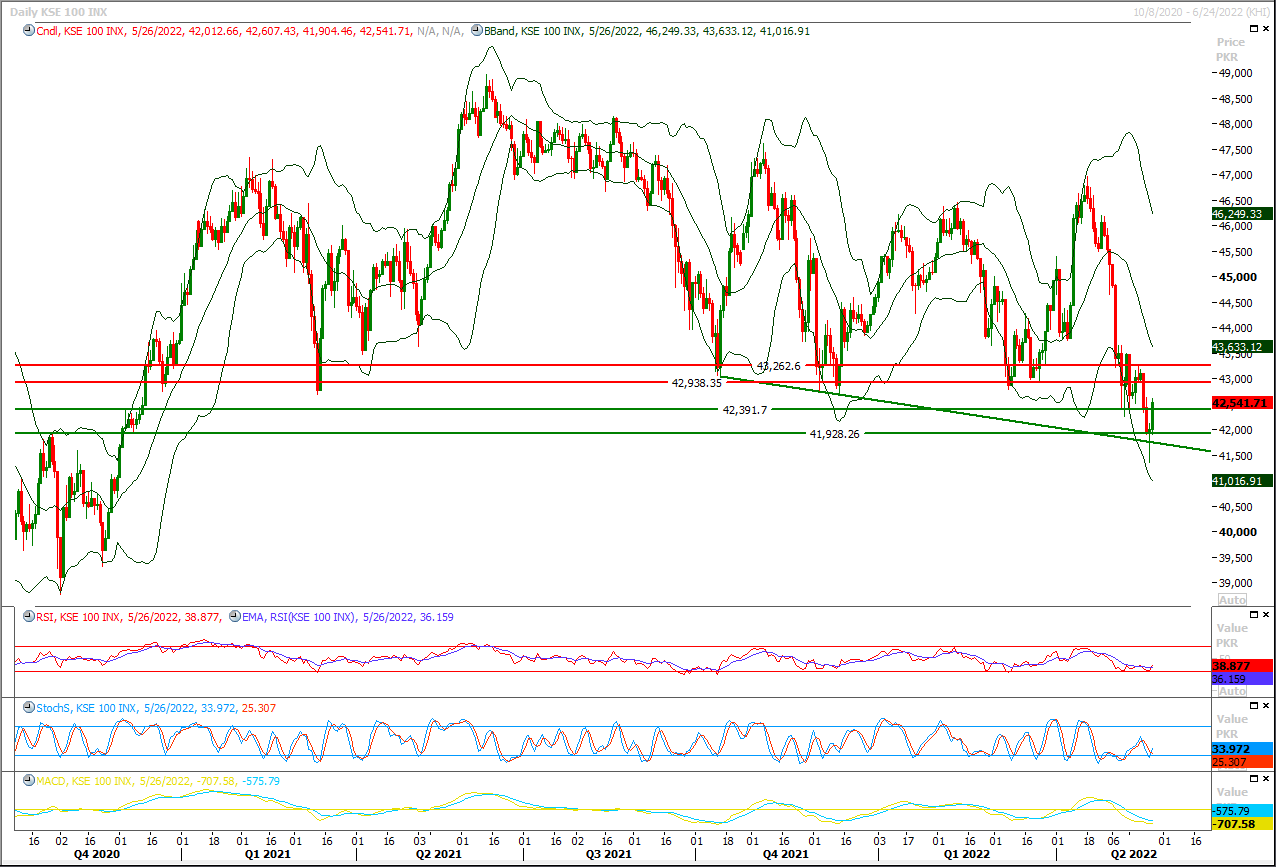

The Benchmark KSE100 index have created a morning shooting star on daily chart after getting support from a descending trend line during last trading session and this is third morning star in current bearish rally while previous two have been converted into false patter but now it's expected that market would provide confirmation of this morning star by closing in positive zone today therefore it's recommended to stay on long side and buying on dip could be beneficial. Currently index seems to target 42,760pts initially and after breakout of this region index would target 42,930pts, today's closing above either of these two levels would provide a push towards bullish side and index would start moving towards 43,500pts and 44,200pts where it's being capped by strong horizontal resistant regions. While on flip side in case of bearish pressure index would try to establish ground above 42,390pts which would be followed by 42,200pts and 41,930pts. Overall sentiment would remain bullish as long as index is trading above 41,930pts. Fresh buying on dip or averaging out existing long positions for a rally of 500-700pts initially could be beneficial from today.

