Morning Market Brief 29th Jul. 2021

Technical Overview

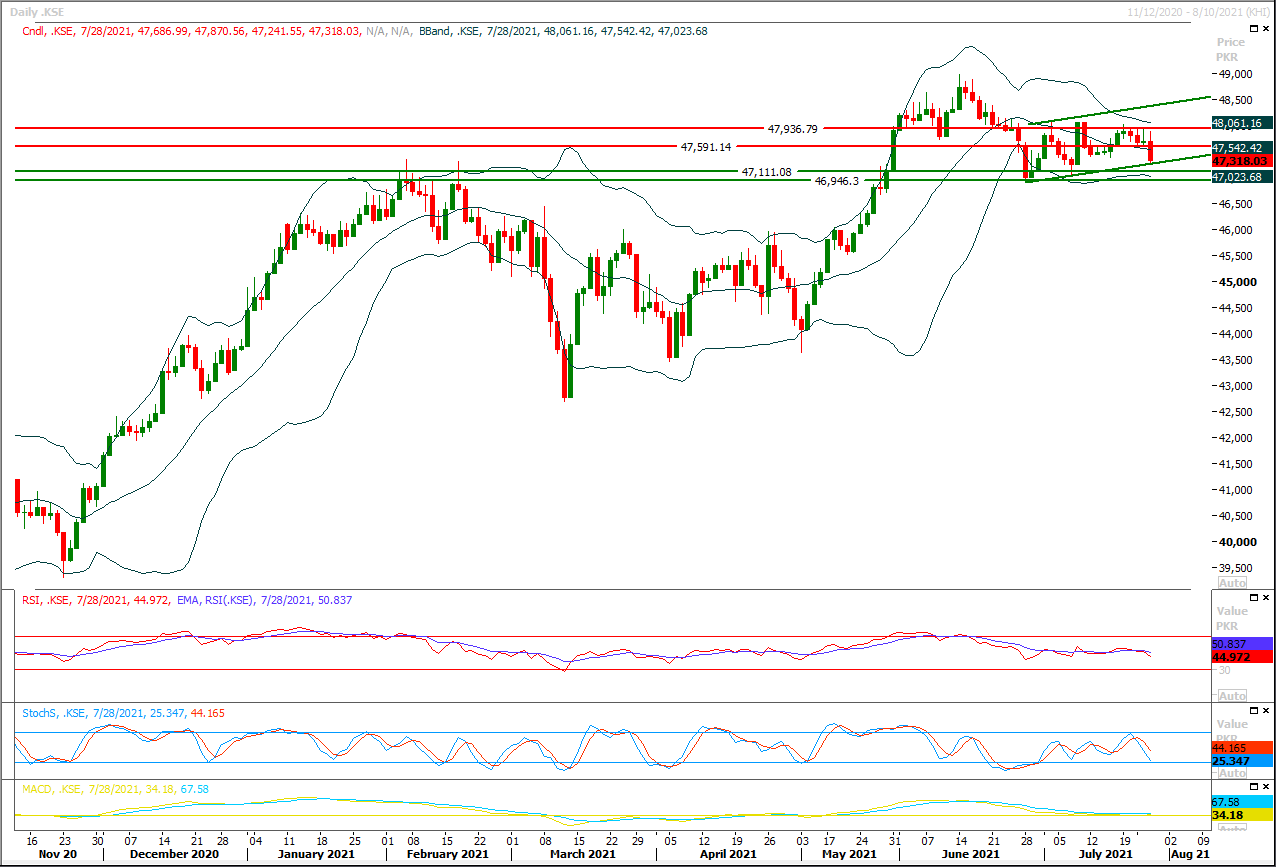

The Benchmark KSE100 index is retesting supportive trend line of its bullish price channel on daily and hourly charts, but it's recommended to stay cautious because it seems that index may try to penetrate supportive trend line of said price channel and would try to establish ground above a strong horizontal supportive region which falls at 47,165pts initially but breakout below this region would call for 47,000pts and 46,900pts. Overall a volatile session could be witnessed during current trading session therefore it's recommended to stay cautious and swing trading could be beneficial for day trading. On flip side in case of bullish pull back index would face initial resistance at 47,500pts which would be followed by 47,600pts and 47,760pts. Hourly stochastic have succeeded in sliding below 20 which indicates that index may face some serious pressure at start of the day and if it would not succeed in finding support at its initial supportive region then it would close the day with a massive selling pressure.

