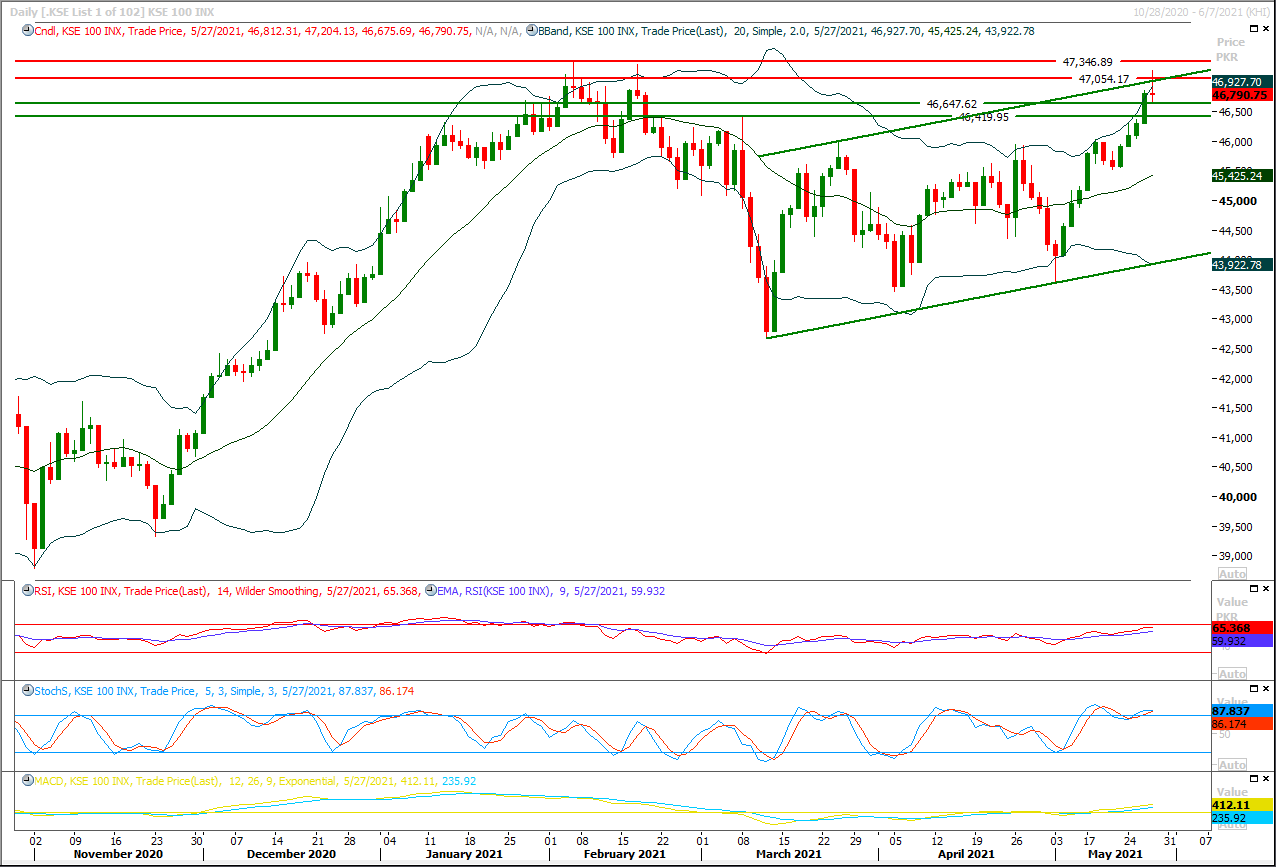

Technical Overview

The Benchmark KSE100 index had faced rejection from resistant trend line of its bullish price channel along with a strong horizontal resistant region during last trading session and could not succeed in penetration above its major resistant region of 47,200pts. As of now hourly momentum indicators have changed their direction towards bearish side and it's expected that index would continue its bearish sentiment initially during the day but later on it may start a pull back after getting support from horizontal supportive region. Overall a volatile session would be witnessed during current trading session because both daily and hourly momentum indicators are ready for a bearish rally therefore it's recommended to stay cautious and its recommended to wait for daily closing below 46,500pts before initiating new short positions because index have created a hammer on daily chart and if it would succeed in closing below 46,500pts then an evening shooting star would take place on daily chart. But a pull back above 46,500pts would push again for retesting of its resistant regions. For day trading its recommended to adopt swing trading. Index would face initial resistance at 47,050ps in case of bullish pull back but sentiment would remain uncertain until index would not succeed in closing above 47,200pts.