Asian shares extended overnight global gains thanks to strong results from regional tech firms and U.S. retailers, while investors also took comfort from Federal Reserve minutes showing a pause to its rate hikes is on the cards later this year.The swing in sentiment left the dollar wallowing at one-month lows, with the euro rising to its highest since April 25.MSCI's broadest index of Asia-Pacific shares outside Japan rose 1.5% in early trading, the biggest gain in a week, buoyed by a 1.2% rebound in resources-heavy Australian shares, a 2.8% jump in Hong Kong stocks and a 0.7% rise for blue chips in mainland China.Japan's Nikkei advanced 1.0%.The Hang Seng tech index opened 4.5% higher, as first quarter revenues from tech giant Alibaba and Baidu beat forecasts.The United States will not block China from growing its economy, but wants it to adhere to international rules, Secretary of State Antony Blinken said on Thursday in remarks that didn't come as a surprise to investors and political analysts.

Read More...Normalcy resumed in the federal capital on Thursday after Chairman PTI Imran Khan abruptly called off his protest sit-in giving a six-day deadline to the government to announce the fresh elections with the warning that he would again announce the long march if the demand was not met.Soon after the former prime minister announced to end his anti-government protest march while addressing his supporters who had gathered at D-Chowk and the main Jinnah Avenue the capital, the PTI protestors peacefully dispersed and left for their homes.This happened after a full day of clashes of protestors with the police and other law enforcement agencies in Punjab and different parts of the country. The police baton-charged and fired teargas at the PTI workers and hundreds were arrested to stop their entry into the protest march.

Read More...

Only NA Will Decide About Election Date, Says PM

Prime Minister Shehbaz Sharif on Wednesday said the present government would complete its constitutional tenure and the decision to announce the next general polls will be taken by the parliament. “The government will not accept dictation or blackmailing of anyone to announce the date of next general elections,” said the PM while addressing the National Assembly after passing the amendments in the ‘NAB ordinance’ and ‘elections bills’. The PM made this statement apparently after PTI Chairman Imran Khan warned the government to fix date for new elections in the next six days or he will again march towards the capital.About PTI’s chief Imran Khan, he said that the doors for the talks were always open but no one can blackmail the incumbent government. “This government would continue its hard work to put the country on a right path in economic and other fronts,” he said, mentioning that there were a lot of difficulties and challenges for the present government..

Read More...

Asian Bank to fund projects worth $2bn in Pakistan

The Asian Development Bank (ADB) on Thursday said that projects worth $2 billion for Pakistan would be finalised after consultation with the private and public sectors.“The $2bn ADB-funded projects related to food security, health, irrigation and education would play a pivotal role in the economic development of Pakistan,” said ADB Deputy Country Director Asad Aleem while speaking to the office bearers and members of the Lahore Chamber of Commerce & Industry (LCCI). “In this regard, consultative sessions have been held with the actual stakeholders, including Sindh and Punjab governments.Mr Aleem said that since meetings have also been held with Karachi and Lahore chambers and the Pakistan Business Council to get feedback from the private sector, the bank’s prime objective is to know what should be done in the country.

Read More...

Fuel price hike can push up cost of production, complains industry

STrade and industry leaders have slammed the government for increasing the petrol and diesel rates by a whopping Rs30 per litre which will not only multiply the woes of already inflation-hit masses but will also push up the cost of production.They said the government bowed to the IMF pressure to withdraw the fuel and power subsidies for releasing a $1bn tranche to pull the country from an economic meltdown.Chairman Businessmen Group (BMG) Zubair Motiwalla anticipated a jump in production cost by 5-7pc due to the petroleum price hike which will have a multiplier impact on the retail prices of goods which would make the life of the masses more miserable due to the rising cost of living.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.