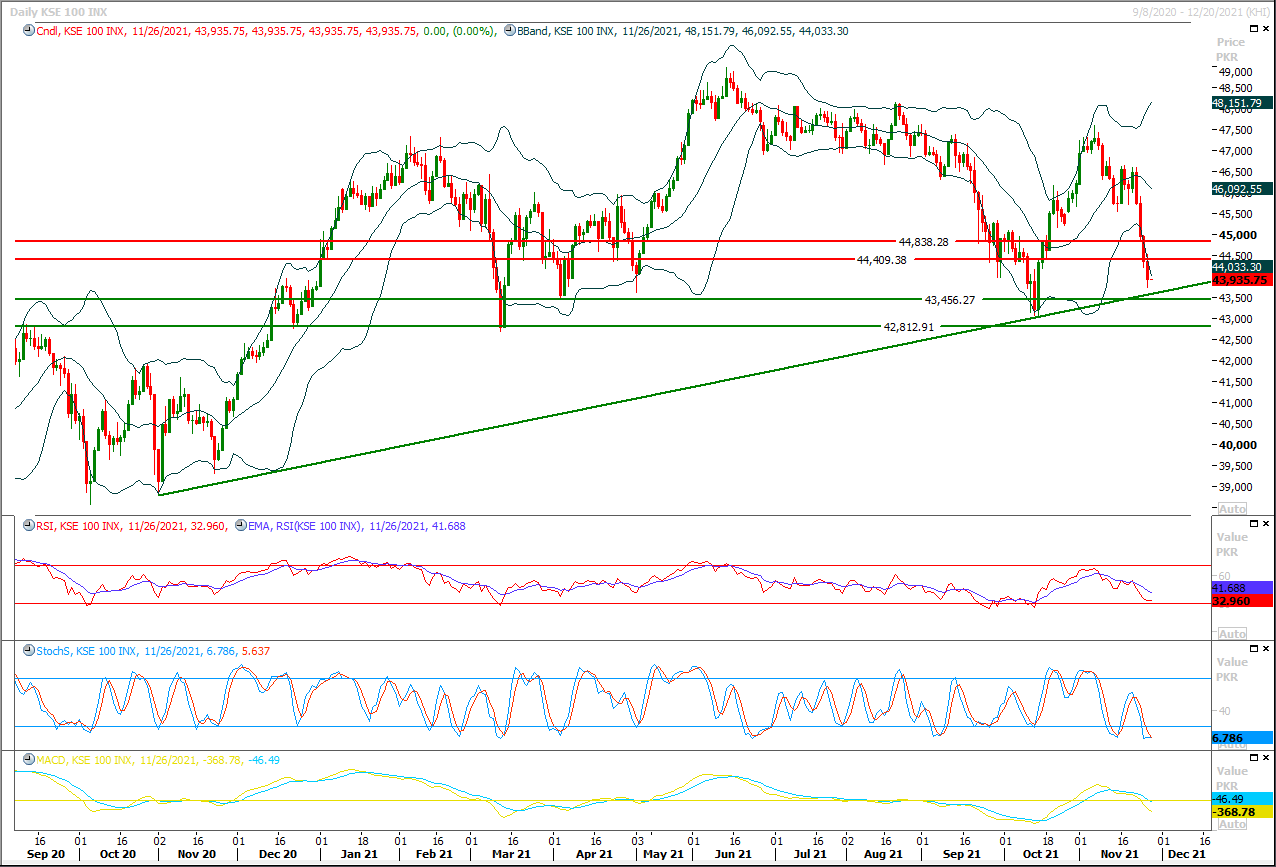

The Benchmark KSE100 index had continue its bearish journey during last trading session and tried to establish ground above 43,800pts before day end. As of now it's being supported by a rising trend line at 43,600pts therefore it's recommended to stay cautious because it seems that index would try to bounce back after a dip today but this pull back could be temporary because weekly momentum indicators have changed their direction towards bearish side which is a negative sign and it may push index in negative zone for short term trading. Meanwhile today's closing below 44,200pts would push index below its major supportive region after two months therefore it's expected that index would try to reverse slightly to attract investors for fresh buying but this could convert into a cheat pattern in coming days. It's recommended to adopt swing trading as long as index is trading between 43,800pts to 45,500pts because breakout of either side would push index for a further 1,000-1,500pts in respective direction.

Stocks fell and headed for their largest weekly drop in nearly two months on Friday, while safe haven assets such as bonds and the yen rallied as a new virus variant added to swirling concerns about future growth and higher U.S. interest rates.The variant, detected by scientists in South Africa, may be able to evade immune responses and has prompted Britain to hurriedly introduce travel restrictions on South Africa.South Africa's rand fell 1% in early trade, as did U.S. crude futures . S&P 500 futures fell 0.4%, while the risk-sensitive Australian and New Zealand dollars dropped to three-month lows."The trigger was news of this COVID variant...and the uncertainty as to what this means," said Ray Attrill, head of FX strategy at National Australia Bank in Sydney.

Read More...A Senate panel on Thursday noted that the inquiry report regarding the damage and repair of Guddu Power Station was incomplete and directed the government to stop the release of $32 million for the repair of Genco-II (747 MW Guddu Thermal Station) till the new inquiry committee presents its fresh report to the Committee.The Senate Power Committee unanimously decided and recommended that a new inquiry Committee may be constituted on mutual consultation, without conflict of interest and include high level expert outside from GENCO (national or international) to probe the damage and repair of Guddu.The Power Committee met to determine the responsible for the repair work of GT -14 (747 MW-Block-V).

Read More...

Federal govt rules out wheat shortage

The federal government on Thursday said that country had sufficient stock of wheat, which could meet the demand by June next year.Federal Minister for National Food Security Syed Fakhar Imam said that there is no shortage of wheat, as the country has sufficient stock that could meet the demand till first week of June 2022. Sharing the details of wheat stock, he said that it would reach to 6.6 million tonnes after arrival of 1.3 million tonnes of imported wheat. The government had already stock of 5.3 million tons of wheat. “We are releasing 40,000 tons of the commodity on daily basis and if this release continues.

Read More...

High inflation poses risks for emerging markets: Fitch

High inflation presents particular risks for emerging markets as they often face higher and more volatile inflation than developed markets, Fitch Ratings said Thursday.The global rating agency said it expects price pressures around the world will ease starting from early 2022, "but inflation could remain elevated in many markets if services prices pick up."Higher inflation reflects the risk of economic overheating, in addition to growing macroeconomic imbalances in labor or asset markets, the agency said in a statement."It may also raise concerns about macro policy credibility, especially in emerging markets," it added.

Read More...

SBP reserves hit FY22’s lowest level

The foreign exchange reserves of the State Bank of Pakistan (SBP), which have been declining fast since August, took the biggest drop of $691 million to $16.254 billion during the week ended on Nov 19.The central bank on Thursday reported what was the current fiscal year’s lowest level mainly due to external debt repayments.The country’s external account has been under dual pressure of debt repayments and rising current account deficit.However, analysts said the situation could improve in the coming weeks or months as the negotiations for release of $1bn tranche with the IMF had been.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.