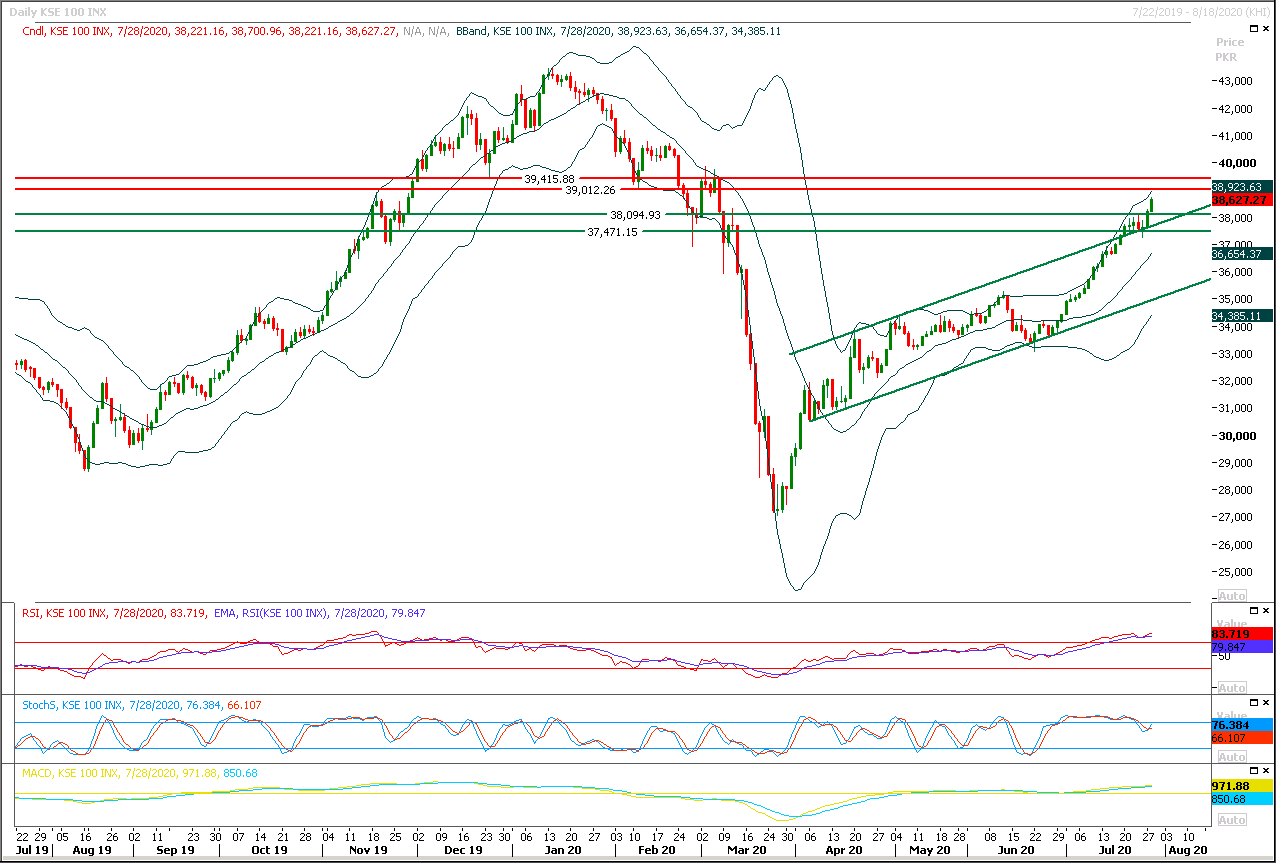

Technical Overview

The Benchmark KSE100 index is going to face strong resistances between 38,700-39,000pts during current trading session therefore it's recommended to start profit taking from existing long positions and adopt wait and see to initiate new positions on either side. Initially index would face a strong resistance at 38,850pts while in case of breakout above that region index can crawl towards 39,000pts where it would again face strong resistance from a horizontal resistant region. It's recommended to stay cautious and wait for this week's closing before initiating new long positions because if index would not succeed in maintaining above 38,000pts then some serious pressure could be witnessed in coming days. In case of bearish pressure index would try to find some ground at 38,200pts and 38,000pts while breakout below these regions would push index towards 37,500pts initially. Bulls would remain hopeful as long as index is trading above 37,500pts while breakout below that region would push index further downward and massive selling pressure would be witnessed below that region.

