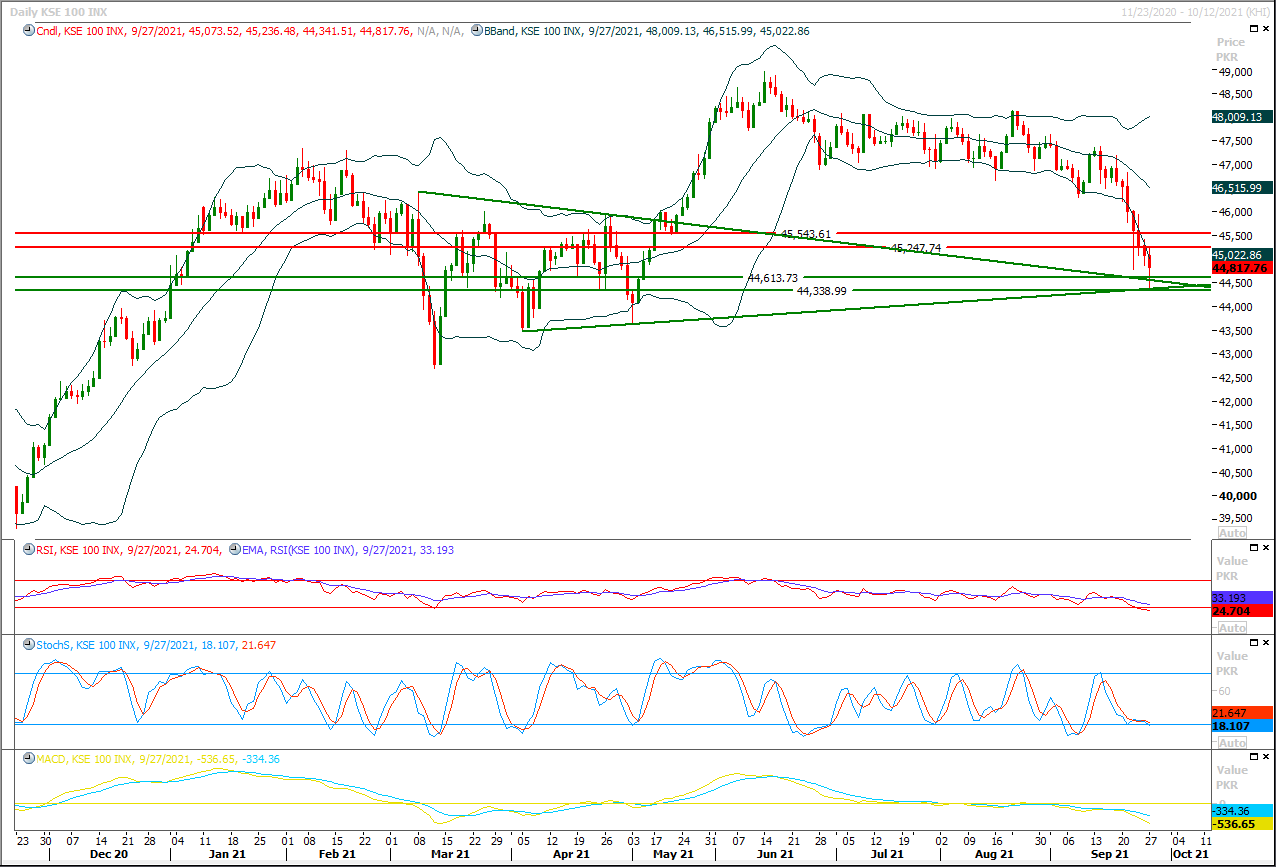

The Benchmark KSE100 index initiated a pull back after establishing ground above a horizontal supportive region and a trend line during last trading session. As of now it's expected that index would try to move towards positive direction during current trading session because its coming back after getting support from supportive trend line of its descending wedge on hourly chart and most likely bullish breakout of this wedge take place and index would take a spike on intraday basis therefore it's recommended to stay on buying side with strict stop loss. Initially index would try to target 45,000pts and 45,250pts where it would face some serious resistance but breakout above this region would call for 45,550pts. While on flip side in case of rejection from its resistant regions index would try to establish ground above 44,600pts which would be followed by 44,330pts. Hourly momentum indicators have generated bullish crossovers therefore it's obvious that index would try to start the day with a positive note.

Regional Markets

Asian markets grapple with Evergrande fallout, eye China power crunch

Asian shares mainly drifted lower Tuesday as investors continued to fret over China Evergrande Group's unsolved debt crisis and eyed the potential impact of a widening power shortage in China. MSCI's broadest index of Asia-Pacific shares outside Japan was 0.13% lower on Tuesday, following a mixed session on Wall Street In early trade Tuesday, Australia's benchmark S&P/ASX200 index was down nearly 1%, while Japan's Nikkei was off 0.6%. China's blue chip index CSI300 edged up 0.1% at the open, as Hong Kong's Hang Seng Index gained 0.44%.

Read More...

Business News

IMF assured of Pakistan’s commitment to programme

Finance Minister Shaukat Tarin on Monday assured the International Monetary Fund (IMF) of Pakistan’s commitment to its ongoing Extended Fund Facility (EFF) programme and hoped to successfully complete the upcoming review as well as Article IV consultations. During a meeting with the outgoing and nominated resident representatives of the IMF, the finance minister said the government would formally launch the ‘track and trace’ system for tobacco products on Oct 1 this year. “This is also one of the requirements under the EFF programme,” an official statement quoted Mr Tarin as saying.

Read More...

Water committee to hold first meeting today

The maiden meeting of the Steering Committee on National Water Policy constituted back in 2018 will be held in Islamabad on Tuesday (today). It will be chaired by Federal Minister for Water Resources Moonis Elahi. The meeting was to be held on Friday (Sept 24), but had to be rescheduled due to unavailability of some members. To be attended by secretaries of ministries of water resources, energy, planning and development, and finance, as well as the chairmen of Water and Power Development Authority (Wapda), National Disaster Management Authority and Engineering Council, the meeting will discuss salient features of the National Water Policy, including its draft implementation framework.

Read More...

Govt may increase petroleum levy to boost revenue

The government is expected to gradually increase petroleum levy on petrol and other petroleum products to improve revenue collection as targeted under the 2021-22 federal budget and IMF programme. The move would help widen a gap between compressed natural gas (CNG) and petrol prices and may contain import bill. The government had set a Rs610bn target of petroleum levy during the current fiscal year but could actually collect no more than Rs25bn in first two and half months of the first quarter, an official said.

Read More...

Dollar scales new height, hits Rs169.6

Amid a strong demand for dollars from panicky importers, the local currency could not put up any resistance and plunged to an all-time low at Rs169.60 against the greenback in the interbank market on Monday. Currency dealers said the interbank market was full of speculative reports and observations which hit the exchange rate negatively bringing the rupee under massive pressure. Meanwhile, in the open market the dollar was selling at Rs171.60. “The currency market is now working like a stock market: highly speculative, news based and [vulnerable to] rumours about the country’s economic health particularly external account,” said Atif Ahmed, a currency dealer in the interbank market.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.