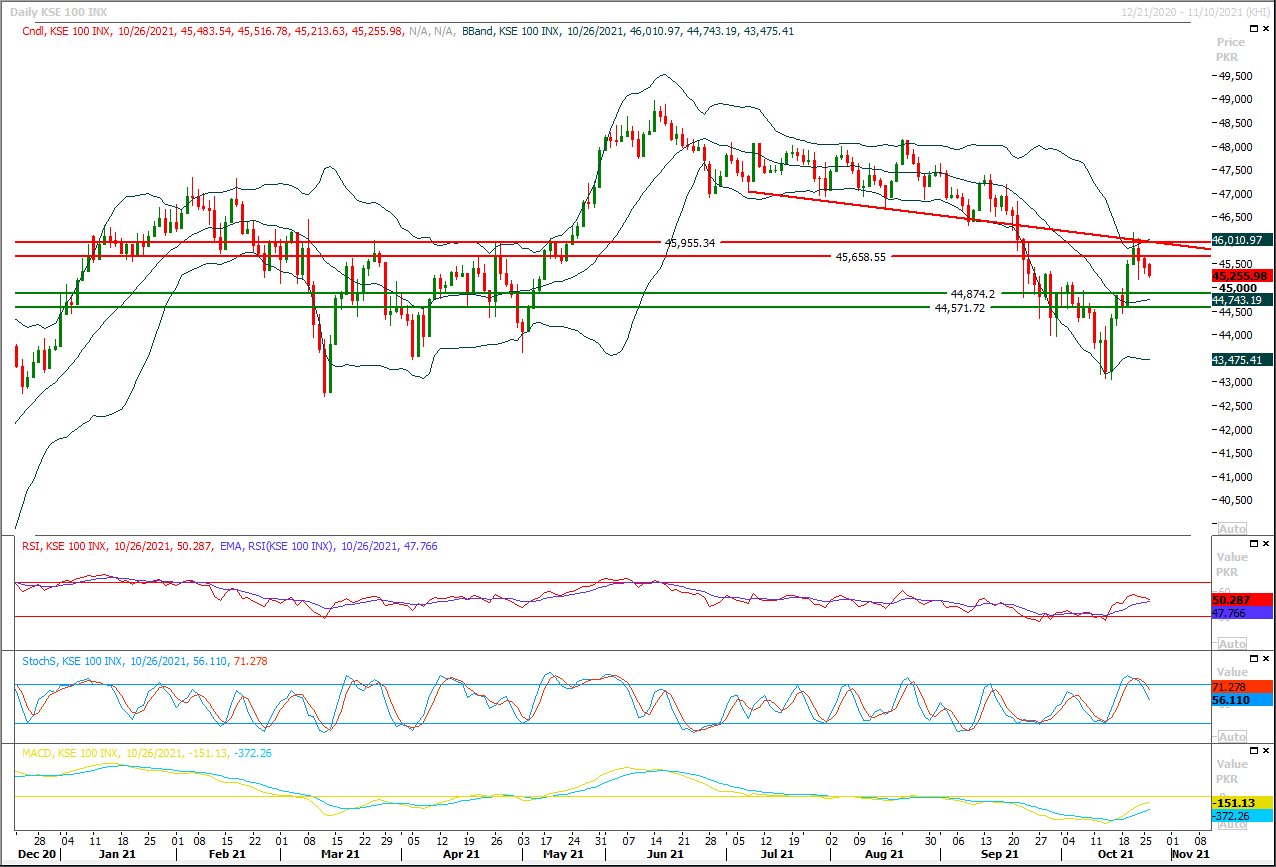

The Benchmark KSE100 index is facing pressure since last trading session and it can be said that index is trying to accumulate momentum to retest its resistant regions. Currently index is being capped by a strong resistant trend line along with a horizontal resistant region therefore it's recommended to say cautious and post trailing stop loss on existing long positions because index would face initial resistance at 45,760pts which would be followed by 45,970pts and 46,200pts. Overall sentiment would remain bearish as long as index is trading below 46,200pts but breakout above this region would call for 46,500pts and 46,960pts. While on flip side index would try to establish ground above 45,100pts in case of bearish pressure and this region would react as a strong support but breakout below this region would call for 44,950pts and 45,570pts. Daily momentum indicators have changed their direction towards bearish side but it's recommended to wait for confirmation before initiating new short positions.

Regional Markets

China Evergrande shares fall on persistent pressure from debt travails

Shares of cash-strapped China Evergrande Group and its electric vehicle unit fell early on Wednesday, as the country's state planner called on companies in "key sectors" to "optimise" offshore debt structures.Evergrande and China Evergrande New Energy Vehicle Group Ltd both fell less than 1% by 0155 GMT. The Hang Seng Index slumped 1.7%.China Evergrande Group is reeling under more than $300 billion in liabilities, fuelling worries about the impact of its fate on global markets.

Read More...

Business News

Stocks fall further amid lack of triggers

Range-bound activity on the Pakistan Stock Exchange (PSX) resulted in another lacklustre session on Tuesday.The benchmark index closed at 45,256 points, down 163 points or 0.36 per cent from a day ago, after reaching an intraday high of 45,517 points (up 0.21pc).According to Topline Securities, investors’ sentiments remained subdued in the absence of any positive trigger as no progress took place on the front of the International Monetary Fund loan programme. In addition, the notification about the premier intelligence agency’s next chief also arrived after trading hours. Also, there was no update on the Saudi oil deferral payment facility.

Read More...

Profits outflow down by 17pc in 1QFY22

The outflow of profits and dividends from the country declined by over 17 per cent during the first quarter of FY22, reflecting low investment made by foreign companies.Data released by the State Bank of Pakistan on Tuesday showed that foreign investment could not yield the profits as much as the previous year. The total outflow of profits and dividends during July-Sept FY22 was $477.7 million compared to $576.8m in the same quarter of last year, showing a decline of 17.2pc, or $99.1m.Pakistan has been receiving the lowest foreign direct investment (FDI) in the region (excluding Afghanistan) and most of the investment came from European countries, the United States and China.

Read More...

Karachiites to pay extra Rs1.35bn for power used in July

The National Electric Power Regulatory Authority (Nepra) on Tuesday notified 69 paisa per unit additional charge to consumers of K-Electric on account of monthly fuel price adjustment (FCA) for electricity consumed in July.In a notification released on Tuesday, the regulator said about 69 paisa per unit additional FCA would be charged to consumers in the coming billing month of November and generate Rs1.355bn in additional revenue to the KE. “The FCAs shall be applicable to all the consumer categories except lifeline consumers,” Nepra said.

Read More...

Saudi govt revives $3bn support to Pakistan

Saudi Arabia has agreed to revive its financial support to Pakistan, including about $3 billion in safe deposits and $1.2bn to $1.5bn worth of oil supplies on deferred payments.An agreement to this effect was reached during the visit of Prime Minister Imran Khan to the kingdom this week, a senior government official told Dawn. However, a formal announcement would be made by PM’s adviser on finance and revenue Shaukat Tarin and Energy Minister Hammad Azhar on Wednesday at a news conference.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.