Regional Markets

Dollar teeters, gold takes a breather as markets await Fed

The U.S. dollar hovered just above a two-year low on Wednesday, while stocks struggled, as growing worries about the U.S. economy had investors cautious and looking to Congress and the Federal Reserve for a boost.The Fed is expected to strike a dovish stance at its policy review later in the day and perhaps open the door to a higher tolerance for inflation - something dollar bears think could squash real yields and sink the currency even further. A $1 trillion U.S. fiscal rescue package is also at an impasse as a Friday deadline to extend unemployment benefits looms. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.1% as gains in China offset small losses elsewhere. Japan's Nikkei .N225 was down 0.8% on a rising yen and weak start to corporate earnings season. Against a basket of currencies =USD the dollar wallowed just 0.3% above a two-year low hit a day ago. It has lost 3.7% in July so far and is headed for its worst month in nine years.

Read More...

Business News

ECC okays import of 0.3m tonnes sugar to check rising prices

The government on Tuesday decided to shift monthly oil pricing to fortnightly basis and ordered import of 300,000 tonnes of sugar to control rising prices. The decisions were taken at a meeting of the Economic Coordination Committee (ECC) of the Cabinet presided over by Adviser to PM on Finance and Revenue Dr Abdul Hafeez Shaikh. The meeting also decided to sell unutilised capacity of the Liquefied Natural Gas (LNG) terminal owned by the government and allow third-party access to private entities. On the request of the Petroleum Division, the ECC also decided to adopt a revised pricing methodology for motor gasoline (petrol) and high speed diesel (HSD) on a fortnightly basis, based on Platt’s average to facilitate oil marketing companies (OMCs) in minimising their inventory losses and improve cost recovery.

Read More...

NA committee slams ‘non-serious’ attitude to meeting FATF conditions

With deadlines looming next month, Pakistan’s compliance with 27-point action plan and 40 recommendations of the Financial Action Task Force (FATF) stands at 14 and 10 respectively. With this update, the government on Tuesday came under severe criticism from the National Assembly’s Standing Committee on Finance and Revenue led by MNA Faiz Ullah of the PTI for wasting precious time of the nation without making tangible progress. While the committee decided to refer three proposed bills — Anti Money Laundering, Limited Liability Partnership and Companies Bill — relating to the FATF to another parliamentary meeting on legislative business, Committee Chairman Faiz announced that he would resign from his position if Adviser to PM on Finance Dr Abdul Hafeez Shaikh maintained his continued abstention from the panel.

Read More...

SBP receives $505.5m from WB

The State Bank of Pakistan (SBP) has announced that it received an amount of $505.5 million from World Bank on Tuesday. Pakistan and World Bank had signed a financing agreement last week to provide financial support to the country. This is concessional financing in the form of budgetary support that is being provided under Resilient Institutions for Sustainable Economy (RISE), Development Policy Financing with the objective to enhancing the policy and institutional framework to improve fiscal management, and improving the regulatory framework to foster growth and competitiveness.

Read More...

ECC approves proposal for revision of petroleum prices on fortnightly basis

The Economic Coordination Committee (ECC) of the Cabinet has approved a proposal by the Ministry of Energy for revision of prices of petroleum products on fortnightly basis instead of the existing monthly basis. The ECC has decided to adopt a revised pricing methodology for motor gasoline and high speed diesel on a fortnightly basis, based on Platts average, in view of its advantages for ensuring fair competition, alignment of margins with international pricing trend and smoothing out of volatility and distortions because of purchasing dates of one OMC. The revision of oil prices on fortnightly basis, coming into effect from 1st August 2020 subject to endorsement from the federal Cabinet, would also allow for planning for three months ahead with refineries and OMCs, better inventory management, better reporting of sales and enforcement of stock requirements, transparency and visibility of prices and reduced dependence on one OMC.

Read More...

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.