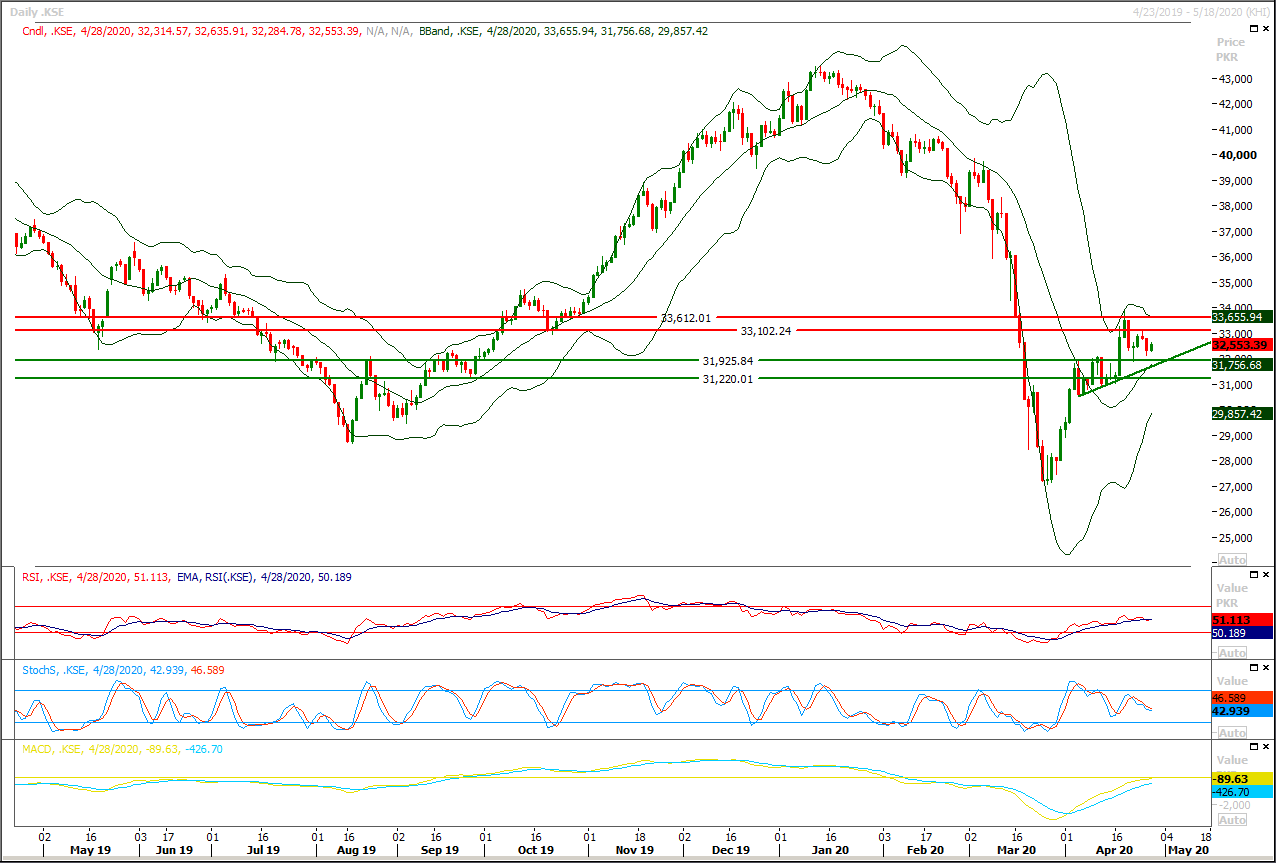

Technical Overview

The Benchmark KSE100 index is extending its lows after intraday correction and expansions and now it seems that index would try to target 32,000pts during current trading session and breakout below that region would call for 31,760pts and then 31,200pts. It's recommended to stay cautious and avoid initiating long positions because if index would succeed in sliding below 32,000pts then its trend would convert towards bearish side on short term basis, which may lead it towards 30,000-29,700pts. Bearish sentiment would start gaining momentum once index would succeed in closing below 31,760pts because breakout below that region would call for 30,000pts region immediately.

