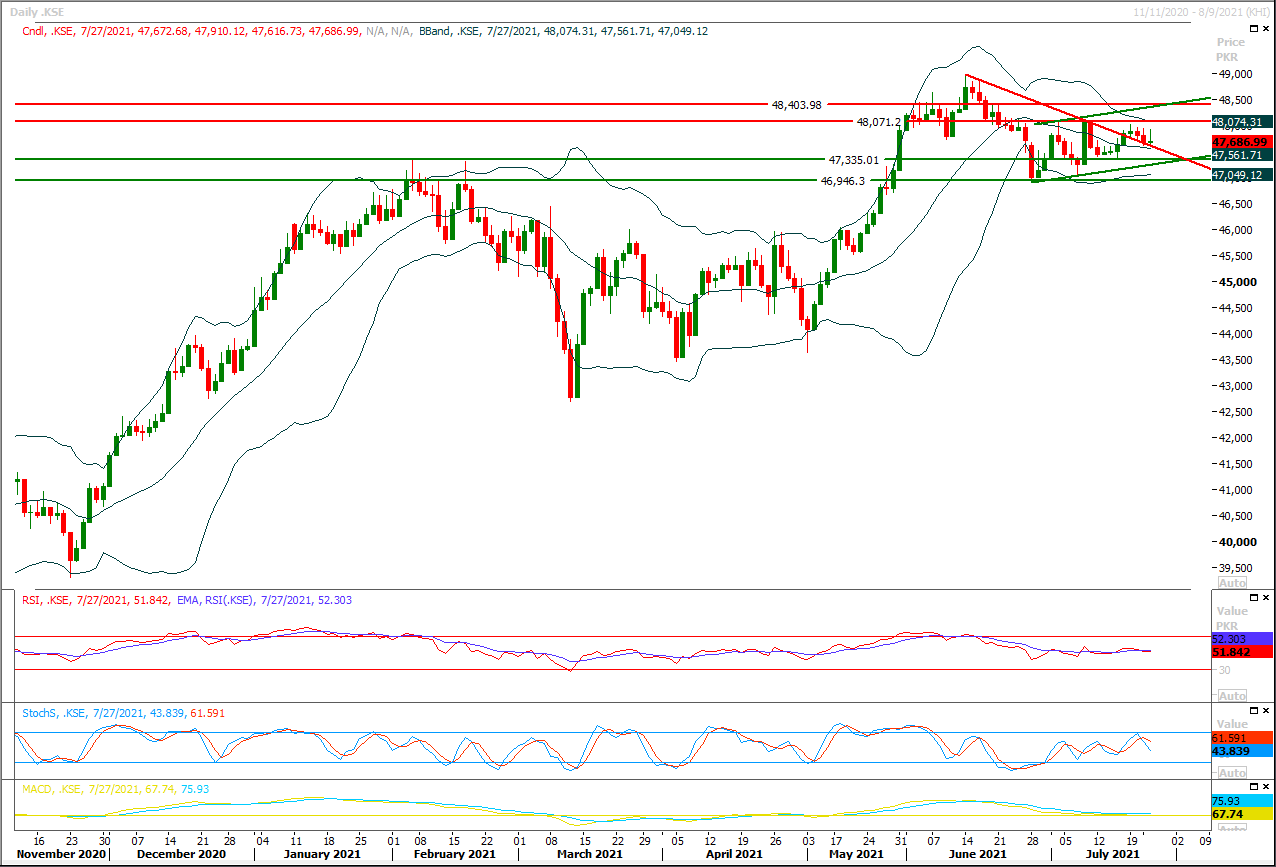

The Benchmark KSE100 index have given bearish breakout of its triangle on hourly chart during last two trading sessions after facing rejection from a strong horizontal resistant region. Overall a volatile session would be witness and index seems to swing between 47,450pts-47,900pts. As of now it's expected that index would take a dip initially which may prolong towards 47,500pts-47,400pts where it would try to establish ground above a horizontal supportive region on intraday basis. On flip side index would face initial resistance at 47,900pts which would be followed by resistant trend line of its triangle at 47,980pts and a strong horizontal resistant region at 48,130pts. Meanwhile hourly and daily momentum indicators have changed their direction towards bearish side but it's recommended to wait for a confirmation and closing below 47,500pts before initiating short positions. Last hope for bulls is standing between 47,450pts-47,350pts where an ascending trend line along with a daily double bottom would try to ignite fresh volumes from long side but breakout below this region would push index towards 47,175pts and 46,900pts. It's recommended to adopt swing trading during current trading session.

Regional Markets

Asia shares sit at 2021 lows ahead of Fed verdict

Asian shares stayed stuck at seven-month lows on Wednesday, as markets continued to digest a storm in Chinese equity markets, while the dollar rested with traders reluctant to place large bets ahead of the outcome of the Federal Reserve meeting.MSCI's broadest index of Asia-Pacific shares outside Japan dropped 0.35% in early trading, having fallen in each of the three previous sessions as regulatory crackdowns in China roiled stocks in the technology, property and education sectors, leaving international investors bruised.Japan's Nikkei slid 1.01%, Chinese bluechips dropped 1.51%, and Australian shares fell 0.43%. Hong Kong bucked the trend, rising 0.63%, after closing at its lowest level since November the day before.

Read More...

Business News

PSDP spending of Rs659b highest utilisation since 2011-12: Asad

Federal Minister for Planning, Development and Special Initiative, Asad Umar has said that total Public Sector Development Programme spending in 2020-21 was Rs 659 billion against the allocations of Rs 650 billion or 101.4per cent terming it the highest utilisation since 2011-12.“Total PSDP spending in 2020 -21 was Rs 659 billion vs a target of Rs 650 billion or 101.4per cent,” the Federal Minister for Planning Development and Special initiative Asad Umar tweeted.He further claimed that this is the highest development funds utilisation since 2011-12. “In a year of Covid restrictions, this exceptionally high development spending reflects resolve of PMIK to accelerate growth,” he added.