Regional Markets

Chinese stocks in tentative bounce, Fed in no hurry to taper

Asian shares managed a semblance of calm on Thursday as the U.S. Federal Reserve signalled it was in no rush to taper stimulus, though the mood was fragile as investors waited to see if Beijing could stem the recent bloodletting in Chinese shares. There was also some promising news on the long-awaited U.S. infrastructure bill as the Senate voted to move ahead on the $1.2 trillion deal. Yet much depended on how China's markets fared amid reports regulators had called banks overnight to ease market fears about tighter rules on the education sector. MSCI's broadest index of Asia-Pacific shares outside Japan bounced 1.1%, having slid to its lowest since early December on Wednesday. Japan's Nikkei edged up 0.4%, while South Korea was flat. S&P 500 futures eased 0.2%, as did EUROSTOXX 50 futures . Nasdaq futures dipped 0.3% perhaps weighed by a retreat in Facebook stock.

Read More...

Business News

ECC re-validates Rs352b unutilised Economic Stimulus Package’s funds

The Economic Coordination Committee (ECC) of Cabinet has re-validated the unutilised funds of Rs352 billion out of the Economic Stimulus Package amounting to Rs 1240 billion for FY 2021-22 for meeting related expenditures including procurement of vaccine for Covid-19. The Finance Division tabled a summary in the ECC to carry forward for FY 2021-22, the unutilised cash component equal to Rs 352 billion out of the Economic Stimulus Package amounting to Rs 1240 billion (given in March 2020) to mitigate the adverse socio-economic impact of the corona virus pandemic and to support the marginalised sections of the society. The funds were allocated under the Economic Stimulus Package for the entire duration of the Covid-19 pandemic irrespective of the financial year.

Read More...

Nepra reduces power tariff by 21.69 paisas/unit for June

National Electric Power Regulatory Authority (Nepra) has Wednesday rejected the CPPA-G petition for 80.54 paisa hike in power tariff and instead reduce the tariff by 21.69 paisa per unit on account of fuel adjustment for month of June 2021. The Central Power Purchasing Agency-Guarantee (CPPA-G) had requested National Electric Power Regulatory Authority (Nepra) to increase the power tariff by Re 0.8054 per unit under monthly Fuel Charges Adjustments (FCA) for the month of June. During hearing held here, Nepra official has noted that in its petition CPPA had sought adjustments of Rs 13 billion for the last three years, adding that adjustments will result in providing benefit of Rs 11 billion to the consumers. CPPA officials said that they had reconciled the adjustments which Nepra had not approved.

Read More...

Fiscal deficit declines to Rs2.197tr in 11 months of FY2021

Pakistan’s fiscal deficit has contained at 4.6 per cent of GDP during eleven months (July-May) of the previous year (FY2021) while the primary balance remained in surplus throughout this time. The country’s budget deficit was recorded at Rs2.197 trillion during July-May period of FY2021 as compared to Rs2.418 trillion in the corresponding period of the FY2020. Despite significant challenges, the current fiscal performance is largely in line with government’s strategy to ensure fiscal discipline, increasing revenues and controlling expenditures. “The government is highly committed to strike a balance between fiscal deficit and economic stimulus package due to COVID-19 without hurting the economic growth,” the ministry of finance noted in its ‘Monthly Economic Update & Outlook July 2021’.

Read More...

Foreign investors satisfied with security environment in Pakistan

Foreign investors have expressed continuing confidence on the security environment in the country, which conveyed a positive message to potential investors. Overseas Investors Chamber of Commerce and Industry (OICCI), the collective body of top 200 foreign investors in Pakistan, released the results of its latest Annual Security Survey 2021, covering feedback on the security environment in the commercial centers of Pakistan. The survey was conducted from May 21st till June 21st. About two third of the OICCI members have their head offices in Karachi with operations all over country.

Read More...

Tags:

Mbrief

Mbrief Analysis

Mbrief Technical Analysis

Mbrief Price Forecast

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.