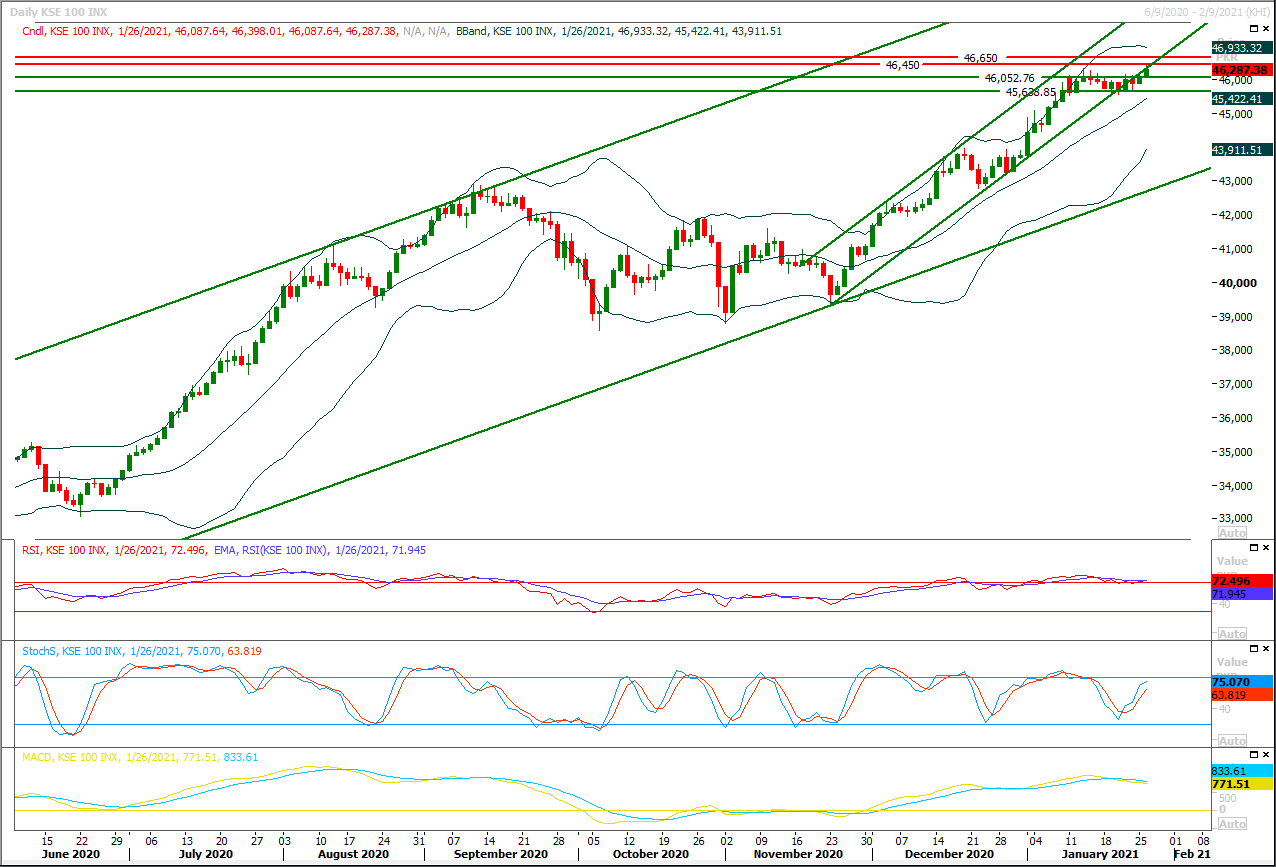

Technical Overview

The Benchmark KSE100 index is trying to penetrate below supportive trend line of its ascending price channel on daily chart since last three days, meanwhile its facing rejection from a strong horizontal resistant region. As of now it's expected that index would face initial resistance at 46,350pts and in case of penetration above this region index would call for 46,450pts and 46,545pts. It's expected that index would remain under pressure after retesting its resistant regions and overall a volatile session could be witnessed therefore it's recommended to stay on selling side, while selling between 46,300pts-46,450pts with strict stop loss of 46,650pts could be beneficial for coming days. After two consecutive Doji formations on weekly chart index have entered uncertain region and it would remain under pressure until it would not succeed in closing above 46,600pts. In case of rejection from its resistant regions index could slide downward till 45,500pts initially where it would try to establish ground above a strong horizontal supportive region but breakout below that region would call for fresh bearish rally for correction of its last bullish spike on weekly chart which may prolong towards 44,500pts or 42,500pts in coming days. Currently index have completed 5th primary wave of its bullish Elliot wave which started from 27,000pts after 74.6% expansion of its third wave. While on longer run index also have completed 74.6% correction of its previous bearish Elliot wave which started from 53,127pts and ended at 27,046pts. Overall scenario is trying to push index for a correction and it can be said that index needs a healthier correction before breakout of 46,500pts-47,000pts.

