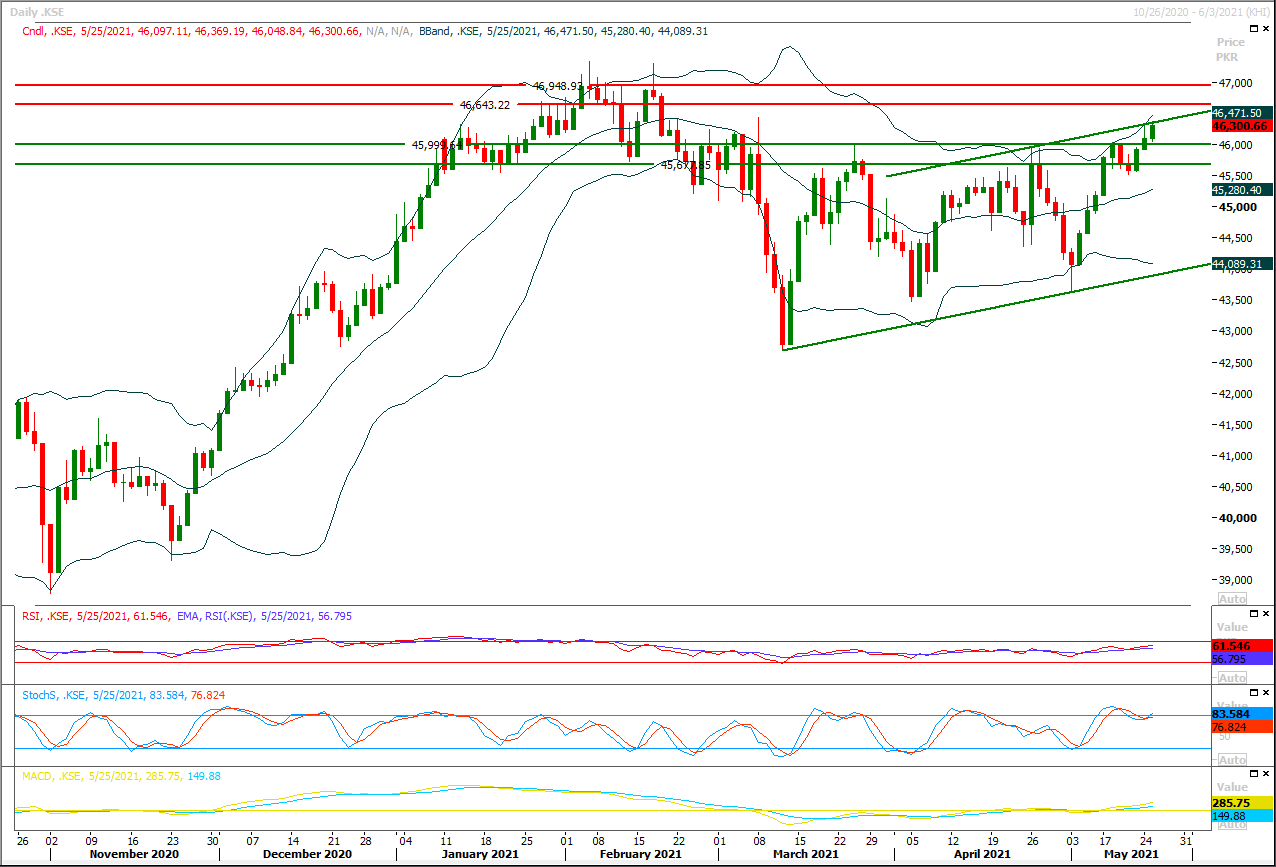

Technical Overview

The Benchmark KSE100 index had continued its bullish journey during last trading session and succeeded in closing above its major resistant region of 46,500pts. As of now it's expected that index would try to target 47,000pts and 47,200pts regions where it would face resistance from a strong horizontal resistant region along with resistant trend line of its bullish price channel therefore its recommended to stay cautious and post trailing stop loss on existing long positions because if index would not succeed in closing above 47,200pts then a corrective rally could be witnessed on intraday basis. On flip side index would try to establish ground initially above 46,350pts but breakout below this region would push index further downward till 45,760pts and 45,500pts in coming days. Daily and hourly momentum indicators are in bullish mode but index needs to take an intraday dip to continue its bullish rally smoothly therefore buying on dip could be beneficial for day trading. Overall sentiment would remain bullish as index have given bullish breakout of its weekly triangle and any dip would be considered a retesting of resistant trend line of that triangle.