Read More...

President calls for proactive steps to promote country’s IT sector

President Dr Arif Alvi on Tuesday called for taking proactive measures to develop the Information Technology sector that can contribute enormously to the economic and scientific development of the country. He expressed these views at a briefing on the National University of Computer and Emerging Sciences here.The President said that globally, the focus of development policies is shifting from Brick-and-Mortar development projects to the intellectual development of human resources and Pakistan needs to adopt this modern strategy.He said academia-industry linkages are essential for the progress of the country. He also urged the need to increase the number of students with a special focus on the provision of hybrid and online education.

Read More...

‘Senate body orders Nepra to solve overbilling, power outages’ problems

The chairman Senate Standing committee on Cabinet Secretariat directed the Ogra officials to introduce a mechanism for the check and balance of disparity in oil pricing, the misconduct in the services provided by the petrol stations and on the use of impurities in the petroleum products.A meeting of the Senate Standing Committee on Cabinet Secretariat was held under the chairmanship of Senator Rana Maqbool Ahmad at the Parliament House yesterday.A detailed briefing on the working and performance of the Oil and Gas Regulatory Authority (Ogra), National Electric Power Regulatory Authority (Nepra) was received by the committee members.

Read More...

SBP expects current account deficit to be 2-3pc

The State Bank of Pakistan has kept the policy rate unchanged at 7 per cent in the hope that the current account deficit will remain in the range of 2 to 3pc of GDP in FY22.Announcing the Monetary Policy for the next two months here on Tuesday, SBP Governor Dr Reza Baqir said: “Given expected resilience in remittances and an improving outlook for exports, the current account deficit is expected to converge towards a sustainable range of 2-3pc of GDP in FY22.He said that as a result of positive developments, growth is projected to rise from 3.9pc in FY21 to 4-5pc during the current financial year, and the average inflation to moderate to 7-9pc this year from its recent higher out-turns.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.