Regional Markets

Asian shares set for mixed opening, eyes on Fed, stimulus

Asian equities looked set to rise on Wednesday, bouncing back from a steep sell-off on Tuesday, while Australian stocks were seen opening weaker in a catchup after a Tuesday holiday. Australian S&P/ASX 200 futures lost 0.25% in early trading. Japan’s Nikkei 225 futures added 0.07%, while the Nikkei 225 index closed the overnight session %.Hong Kong’s Hang Seng index futures rose 0.68%. E-mini futures for the S&P 500 rose 0.21%. The Australian dollar rose 0.05% versus the greenback at $0.775. The U.S. dollar edged lower across the board as traders showed a preference for riskier currencies. The dollar index fell 0.194%, with the euro up 0.02% to $1.2162. The Japanese yen weakened 0.01% versus the greenback at 103.61 per dollar, while Sterling was last trading at $1.3735, up 0.01% on the day.

Read More...

Business News

Pakistan gets up to 38pc lower LNG rates through revised bids

Amid falling international market, Pakistan on Wednesday received significantly cheaper bids for three cargoes of liquefied natural gas (LNG) to be delivered in March under an urgent tendering process. The state-run Pakistan LNG Limited (PLL) had last week cancelled bids for LNG deliveries in March for three windows as prices in the international spot market started to crash. For replacement, the PLL went for a revised urgent tender on January 22 with deadline of January 26. The revised bids attracted 26 to 38 per cent cheaper rates when compared with the cancelled bids.

Read More...

Palm oil valuing $1.111b, soyabean $48.309m imported in 6 months

Imports of edible oil including soyabean and palm into the country during first half of current financial year grew by 18.36 percent and 31.98 percent respectively as compared to the imports of corresponding period of last year. During the period from July-December, 2020-21, over 1,269,769 metric tonnes of palm oil costing $1.111 billion was imported in order to fulfill the domestic consumption of edible oil and vegetable ghee as against the import of 1,516,180 metric tonnes valuing $882.420 million of same period last year. Meanwhile, 72,756 metric tonnes of soyabean oil costing $48.309 million was also imported for tackling with the local requirements, which stood at 59,278 metric tonnes valuing $40.815 million in same period of last year, according to the data of Pakistan Bureau of Statistics.

Read More...

ECC to discuss 300mw Gwadar coal power project today

The Economic Coordination Committee (ECC) of the Cabinet will discuss the approval of the summary for the implementation agreement, supplemental agreement and power purchase agreement (PPA) for 300MW Gwadar coal power project today (Wednesday). The 300MW Gwadar Coal Power Project is on the agenda of upcoming CPEC Joint Coordination Committee (JCC) and therefore the approval of the implementation agreement and power purchase agreement (PPA) by the ECC and Cabinet prior to the meeting is required, official source told The Nation. After the approval of the ECC, the summary will be moved to the cabinet for final approval. The 300 MW coal power project is most likely to get the approval during next JCC, the source said. The total cost of the project is $542 million and it will be completed by June 2023. Meanwhile, a press statement issued here stated that a meeting of the Cabinet Committee on CPEC (CCoCPEC) was held under the chairmanship of Federal Minister for Planning, Development and Special Initiatives Asad Umar here.

Read More...

Budget deficit rises to Rs822b in 5 months

Pakistan’s budget deficit was recorded at Rs822 billion (1.8 percent of the GDP) during first five months (July to November) of the current fiscal year (2020-21). The country’s budget deficit stood at Rs822 billion during July to November period of FY2020-21 as compared to Rs676 billion in corresponding period of the last year, said ministry of finance said in its Monthly Economic Update & Outlook (MEUO). The primary balance remained in surplus of Rs216 billion (0.5 percent of GDP) during July-November (0.3 percent of GDP, Rs117 billion last year).

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.