Regional Markets

Asian shares step back from 2-wk highs, dollar firm

Asian shares retreated from two-week highs on Thursday and China started on the backfoot on fears central banks were closer to considering winding back their emergency stimulus while the dollar held at a one-week top. MSCI's broadest index of Asia-Pacific shares outside Japan was down 0.5% at 691.76, still not too far from Wednesday's high of 696.76, a level last seen on May 10. Chinese shares started weaker with the blue-chip index off 0.2%. Australian shares were flat while New Zealand's benchmark index stumbled 0.9%, extending losses for a second day in a row after the country's central bank on Wednesday signalled rate rises from next year. Japan's Nikkei was down 0.8%. E-Mini futures for the S&P 500 were down 0.2%. Global equities markets have been supported by a concerted effort from major central banks who have pumped trillions of dollars in financial markets since last year while reiterating their lower-for-longer interest rate stance as they seek to cast any inflation rise as temporary.

Read More...

Business News

ECC okays Rs48bn for Ehsaas cash handouts

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday approved the launch of second phase of the Ehsaas Emergency Cash Programme (EECP) worth Rs48 billion, under which Rs12,000 would be provided to each of the four million additional beneficiaries. The meeting of the ECC virtually presided over by Minister for Finance and Revenue Shaukat Tarin also approved issuance of a series of notifications for the implementation of the Pakistan Single Window for imports and exports and constituted a committee to suggest how to ensure payment of net hydel profit to provinces, including an upfront payment of Rs87bn, without burdening the federal budget. The EECP’s second phase envisages increasing the number of regular Ehsaas Kafalat beneficiaries to 8m by June through the ongoing National Socio-Economic Registry Survey (NSER). All these beneficiaries will be provided a six-monthly tranche (January-June, 2021) of Rs12,000 per beneficiary under Ehsaas Kafalat. These 4m additional beneficiaries will be identified through the ongoing NSER by using higher eligibility threshold while remaining below the poverty line. These beneficiaries will also be provided one-time emergency cash assistance of Rs12,000 per head to compensate for unemployment caused by Covid-19. The disbursement process will be initiated within this financial year.

Read More...

Urea sales jump 35pc in 4MCY21

The country’s urea offtake grew by 35 per cent to 1.707 million tonnes during the first four months of calendar 2021 from 1.266m tonnes in the same period last year. However, the DAP sales remained pegged at 360,000 tonnes versus 361,000 tonnes in 4MCY21. As per latest data of fertiliser offtake issued by National Fertiliser Development Company (NFDC), urea sales in April rose by 28pc to 309,000 tonnes from 242,000 tonnes in April 2020 mainly on account of improving farm economics, low-base effect and increase in urea production due to resumption of production by LNG-based plants. Farmers and dealers delayed urea purchases in April 2020 due to expectations of fertiliser subsidy announcement which later included Rs243 per bag relief in urea. On the other hand, urea volumes contracted by 10pc sequentially owing to seasonal factors. This has taken the cumulative urea sales to 1.71m tonnes in 4MFY21, up by 35pc year-on-year, Research Analyst at BMA Capital, Noor Huda Shaikh said.

Read More...

SBP to announce Monitory Policy on Friday

Monetary Policy Committee of State Bank of Pakistan will meet on Friday, May 28 in Karachi to decide about Monetary Policy for next two months. It would be the first MPC meeting after announcement of a half-yearly schedule of Monetary Policy Committee (MPC) meetings on a rolling basis aimed at making the process of monetary policy formulation more predictable and transparent. The MPC would review key trends and prospects in the real, external and fiscal sectors, and the resulting outlook for monetary conditions and inflation. The Monetary Policy Committee, in its March 19 meeting, decided to maintain the policy rate at 7 per cent noting continued recovery of growth and employment coupled with improvement in business sentiment. On the basis of improved prospects for manufacturing and monetary and fiscal stimulus provided during Covid, the MPC had updated growth projections for FY21 at around 3 per cent while average inflation in FY21 was estimated to fall to the 5-7 per cent target range over the medium-term.

Read More...

HBL makes landmark investment in Pakistan’s leading fintech Finja

HBL becomes the first bank in Pakistan to invest in a digital fintech startup with its Rs 176 Million participation in the last tranche of Finja’s Rs. 1.56 billion (USD10.15 million) Series A1 round. HBL joins an impressive list of leading global fintech funds that have invested in Finja including BeeNext, Vostok Emerging Finance, Quona Capital, and ICU Ventures. All investors from previous rounds topped up their investment in Finja’s Series A1 round. For HBL, an investment in Finja serves two of the bank’s strategic priorities, namely, making investments into Digital Financial Inclusion and Development Finance companies, especially ones making an impact in agriculture and SMEs as these are the backbone of the economy, and proactively reinventing HBL to become a “technology company with a banking license”. Since the beginning of the Covid-19 pandemic in April last year, Finja has scaled its digital lending portfolio by 550 per cent disbursing over 50,000 digital loans to Micro, Small and Medium Enterprises (MSMEs). Despite being the backbone of the economy, small businesses in Pakistan have traditionally not been able to obtain credit to grow.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.