While on flipside index would face strong resistances at 33,100pts if it would succeed in bouncing back from its supportive region of 32,000pts or 31,760pts. This region would getting strengthen with every passing day because on weekly chart momentum would start losing strength.

Regional Markets

Asia shares extend gains as economies slowly re-open, oil rallies

Asian shares rose for a third session on the trot on Wednesday as investors took heart from easing coronavirus lockdowns in some parts of the world while oil prices jumped on hopes demand will pick up. Moreover, investors have regained some confidence as parts of the United States, Europe and Australia are gradually easing restrictions while New Zealand this week allowed some businesses to open. These factors helped lift MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS by 0.9% on Wednesday, having rallied 3.3% already this week. Japan’s markets were closed for a public holiday. Australian shares rose 1.2% led by energy and resources firms while South Korea .KS11 added 1.2%. Chinese markets opened in the black with the blue-chip index .CSI300 up 0.6%. All the same, analysts were circumspect about the rally

Read More...

Business News

Budget deficit to swell to 9.6pc of GDP due to lockdown situation

A high-level meeting on Tuesday noted that Pakistan’s budget deficit would swell to 9.6 percent of the GDP, economic growth would be contracted by 1.5 percent while the impact on the poverty figures could also be higher due to closure of businesses and restricted economic activity due to the lockdown situation. A high Ievel meeting underlined several challenges the country was likely to face on the economic front due to the impact of COVID-19 on the national, regional and global economy. The meeting, chaired by Adviser to the Prime Minister on Finance & Revenue Dr Abdul Hafeez Shaikh and attended by leading development partners, including World Bank, Asian Development Bank, DFID and UNDP, agreed that while it was too early to predict the impact of COVID-19 but if the crisis persisted then the manufacturing and service sectors as well as the exports were likely to be severely affected in the year 2020 while agriculture growth was likely to remain intact in Pakistan.

Read More...

Govt, ADB sign concessional loan agreement worth $15m

The government of Pakistan and the Asian Development Bank have signed a concessional loan agreement amounting to USD $ 15 million. This concessional loan is a Project Readiness Financing Facility for engineering and designing urban development projects in seven (7) major cities across Punjab, as identified by the provincial government. Dr Syed Pervaiz Abbas, Secretary, Economic Affairs Division (EAD), signed the loan agreement with Ms Xiaohong Yang, Country Director, ADB. The Local Government & Community Development Department, Government of the Punjab is the Executing Agency for the subject project. The PRF is expected to be completed by 31st October, 2022.

Read More...

Govt to facilitate remittances through tax exemptions

Estimating a shortfall of about 16 per cent against the target for the current financial year, the government has decided to facilitate remittances from overseas Pakistanis through tax exemptions and other incentives under a special loyalty programme with effect from the start of next fiscal year. The downward revision in the current year’s target for remittances has been made following economic downturn in the Middle East after oil price plunge coupled with the effects of coronavirus pandemic. The ministry of finance on Tuesday said the remittances were estimated to reach $20-21 billion by the end of current fiscal year on June 30, down by 13-17 per cent against a budgeted target of $24bn.

Read More...

Economy will need ‘reset and reboot’ after recession

The number of global novel coronavirus cases crossed the 3 million mark on Monday, according to a running tally by the US' Johns Hopkins University. The data showed that the number of infections had reached 3,002,303 while the number of people who died from complications from the virus topped 208,000. Over 878,000 people have recovered. The US remains the country with the most infections at nearly 973,000. It also has the highest number of deaths with over 55,000. Meanwhile, over 5.4 million coronavirus tests have been administered so far in the US. Italy has the second-highest death toll with over 26,900, followed by Spain with over 23,500 deaths.Pakistan is facing the worst economic conditions in its history — a negative economic growth at 1.57 per cent and a fiscal deficit of 9.6pc — during the current fiscal year owing to economic losses in the aftermath of coronavirus pandemic. “In a worst-case scenario, the growth rate could remain negative at 1.57pc of GDP”, said the Ministry of Finance on Tuesday after Adviser to PM on Finance and Revenue Dr Abdul Hafeez Shaikh met with representatives of multilateral lending agencies. The poverty situation was also likely to worsen in the country, the statement noted.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.