Regional Markets

Asian stocks extend global rally to 7th day, U.S. stimulus in focus

Asian stocks put global equities on course for a seventh day of gains on Friday as investors bet the U.S. will lead the world out of the COVID-19 pandemic, with the focus turning to a multi-trillion dollar spending boost by the Biden administration.Tokyo led the advance, with the Nikkei jumping 1.9% early in the session. MSCI's broadest index of Asia-Pacific shares outside Japan added 0.3%, hitting its highest level this month, though Chinese blue chips slipped 0.1% just after the open.The MSCI world equity index added 0.1% to 709.71, nearing the all-time closing high of 710.36 set on May 7.U.S. stocks were also poised for further gains after the S&P 500's 0.1% rise overnight, with futures pointing to a 0.3% increase at the open.

Read More...

Business News

Funeral Grant: OPF comes up with a new welfare service for destitute overseas Pakistanis

Overseas Pakistanis Foundation (OPF) has been assisting overseas Pakistanis working abroad and their families in Pakistan since its inception. A number of schemes have been introduced by the OPF which are directly beneficial to the overseas Pakistanis. The Main focus of OPF’sactivities has been in the field of education, housing, financial assistance and other personalised welfare services.OPF Managing Director Dr Amer Sheikh asserted that it has always been OPF’s endeavour to initiate new schemes and projects for the welfare and wellbeing of overseas Pakistanis and their families back home, especially the financially vulnerable segment amongst the overseas Pakistanis.

Read More...

Irsa anticipates over 17pc water shortage for early Kharif season

Indus River System Authority (Irsa) has anticipated that in view of the dwindling inflows the water shortage for the early Kharif can go beyond 17 per cent as Tarbela dam is likely reach to its dead level within next 24 to 48 hours.Tarbela current level is 1402.55 feet which is only two feet above the useable level of 1400 feet of the reservoir, Khalid Rana told The Nation. When asked if the dead level of Tarbela is 1392 feet, then how it could reach to the dead level in 24 or 48 hours, he replied that in the current situation, because of sediments, water can be extracted only to 1400 feet of the dam level. Early in an interaction with media persons, he said that on Wednesday the water flows in the country have further decreased and it has been felt that Tarbela dam may touch its dead level within next 24 to 48 hours. He said that the provinces have been apprised of the situation.

Read More...

Wapda floats first green Eurobond for $500m

In a significant development, the Water and Power Development Authority (Wapda) on Thursday launched its first green Eurobond, called Indus bond, for 10 years to raise $500 million at a competitive price of about 7.5 per cent interest rate.The launch of the bond attracted a number of international investors, who offered Wapda investments worth $3 billion — six times more than its need — through the Indus bond that would formally be launched by Prime Minister Imran Khan in a ceremony scheduled to be held in Islamabad on May 31.“This kind of willingness shows the belief and confidence the international investors have in Wapda in particular and Pakistan in general.

Read More...

With IMF consent, govt sets higher economic targets

With an apparent understanding with the International Monetary Fund for a controlled expansionary stance, the government is setting higher benchmarks for rates of inflation, economic growth and fiscal and primary deficits for the next fiscal year following changes in the economic team and encouraging macroeconomic indicators this year.A government team on Thursday told a parliamentary panel that the GDP growth rate for next year was being targeted at five per cent instead of 4.2pc approved by the federal cabinet on April 13, while inflation was now anticipated to increase by 8.2pc instead of 8pc. Likewise, the overall budget deficit limit has now been pitched at 6.3pc of GDP instead of earlier 6pc, while primary deficit would be around 0.6pc instead of 0.1pc.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.